Pathward Financial Results Presentation Deck

ASSET QUALITY

$ in millions

$ in millions

0.67%

$39.4

2Q20

0.87%

$31.5

2Q20

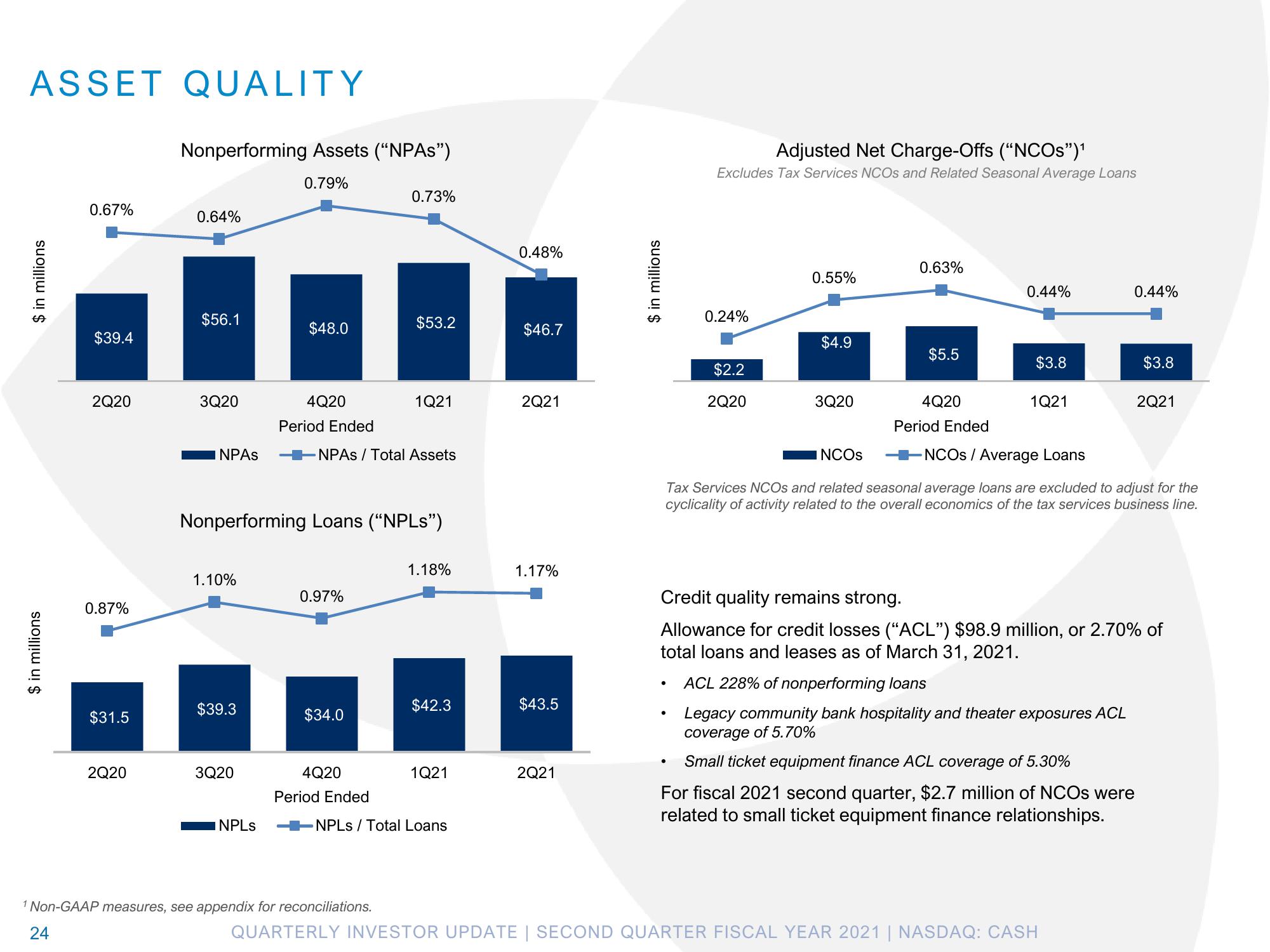

Nonperforming Assets ("NPAs")

0.79%

0.64%

$56.1

3Q20

INPAS

1.10%

$39.3

3Q20

$48.0

INPLs

4Q20

Period Ended

Nonperforming Loans ("NPLs")

0.97%

NPAs / Total Assets

$34.0

0.73%

4Q20

Period Ended

$53.2

1Q21

¹ Non-GAAP measures, see appendix for reconciliations.

24

1.18%

$42.3

1Q21

NPLs/Total Loans

0.48%

$46.7

2Q21

1.17%

$43.5

2Q21

$ in millions

Adjusted Net Charge-Offs ("NCOS")¹

Excludes Tax Services NCOS and Related Seasonal Average Loans

0.24%

●

$2.2

2Q20

0.55%

$4.9

3Q20

0.63%

$5.5

4Q20

Period Ended

0.44%

$3.8

1Q21

0.44%

$3.8

INCOS

-NCOS / Average Loans

Tax Services NCOs and related seasonal average loans are excluded to adjust for the

cyclicality of activity related to the overall economics of the tax services business line.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

2Q21

Credit quality remains strong.

Allowance for credit losses ("ACL") $98.9 million, or 2.70% of

total loans and leases as of March 31, 2021.

ACL 228% of nonperforming loans

Legacy community bank hospitality and theater exposures ACL

coverage of 5.70%

Small ticket equipment finance ACL coverage of 5.30%

For fiscal 2021 second quarter, $2.7 million of NCOs were

related to small ticket

nent finance relationships.View entire presentation