Hertz Investor Presentation Deck

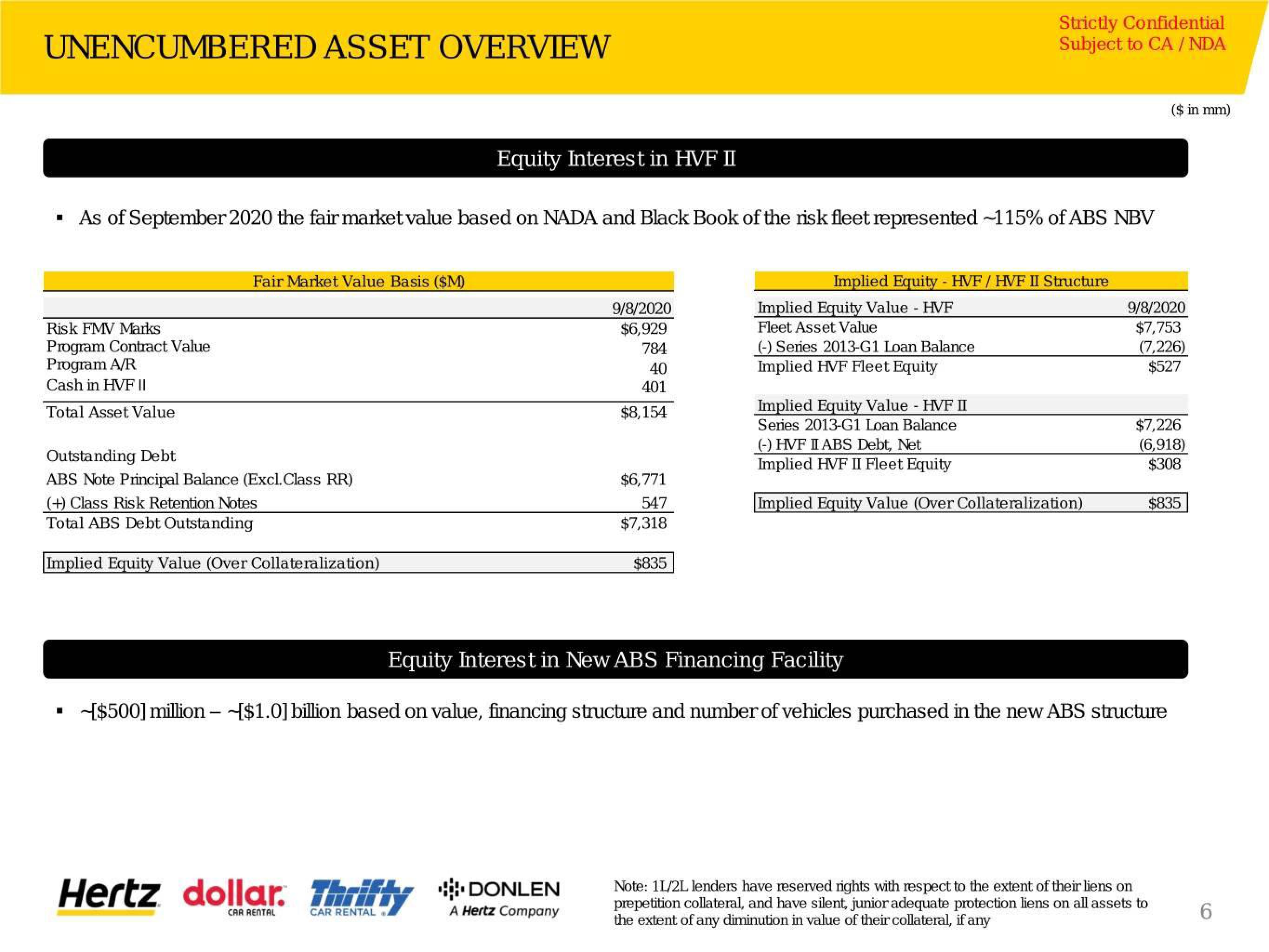

UNENCUMBERED ASSET OVERVIEW

Risk FMV Marks

Program Contract Value

Program A/R

Cash in HVF II

Total Asset Value

▪ As of September 2020 the fair market value based on NADA and Black Book of the risk fleet represented -115% of ABS NBV

Fair Market Value Basis ($M)

Outstanding Debt

ABS Note Principal Balance (Excl. Class RR)

(+) Class Risk Retention Notes

Total ABS Debt Outstanding

Implied Equity Value (Over Collateralization)

■

Equity Interest in HVF II

9/8/2020

$6,929

784

40

401

$8,154

Hertz dollar. Thrifty DONLEN

CAR RENTAL

CAR RENTAL

A Hertz Company

$6,771

547

$7,318

$835

Strictly Confidential

Subject to CA/NDA

Implied Equity - HVF/HVF II Structure

Implied Equity Value - HVF

Fleet Asset Value

(-) Series 2013-G1 Loan Balance

Implied HVF Fleet Equity

Implied Equity Value - HVF II

Series 2013-G1 Loan Balance

(-) HVF II ABS Debt, Net

Implied HVF II Fleet Equity

Implied Equity Value (Over Collateralization)

9/8/2020

$7,753

(7,226)

$527

($ in mm)

$7,226

(6,918)

$308

Equity Interest in New ABS Financing Facility

[$500] million [$1.0] billion based on value, financing structure and number of vehicles purchased in the new ABS structure

$835

Note: 11/2L lenders have reserved rights with respect to the extent of their liens on

prepetition collateral, and have silent, junior adequate protection liens on all assets to

the extent of any diminution in value of their collateral, if any

6View entire presentation