Acast Results Presentation Deck

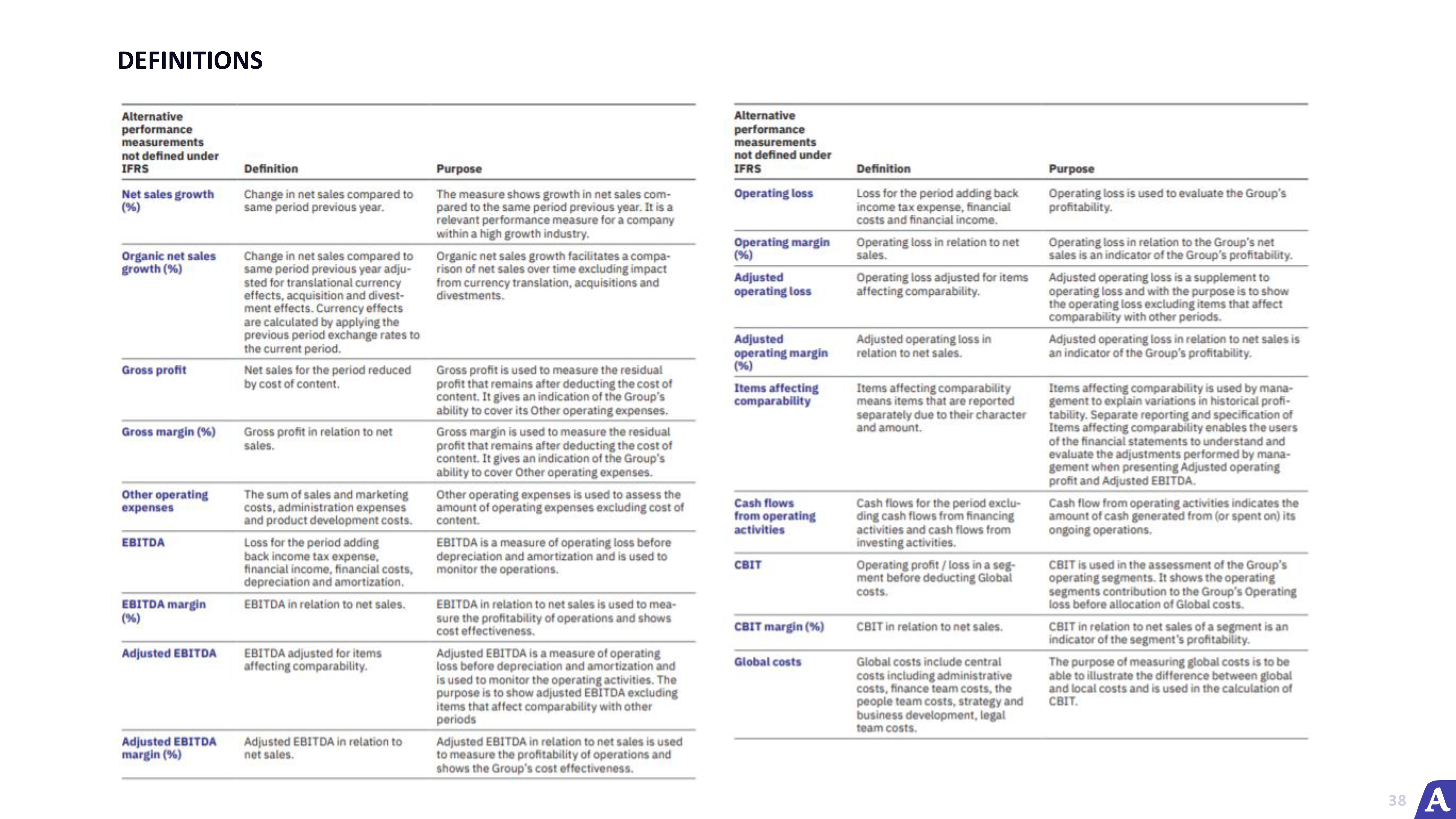

DEFINITIONS

Alternative

performance

measurements

not defined under

IFRS

Net sales growth

(%)

Organic net sales

growth (%)

Gross profit

Gross margin (%)

Other operating

expenses

EBITDA

EBITDA margin

Adjusted EBITDA

Adjusted EBITDA

margin (%)

Definition

Change in net sales compared to

same period previous year.

