Liberty Global Results Presentation Deck

REBASE INFORMATION

Rebase growth percentages, which are non-GAAP measures, are presented as a basis for assessing growth rates on a comparable basis. For purposes of calculating rebased growth rates on a comparable basis

for all businesses that we owned during 2022, we have adjusted our historical revenue, Adjusted EBITDA and Adjusted EBITDA less P&E Additions for the three months ended March 31, 2021 to (i) include the pre-

acquisition revenue, Adjusted EBITDA and P&E additions of entities acquired during 2021 in our rebased amounts for the three months ended March 31, 2021 to the same extent that the revenue, Adjusted EBITDA

and P&E additions of these entities are included in our results for the three months ended March 31, 2022, (ii) exclude from our rebased amounts the revenue, Adjusted EBITDA and P&E additions of entities

disposed of during 2022 and 2021 to the same extent that the revenue, Adjusted EBITDA and P&E additions of these entities are excluded in our results for the three months ended March 31, 2022, (iii) include in

our rebased results the revenue and costs for the temporary elements of transitional and other services provided to the VMO2 JV, the VodafoneZiggo JV, Vodafone, Deutsche Telekom (the buyer of UPC Austria),

Liberty Latin America and M7 Group (the buyer of UPC DTH), to reflect amounts related to these services equal to those included in our results for the three months ended March 31, 2022 and (iv) reflect the

translation of our rebased amounts at the applicable average foreign currency exchange rates that were used to translate our results for the three months ended March 31, 2022. We have reflected the revenue,

Adjusted EBITDA and P&E additions entities in our 2021 rebased amounts based on what we believe to be the most reliable information that is currently available to us (generally pre-acquisition financial

statements), as adjusted forof these acquired the estimated effects of (a) any significant differences between U.S. GAAP and local generally accepted accounting principles, (b) any significant effects of acquisition

accounting adjustments, (c) any significant differences between our accounting policies and those of the acquired entities and (d) other items we deem appropriate. We do not adjust pre-acquisition periods to

eliminate nonrecurring items or to give retroactive effect to any changes in estimates that might be implemented during post-acquisition periods. As we did not own or operate the acquired businesses during the pre-

acquisition periods, no assurance can be given that we have identified all adjustments necessary to present the revenue, Adjusted EBITDA and Adjusted EBITDA less P&E Additions of these entities on a basis that

is comparable to the corresponding post-acquisition amounts that are included in our historical results or that the pre-acquisition financial statements we have relied upon do not contain undetected errors. In

addition, the rebased growth percentages are not necessarily indicative of the revenue, Adjusted EBITDA and Adjusted EBITDA less P&E Additions that would have occurred if these transactions had occurred on

the dates assumed for purposes of calculating our rebased amounts or the revenue, Adjusted EBITDA and Adjusted EBITDA less P&E Additions that will occur in the future. Investors should view rebased growth as

a supplement to, and not a substitute for, U.S. GAAP measures of performance included in our condensed consolidated statements of operations.

