PropertyGuru SPAC Presentation Deck

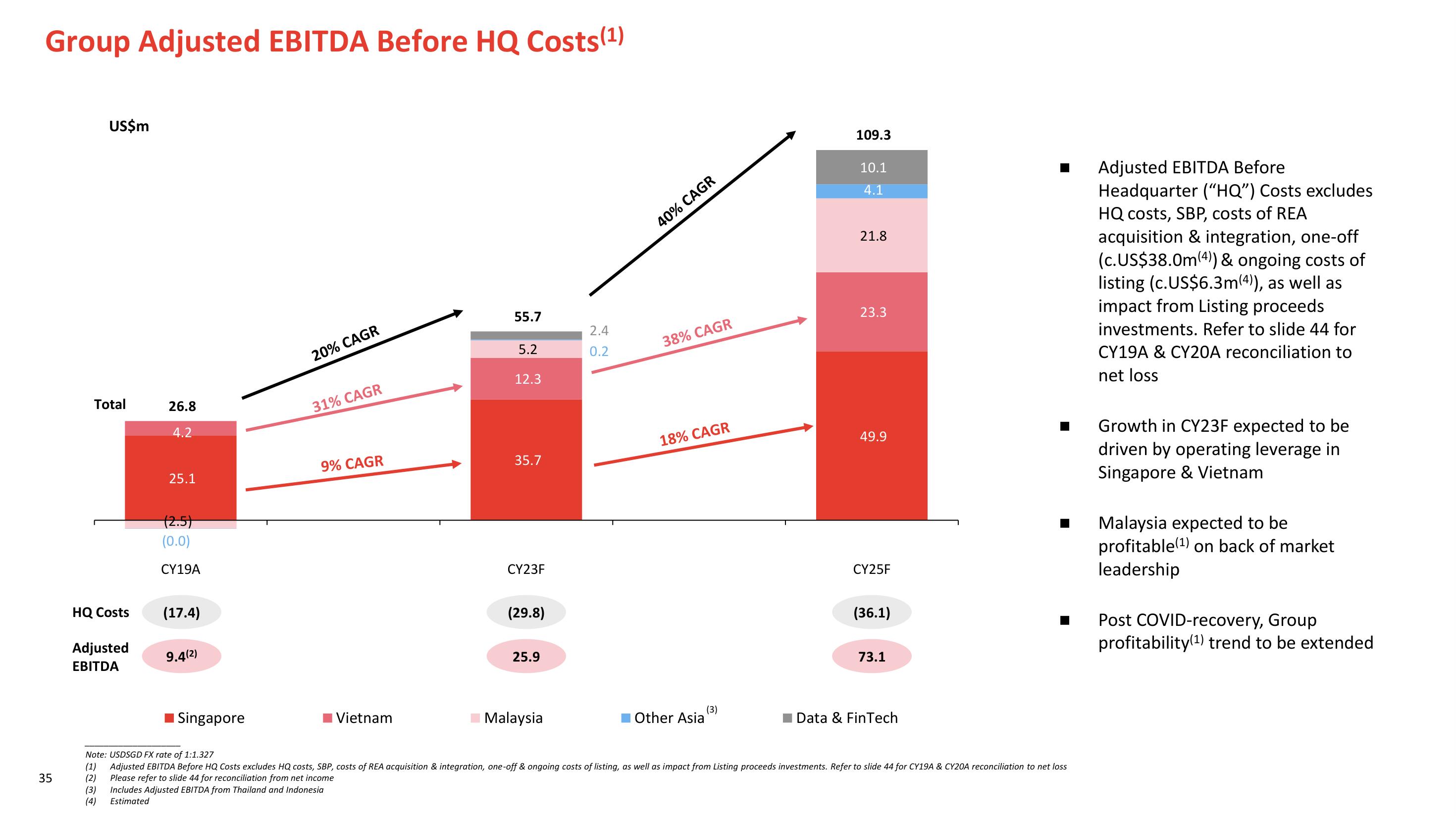

Group Adjusted EBITDA Before HQ Costs(1)

35

US$m

Total

HQ Costs

Adjusted

EBITDA

26.8

4.2

25.1

(2.5)

(0.0)

CY19A

(17.4)

9.4(2)

Singapore

20% CAGR

31% CAGR

9% CAGR

Vietnam

55.7

5.2

12.3

35.7

CY23F

(29.8)

25.9

Malaysia

2.4

0.2

40% CAGR

38% CAGR

18% CAGR

Other Asia

(3)

109.3

10.1

4.1

21.8

23.3

49.9

CY25F

(36.1)

73.1

Data & FinTech

Note: USDSGD FX rate of 1:1.327

(1) Adjusted EBITDA Before HQ Costs excludes HQ costs, SBP, costs of REA acquisition & integration, one-off & ongoing costs of listing, as well as impact from Listing proceeds investments. Refer to slide 44 for CY19A & CY20A reconciliation to net loss

(2) Please refer to slide 44 for reconciliation from net income

(3)

Includes Adjusted EBITDA from Thailand and Indonesia

(4)

Estimated

Adjusted EBITDA Before

Headquarter ("HQ") Costs excludes

HQ costs, SBP, costs of REA

acquisition & integration, one-off

(c.US$38.0m (4)) & ongoing costs of

listing (c.US$6.3m (4)), as well as

impact from Listing proceeds

investments. Refer to slide 44 for

CY19A & CY20A reconciliation to

net loss

Growth in CY23F expected to be

driven by operating leverage in

Singapore & Vietnam

Malaysia expected to be

profitable(¹) on back of market

leadership

Post COVID-recovery, Group

profitability(¹) trend to be extendedView entire presentation