Change in net sales compared to

same period previous year adju-

sted for translational currency

effects, acquisition and divest-

ment effects. Currency effects

are calculated by applying the

previous period exchange rates to

the current period.

Net sales for the period reduced

by cost of content.

Gross profit in relation to net

sales.

The sum of sales and marketing

costs, administration expenses

and product development costs.

Loss for the period adding

back income tax expense,

financial income, financial costs,

depreciation and amortization.

EBITDA in relation to net sales.

EBITDA adjusted for items

affecting comparability.

Adjusted EBITDA in relation to

net sales.

Purpose

The measure shows growth in net sales com-

pared to the same period previous year. It is a

relevant performance measure for a company

within a high growth industry.

Organic net sales growth facilitates a compa-

rison of net sales over time excluding impact

from currency translation, acquisitions and

divestments.

Gross profit is used to measure the residual

profit that remains after deducting the cost of

content. It gives an indication of the Group's

ability to cover its Other operating expenses.

Gross margin is used to measure the residual

profit that remains after deducting the cost of

content. It gives an indication of the Group's

ability to cover Other operating expenses.

Other operating expenses is used to assess the

amount of operating expenses excluding cost of

content.

EBITDA is a measure of operating loss before

depreciation and amortization and is used to

monitor the operations.

EBITDA in relation to net sales is used to mea-

sure the profitability of operations and shows

cost effectiveness.

Adjusted EBITDA is a measure of operating

loss before depreciation and amortization and

is used to monitor the operating activities. The

purpose is to show adjusted EBITDA excluding

items that affect comparability with other

periods

Adjusted EBITDA in relation to net sales is used

to measure the profitability of operations and

shows the Group's cost effectiveness.

Alternative

performance

measurements

not defined under

IFRS

Operating loss

Operating margin

(%)

Adjusted

operating loss

Adjusted

operating margin

(%)

Items affecting

comparability

Cash flows

from operating

activities

CBIT

CBIT margin (%)

Global costs

Definition

Loss for the period adding back

income tax expense, financial

costs and financial income.

Operating loss in relation to net

sales.

Operating loss adjusted for items

affecting comparability.

Adjusted operating loss in

relation to net sales.

Items affecting comparability

means items that are reported

separately due to their character

and amount.

Cash flows for the period exclu-

ding cash flows from financing

activities and cash flows from

investing activities.

Operating profit/loss in a seg-

ment before deducting Global

costs.

CBIT in relation to net sales.

Global costs include central

costs including administrative

costs, finance team costs, the

people team costs, strategy and

business development, legal

team costs.

Purpose

Operating loss is used to evaluate the Group's

profitability.

Operating loss in relation to the Group's net

sales is an indicator of the Group's profitability.

Adjusted operating loss is a supplement to

operating loss and with the purpose is to show

the operating loss excluding items that affect

comparability with other periods.

Adjusted operating loss in relation to net sales is

an indicator of the Group's profitability.

Items affecting comparability is used by mana-

gement to explain variations in historical profi-

tability. Separate reporting and specification of

Items affecting comparability enables the users

of the financial statements to understand and

evaluate the adjustments performed by mana-

gement when presenting Adjusted operating

profit and Adjusted EBITDA.

Cash flow from operating activities indicates the

amount of cash generated from (or spent on) its

ongoing operations.

CBIT is used in the assessment of the Group's

operating segments. It shows the operating

segments contribution to the Group's Operating

loss before allocation of Global costs.

CBIT in relation to net sales of a segment is an

indicator of the segment's profitability.

The purpose of measuring global costs is to be

able to illustrate the difference between global

and local costs and is used in the calculation of

CBIT.

38 AView entire presentation