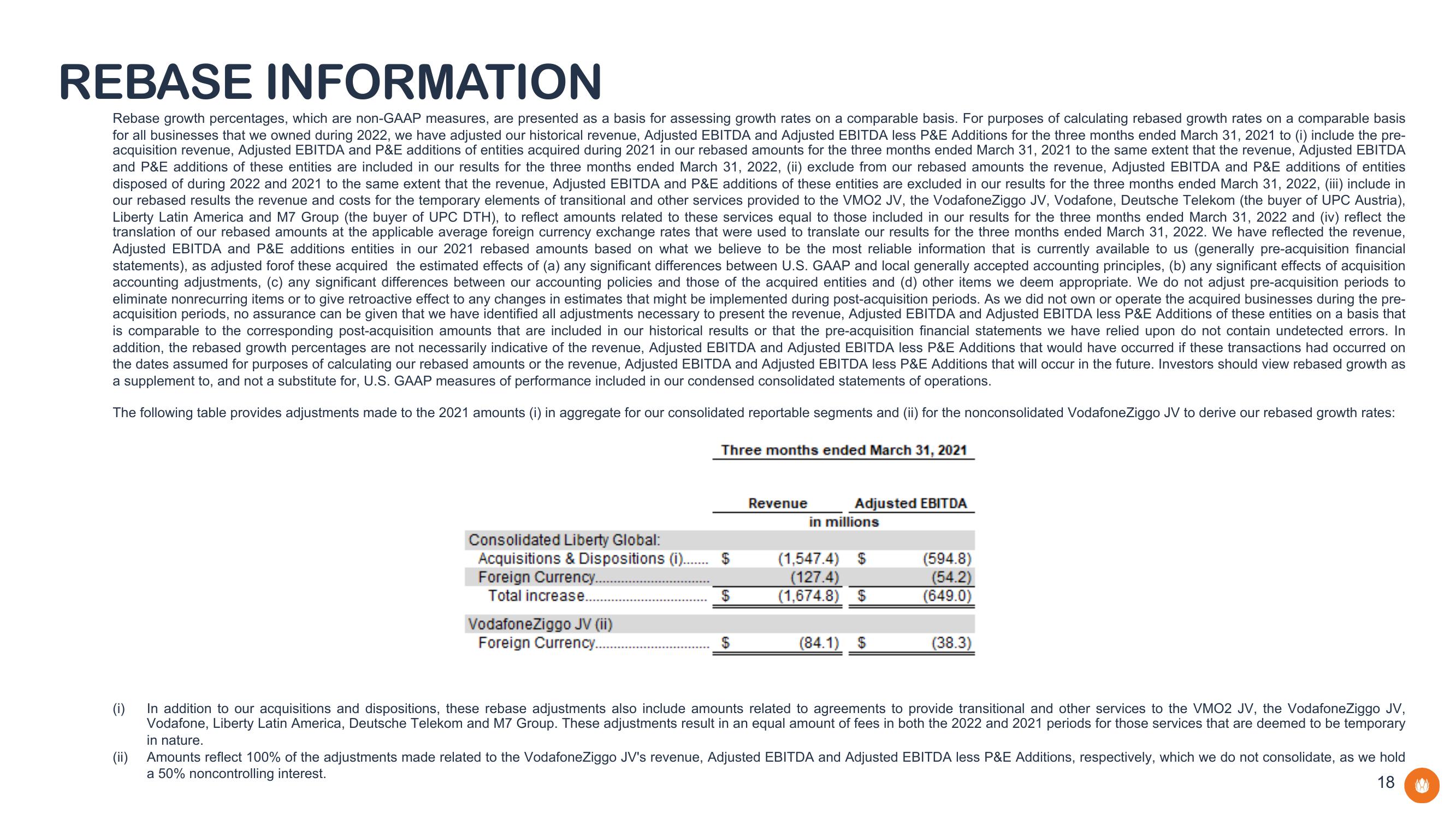

The following table provides adjustments made to the 2021 amounts (i) in aggregate for our consolidated reportable segments and (ii) for the nonconsolidated VodafoneZiggo JV to derive our rebased growth rates:

Consolidated Liberty Global:

Acquisitions & Dispositions (i)......

Foreign Currency....

Total increase....

(ii)

VodafoneZiggo JV (ii)

Foreign Currency..

Three months ended March 31, 2021

$

Revenue

Adjusted EBITDA

in millions

(1,547.4) $

(127.4)

(1,674.8) $

(84.1) $

(594.8)

(54.2)

(649.0)

(38.3)

(i)

In addition to our acquisitions and dispositions, these rebase adjustments also include amounts related to agreements to provide transitional and other services to the VMO2 JV, the VodafoneZiggo JV,

Vodafone, Liberty Latin America, Deutsche Telekom and M7 Group. These adjustments result in an equal amount of fees in both the 2022 and 2021 periods for those services that are deemed to be temporary

in nature.

Amounts reflect 100% of the adjustments made related to the VodafoneZiggo JV's revenue, Adjusted EBITDA and Adjusted EBITDA less P&E Additions, respectively, which we do not consolidate, as we hold

a 50% noncontrolling interest.

18View entire presentation