Engine No. 1 Activist Presentation Deck

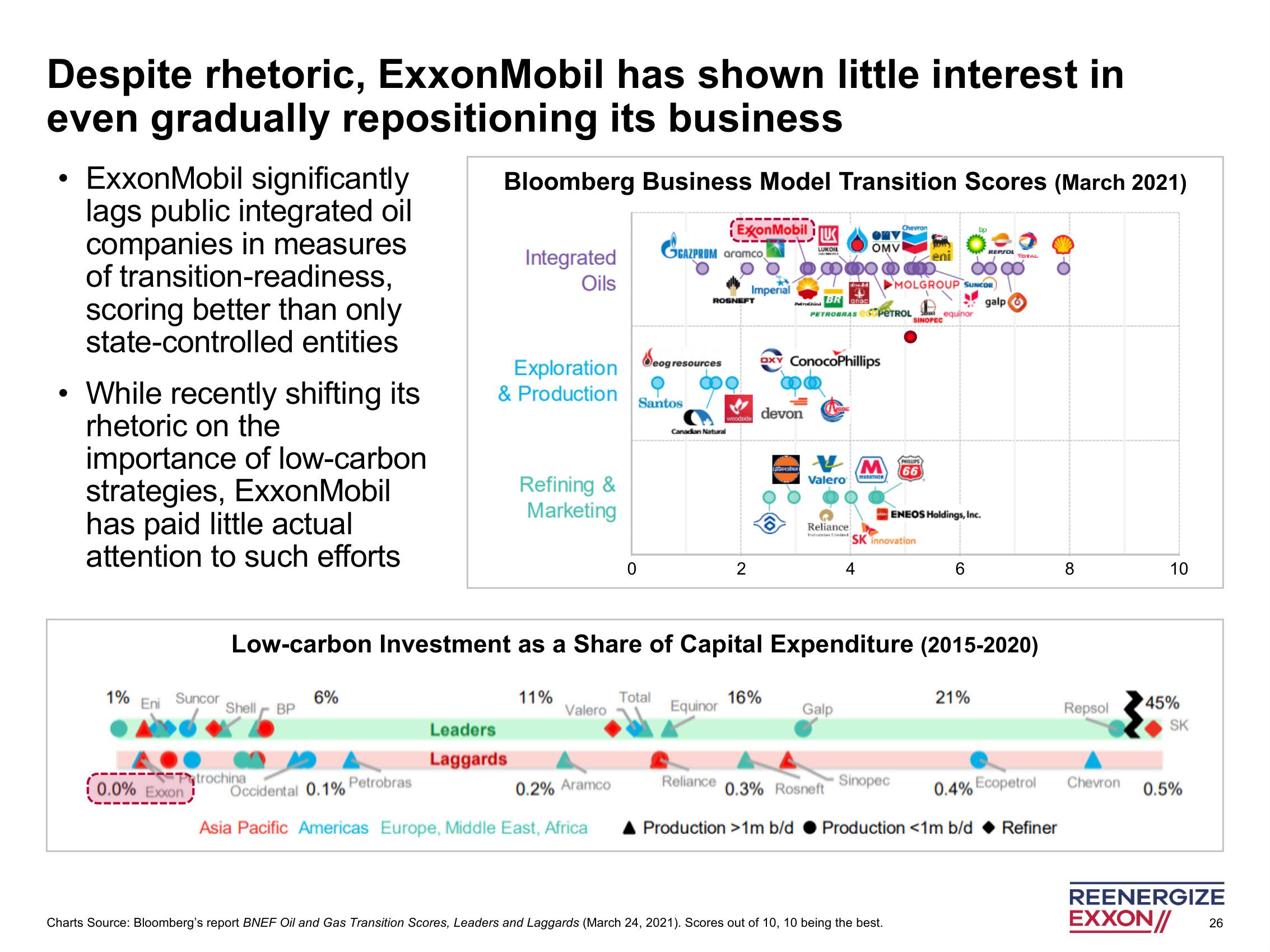

Despite rhetoric, ExxonMobil has shown little interest in

even gradually repositioning its business

●

ExxonMobil significantly

lags public integrated oil

companies in measures

of transition-readiness,

scoring better than only

state-controlled entities

While recently shifting its

rhetoric on the

importance of low-carbon

strategies, ExxonMobil

has paid little actual

attention to such efforts

1%

Eni

Suncor

0.0% Exxon

Shell

trochina

BP

Bloomberg Business Model Transition Scores (March 2021)

6%

Integrated

Oils

Exploration

& Production

Leaders

Laggards

Refining &

Marketing

11%

0

Valero

GGAZPROM aramco

Santos

Total

eog resources

ExxonMobil U

LUKOIL

ROSNEFT

Canadian Natural

woodside

Equinor

Imperial

2

Petruchin

devon

16%

axy ConocoPhillips

produ

Valero

Hoold

Reliance

Intimited

BR anoc

PETROBRAS PETROL equinor

OKV

OMV

Galp

4

M

MARATHON

Low-carbon Investment as a Share of Capital Expenditure (2015-2020)

Chevron

Sinopec

eni

SK innovation

Charts Source: Bloomberg's report BNEF Oil and Gas Transition Scores, Leaders and Laggards (March 24, 2021). Scores out of 10, 10 being the best.

MOLGROUP SUNCOR)

galp

SINOPEC

PHILLIPS

66

ENEOS Holdings, Inc.

bp

6

REPSOL

21%

TOTAL

Occidental 0.1% Petrobras

0.2% Aramco

Reliance 0.3% Rosneft

0.4% Ecopetrol

Asia Pacific Americas Europe, Middle East, Africa ▲ Production >1m b/d Production <1m b/d Refiner

8

Repsol

Chevron

10

45%

SK

0.5%

REENERGIZE

EXXON//

26View entire presentation