Tudor, Pickering, Holt & Co Investment Banking

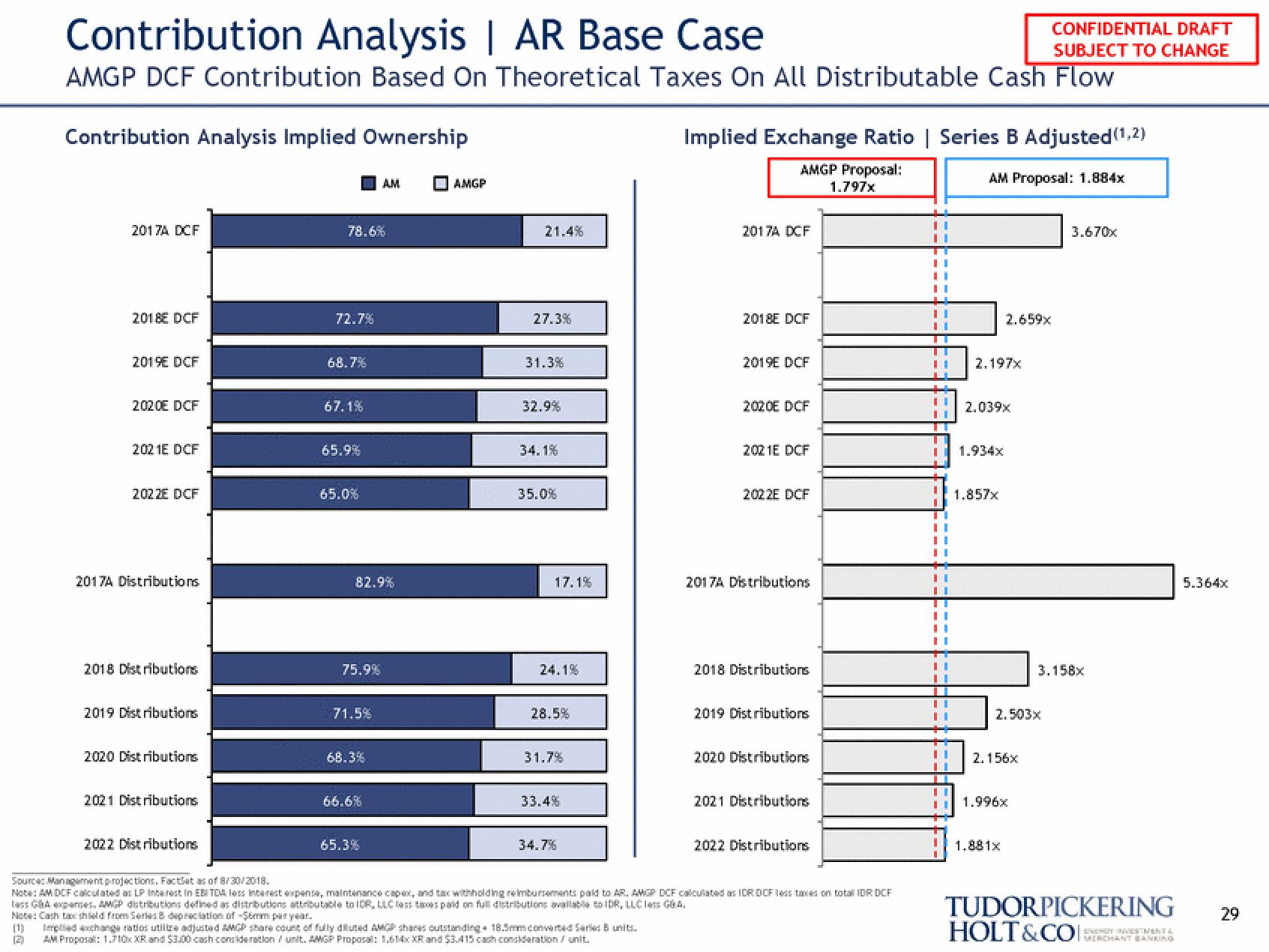

Contribution Analysis | AR Base Case

AMGP DCF Contribution Based On Theoretical Taxes On All Distributable Cash Flow

Contribution Analysis Implied Ownership

2017A DCF

2018 DCF

2019E DCF

2020E DCF

2021E DCF

2022E DCF

20174 Distributions

2018 Distributions

2019 Distributions

2020 Distributions

2021 Distributions

2022 Distributions

78.6%

72.7%

68.7%

67.1%

65.9%

65.0%

82.9%

75.9%

71.5%

AM

68.3%

66.6%

65.3%

AMGP

21.4%

27.3%

31.3%

32.9%

34.1%

35.0%

17.1%

24.1%

28.5%

31.7%

33.4%

34.7%

Imped exchange ratios utilize adjusted AMGP share count of fully diluted AMGP shares outstanding 18.5mm converted Series 5 units.

AM Proposal: 1.710x XR and $3.00 cash consideration / unit. AMGP Proposal: 1.614x XR and $3.415 cach consideration / unit.

Implied Exchange Ratio | Series B Adjusted (1,2)

AMGP Proposal:

1.797x

2017A DCF

2018E DCF

2019E DCF

2020E DCF

2021E DCF

2022E DCF

2017A Distributions

2018 Distributions

2019 Distributions

2020 Distributions

2021 Distributions

2022 Distributions

Sources Management projections. FactSet as of 8/30/2018.

Note: AM DCF calculated as LP Interest in EBITDA less interest expense, maintenance capex, and tax withholding reimbursements paid to AR. AMGP DCF calculated as IDR DCF less taxes on totall IDR DCF

less GBA expandes AMGP distributions defined as distributions attributable to IDR, LLC less taxes paid on full distributions available to IDR, LLC GA

Note: Cash taxshield from Series 8 depreciation of -S6mm per year.

12)

11

1

I

II

11

T

T

I

I

I

T

II

II

II

AM Proposal: 1.884x

2.197x

2.039x

1.934x

2.659x

1.857x

11 2.156x

2.503x

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

1.996x

1.881x

3.670x

3.158x

TUDORPICKERING

HOLT&COI:

MERCHANT BANKING

5.364x

29View entire presentation