Credit Suisse Results Presentation Deck

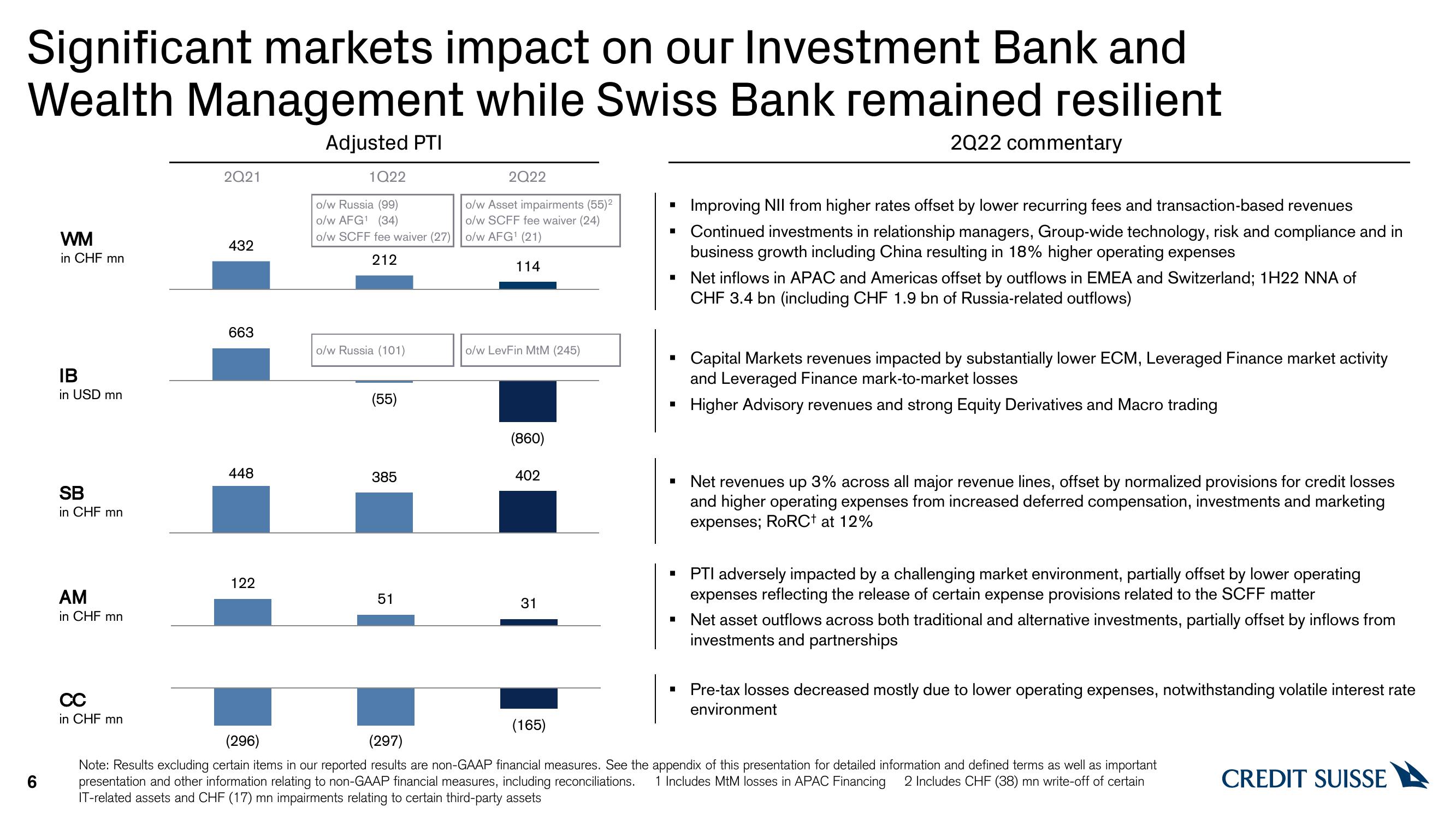

Significant markets impact on our Investment Bank and

Wealth Management while Swiss Bank remained resilient

Adjusted PTI

2022 commentary

6

WM

in CHF mn

IB

in USD mn

SB

in CHF mn

AM

in CHF mn

CC

in CHF mn

2Q21

432

663

448

122

1Q22

o/w Russia (99)

o/w AFG¹ (34)

o/w SCFF fee waiver (27) o/w AFG¹ (21)

212

114

o/w Russia (101)

(55)

385

51

2Q22

o/w Asset impairments (55)²

o/w SCFF fee waiver (24)

o/w LevFin MtM (245)

(860)

402

31

(165)

■

■

▪ Net inflows in APAC and Americas offset by outflows in EMEA and Switzerland; 1H22 NNA of

CHF 3.4 bn (including CHF 1.9 bn of Russia-related outflows)

I

Improving NII from higher rates offset by lower recurring fees and transaction-based revenues

Continued investments in relationship managers, Group-wide technology, risk and compliance and in

business growth including China resulting in 18% higher operating expenses

■

Capital Markets revenues impacted by substantially lower ECM, Leveraged Finance market activity

and Leveraged Finance mark-to-market losses

Higher Advisory revenues and strong Equity Derivatives and Macro trading

Net revenues up 3% across all major revenue lines, offset by normalized provisions for credit losses

and higher operating expenses from increased deferred compensation, investments and marketing

expenses; RoRC+ at 12%

PTI adversely impacted by a challenging market environment, partially offset by lower operating

expenses reflecting the release of certain expense provisions related to the SCFF matter

Net asset outflows across both traditional and alternative investments, partially offset by inflows from

investments and partnerships

Pre-tax losses decreased mostly due to lower operating expenses, notwithstanding volatile interest rate

environment

(296)

(297)

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes MtM losses in APAC Financing 2 Includes CHF (38) mn write-off of certain

IT-related assets and CHF (17) mn impairments relating to certain third-party assets

CREDIT SUISSEView entire presentation