J.P.Morgan Investment Banking

APPENDIX

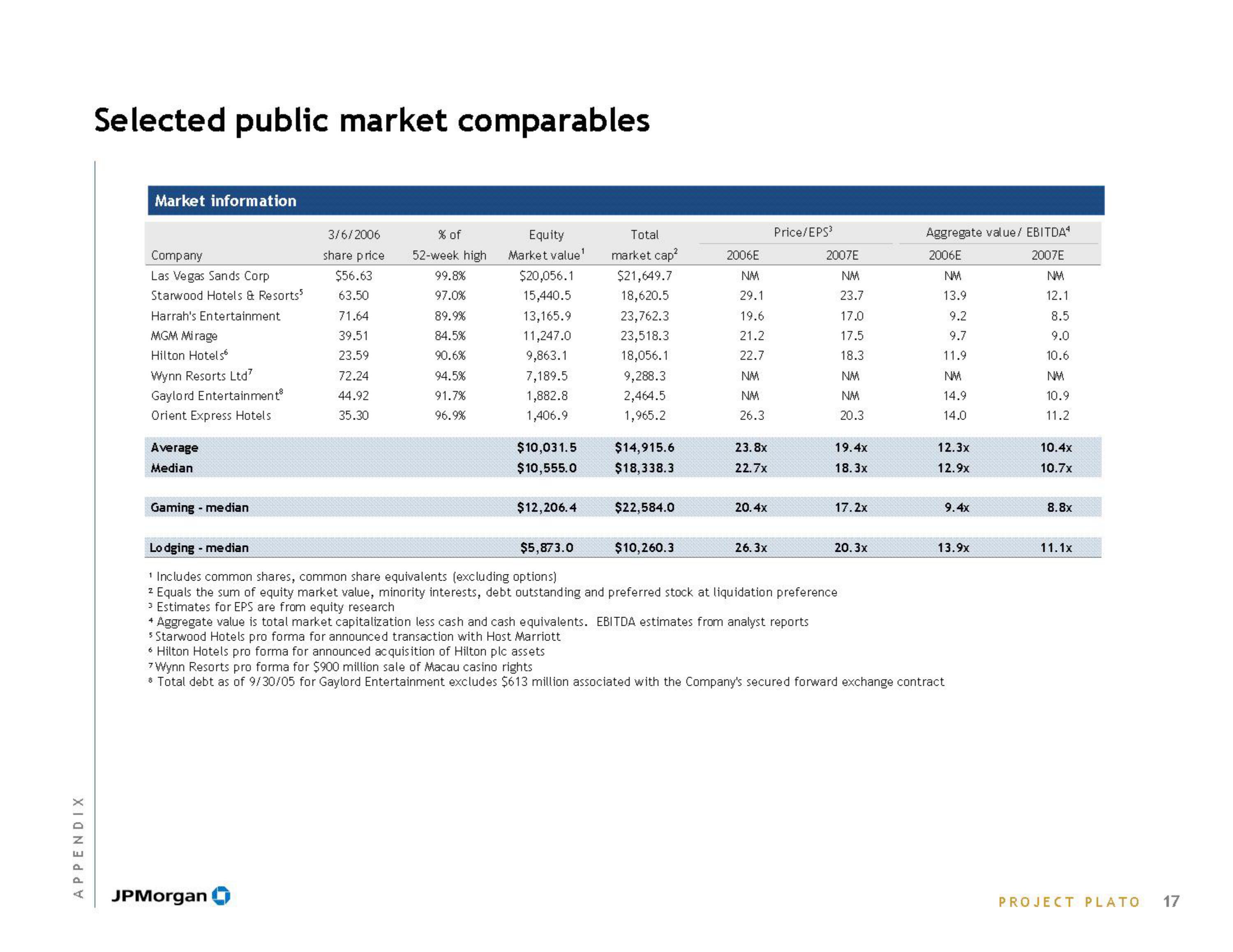

Selected public market comparables

Market information

Company

Las Vegas Sands Corp

Starwood Hotels & Resorts'

Harrah's Entertainment

MGM Mirage

Hilton Hotels

Wynn Resorts Ltd7

Gaylord Entertainment

Orient Express Hotels

Average

Median

Gaming - median

3/6/2006

share price

$56.63

63.50

JPMorgan

71.64

39.51

23.59

72.24

44.92

35.30

% of

52-week high

99.8%

97.0%

89.9%

84.5%

90.6%

94.5%

91.7%

96.9%

Equity

Market value¹

$20,056.1

15,440.5

13,165.9

11,247.0

9,863.1

7,189.5

1,882.8

1,406.9

$10,031.5

$10,555.0

$12,206.4

Total

market cap²

$21,649.7

18,620.5

23,762.3

23,518.3

18,056.1

9,288.3

2,464.5

1,965.2

$14,915.6

$18,338.3

$22,584.0

2006E

NM

$10,260.3

29.1

19.6

21.2

22.7

NM

NM

26.3

23.8x

22.7x

20.4x

Price/EPS³

26.3x

2007E

NM

23.7

17.0

17.5

18.3

NM

NM

20.3

19.4x

18.3x

17.2x

Aggregate value / EBITDA¹

2006E

2007E

NM

NM

13.9

12.1

9.2

8.5

9.7

9.0

11.9

10.6

NM

10.9

11.2

Lodging - median

$5,873.0

¹ Includes common shares, common share equivalents (excluding options)

2 Equals the sum of equity market value, minority interests, debt outstanding and preferred stock at liquidation preference

3 Estimates for EPS are from equity research

4 Aggregate value is total market capitalization less cash and cash equivalents. EBITDA estimates from analyst reports

5 Starwood Hotels pro forma for announced transaction with Host Marriott

* Hilton Hotels pro forma for announced acquisition of Hilton plc assets

7Wynn Resorts pro forma for $900 million sale of Macau casino rights

* Total debt as of 9/30/05 for Gaylord Entertainment excludes $613 million associated with the Company's secured forward exchange contract

20.3x

NM

14.9

14.0

12.3x

12.9x

9.4x

13.9x

10.4x

10.7x

8.8x

11.1x

PROJECT PLATO 17View entire presentation