Credit Suisse Investment Banking Pitch Book

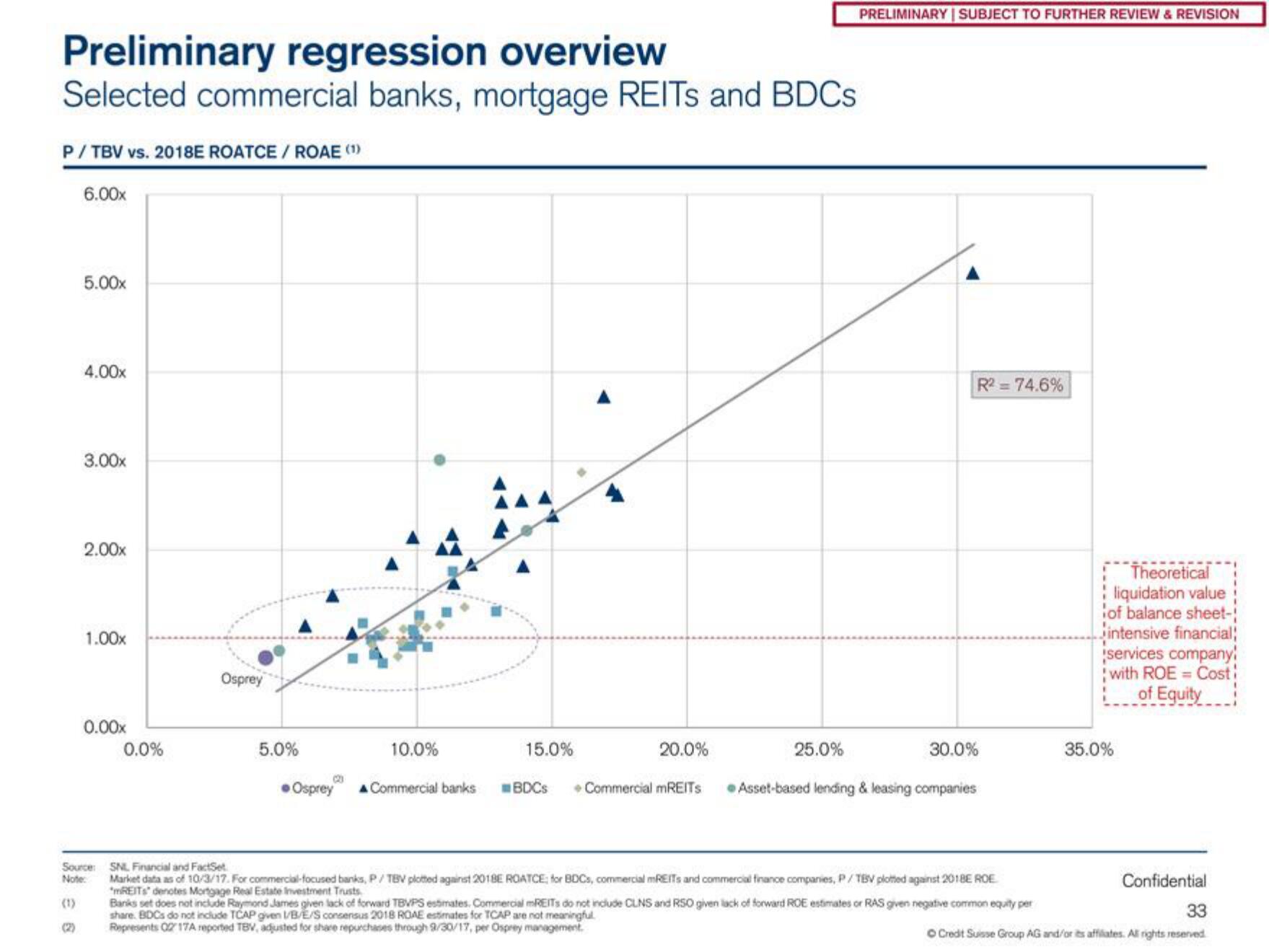

Preliminary regression overview

Selected commercial banks, mortgage REITS and BDCs

P/TBV vs. 2018E ROATCE / ROAE (1)

6.00x

(1)

5.00x

4.00x

3.00x

2.00x

1.00x

0.00x

Source:

Note:

0.0%

Osprey

5.0%

(23

10.0%

Osprey A Commercial banks

15.0%

BDCS

20.0%

Commercial mREITS

25.0%

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

R²=74.6%

30.0%

Asset-based lending & leasing companies

SNL Financial and FactSet

Market data as of 10/3/17. For commercial-focused banks, P/TBV plotted against 2018E ROATCE: for BDCs, commercial mREITs and commercial finance companies, P/TBV plotted against 2018E ROE

"REITS" denotes Mortgage Real Estate Investment Trusts

Banks set does not include Raymond James given lack of forward TBVPS estimates. Commercial mREITs do not include CLNS and RSO given lack of forward ROE estimates or RAS given negative common equity per

share. BDCs do not include TCAP given I/B/E/S consensus 2018 ROAE estimates for TCAP are not meaningful

Represents 0217A reported TBV, adjusted for share repurchases through 9/30/17, per Osprey management.

Theoretical

liquidation value

of balance sheet-

intensive financial

services company!

with ROE = Cost:

of Equity

35.0%

Confidential

33

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation