BuzzFeed SPAC Presentation Deck

BuzzFeed

Total Sources

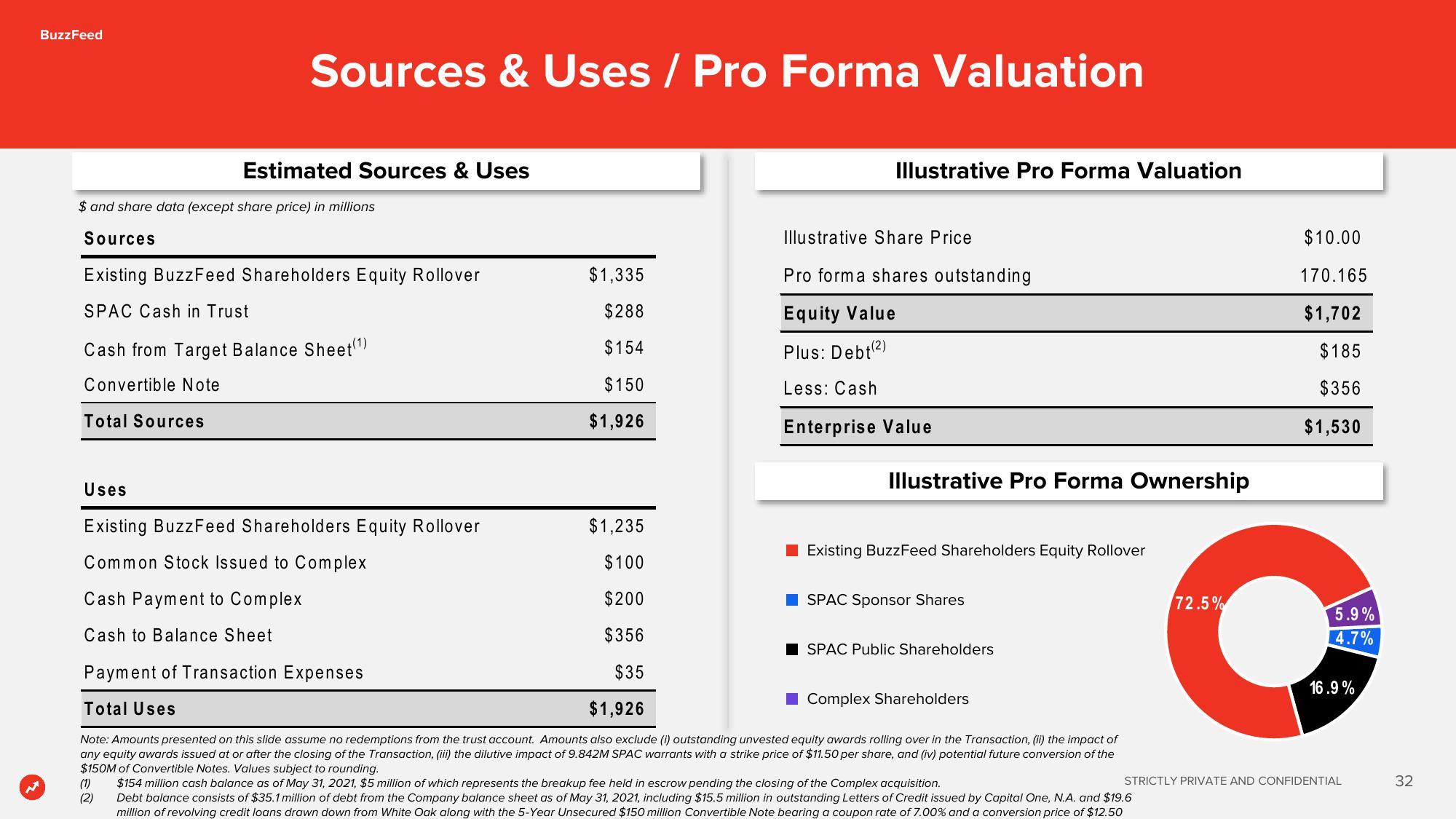

$ and share data (except share price) in millions

Sources

Existing BuzzFeed Shareholders Equity Rollover

SPAC Cash in Trust

Cash from Target Balance Sheet(¹)

Convertible Note

Sources & Uses / Pro Forma Valuation

Estimated Sources & Uses

Uses

Existing BuzzFeed Shareholders Equity Rollover

Common Stock Issued to Complex

Cash Payment to Complex

Cash to Balance Sheet

(1)

(2)

$1,335

$288

$154

$150

$1,926

Illustrative Pro Forma Valuation

Illustrative Share Price

Pro forma shares outstanding

Equity Value

Plus: Debt(2)

Less: Cash

Enterprise Value

$1,235

$100

$200

$356

Payment of Transaction Expenses

$35

$1,926

Complex Shareholders

Total Uses

Note: Amounts presented on this slide assume no redemptions from the trust account. Amounts also exclude (i) outstanding unvested equity awards rolling over in the Transaction, (ii) the impact of

any equity awards issued at or after the closing of the Transaction, (iii) the dilutive impact of 9.842M SPAC warrants with a strike price of $11.50 per share, and (iv) potential future conversion of the

$150M of Convertible Notes. Values subject to rounding.

$154 million cash balance as of May 31, 2021, $5 million of which represents the breakup fee held in escrow pending the closing of the Complex acquisition.

Debt balance consists of $35.1 million of debt from the Company balance sheet as of May 31, 2021, including $15.5 million in outstanding Letters of Credit issued by Capital One, N.A. and $19.6

million of revolving credit loans drawn down from White Oak along with the 5-Year Unsecured $150 million Convertible Note bearing a coupon rate of 7.00% and a conversion price of $12.50

Illustrative Pro Forma Ownership

Existing BuzzFeed Shareholders Equity Rollover

SPAC Sponsor Shares

SPAC Public Shareholders

72.5%

$10.00

170.165

$1,702

$185

$356

$1,530

5.9%

4.7%

16.9%

STRICTLY PRIVATE AND CONFIDENTIAL

32View entire presentation