Nikola Results Presentation Deck

10

PAGE

NIKOLA

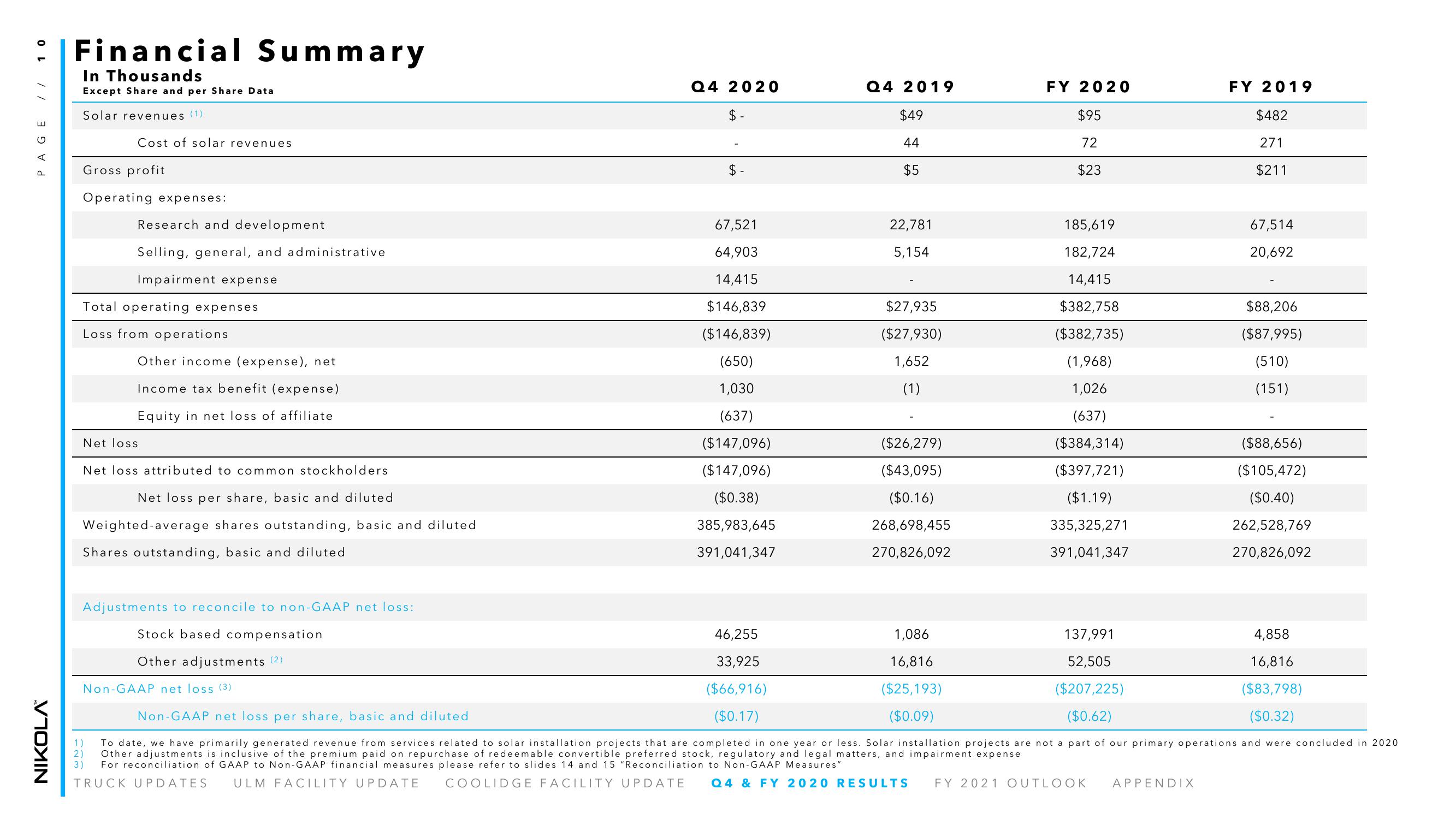

Financial Summary

In Thousands

Except Share and per Share Data

Solar revenues (1)

Cost of solar revenues

Gross profit

Operating expenses:

Research and development

Selling, general, and administrative

Impairment expense

Total operating expenses

Loss from operations

Other income (expense), net

Income tax benefit (expense)

Equity in net loss of affiliate

Net loss

Net loss attributed to common stockholders

Net loss per share, basic and diluted

Weighted-average shares outstanding, basic and diluted

Shares outstanding, basic and diluted

Adjustments to reconcile to non-GAAP net loss:

Stock based compensation

Other adjustments (2)

Non-GAAP net loss (3)

Q4 2020

$-

$.

67,521

64,903

14,415

$146,839

($146,839)

(650)

1,030

(637)

($147,096)

($147,096)

($0.38)

385,983,645

391,041,347

46,255

33,925

($66,916)

($0.17)

Q4 2019

$49

44

$5

22,781

5,154

$27,935

($27,930)

1,652

(1)

($26,279)

($43,095)

($0.16)

268,698,455

270,826,092

1,086

16,816

($25,193)

($0.09)

FY 2020

$95

72

$23

185,619

182,724

14,415

$382,758

($382,735)

(1,968)

1,026

(637)

($384,314)

($397,721)

($1.19)

335,325,271

391,041,347

137,991

52,505

($207,225)

($0.62)

FY 2019

$482

271

$211

APPENDIX

67,514

20,692

$88,206

($87,995)

(510)

(151)

($88,656)

($105,472)

($0.40)

262,528,769

270,826,092

4,858

16,816

($83,798)

($0.32)

Non-GAAP net loss per share, basic and diluted

1) To date, we have primarily generated revenue from services related to solar installation projects that are completed in one year or less. Solar installation projects are not a part of our primary operations and were concluded in 2020

2) Other adjustments is inclusive of the premium paid on repurchase of redeemable convertible preferred stock, regulatory and legal matters, and impairment expense

3) For reconciliation of GAAP to Non-GAAP financial measures please refer to slides 14 and 15 "Reconciliation to Non-GAAP Measures"

TRUCK UPDATES ULM FACILITY UPDATE COOLIDGE FACILITY UPDATE Q4 & FY 2020 RESULTS FY 2021 OUTLOOKView entire presentation