HSBC Results Presentation Deck

UK RFB disclosures

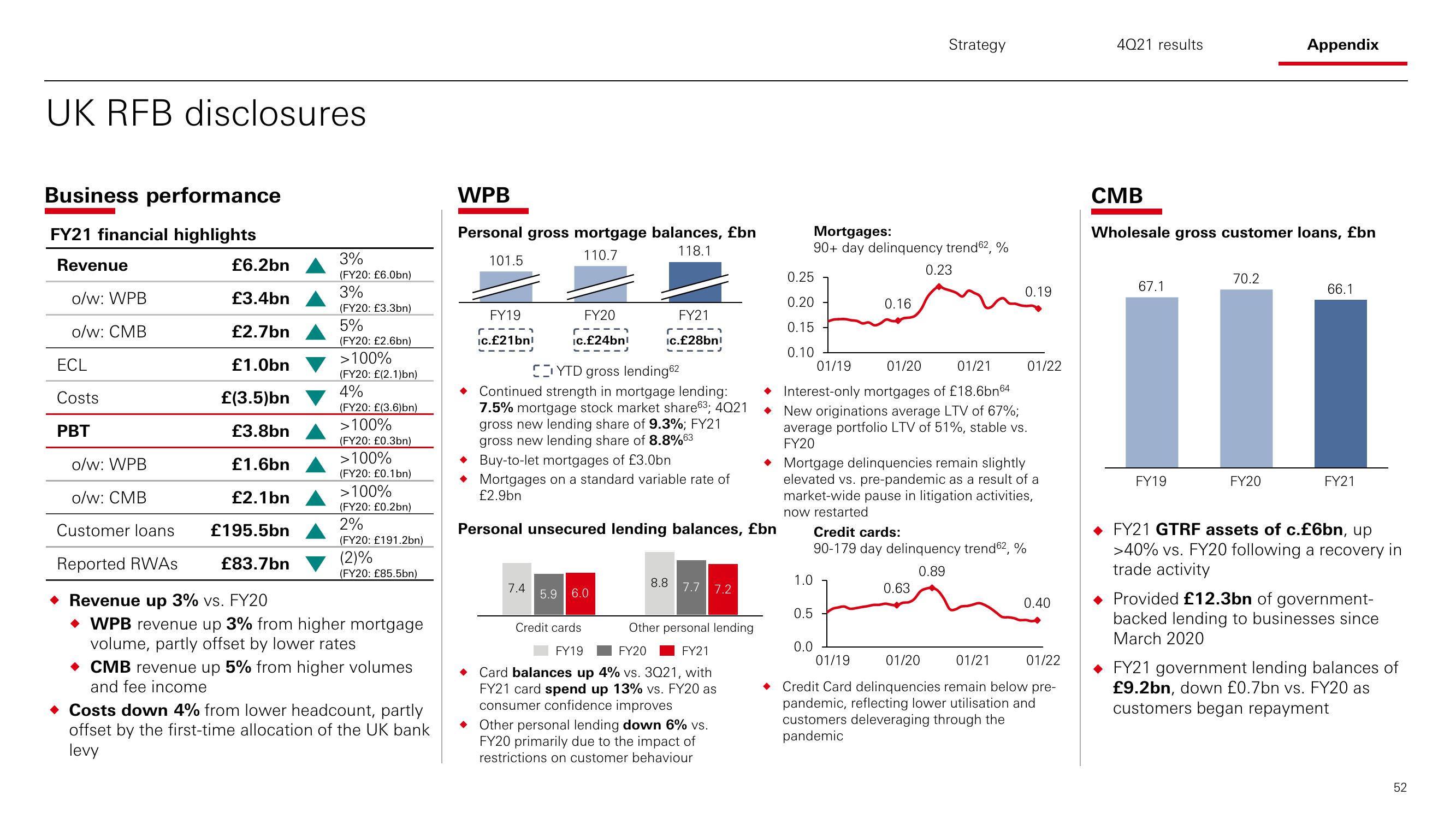

Business performance

FY21 financial highlights

Revenue

o/w: WPB

o/w: CMB

ECL

Costs

PBT

o/w: WPB

o/w: CMB

Customer loans

Reported RWAS

£6.2bn

£3.4bn

£2.7bn

£1.0bn

£(3.5)bn

£3.8bn

£1.6bn

£2.1bn

£195.5bn

£83.7bn

3%

(FY20: £6.0bn)

3%

(FY20: £3.3bn)

5%

(FY20: £2.6bn)

>100%

(FY20: £(2.1)bn)

4%

(FY20: £(3.6)bn)

>100%

(FY20: £0.3bn)

>100%

(FY20: £0.1bn)

>100%

(FY20: £0.2bn)

2%

(FY20: £191.2bn)

(2)%

(FY20: £85.5bn)

Revenue up 3% vs. FY20

◆ WPB revenue up 3% from higher mortgage

volume, partly offset by lower rates

◆ CMB revenue up 5% from higher volumes

and fee income

Costs down 4% from lower headcount, partly

offset by the first-time allocation of the UK bank

levy

WPB

Personal gross mortgage balances, £bn

118.1

101.5

110.7

FY19

ic.£21bn¹

•

FY20

ic.£24bn

7.4

FY21

ic.£28bn¹

CYTD gross lending62

Continued strength in mortgage lending:

7.5% mortgage stock market share63; 4021

gross new lending share of 9.3%; FY21

gross new lending share of 8.8%63

r

◆ Buy-to-let mortgages of £3.0bn

◆ Mortgages on a standard variable rate of

£2.9bn

Personal unsecured lending balances, £bn

5.9 6.0

8.8

7.7 7.2

Credit cards

Other personal lending

FY19 FY20 FY21

Card balances up 4% vs. 3021, with

FY21 card spend up 13% vs. FY20 as

consumer confidence improves

Other personal lending down 6% vs.

FY20 primarily due to the impact of

restrictions on customer behaviour

0.25

0.20

0.15

0.10

Mortgages:

90+ day delinquency trend62, %

0.5

0.16

01/19 01/20 01/21

Interest-only mortgages of £18.6bn64

◆ New originations average LTV of 67%;

average portfolio LTV of 51%, stable vs.

FY20

1.0

0.0

Strategy

0.23

→ Mortgage delinquencies remain slightly

elevated vs. pre-pandemic as a result of a

market-wide pause in litigation activities,

now restarted

0.19

0.63

Credit cards:

90-179 day delinquency trend 62, %

0.89

01/22

0.40

01/19 01/20 01/21 01/22

Credit Card delinquencies remain below pre-

pandemic, reflecting lower utilisation and

customers deleveraging through the

pandemic

4021 results

CMB

Wholesale gross customer loans, £bn

67.1

FY19

70.2

Appendix

FY20

66.1

FY21

FY21 GTRF assets of c.£6bn, up

>40% vs. FY20 following a recovery in

trade activity

Provided £12.3bn of government-

backed lending to businesses since

March 2020

FY21 government lending balances of

£9.2bn, down £0.7bn vs. FY20 as

customers began repayment

52View entire presentation