Evercore Investment Banking Pitch Book

Appendix

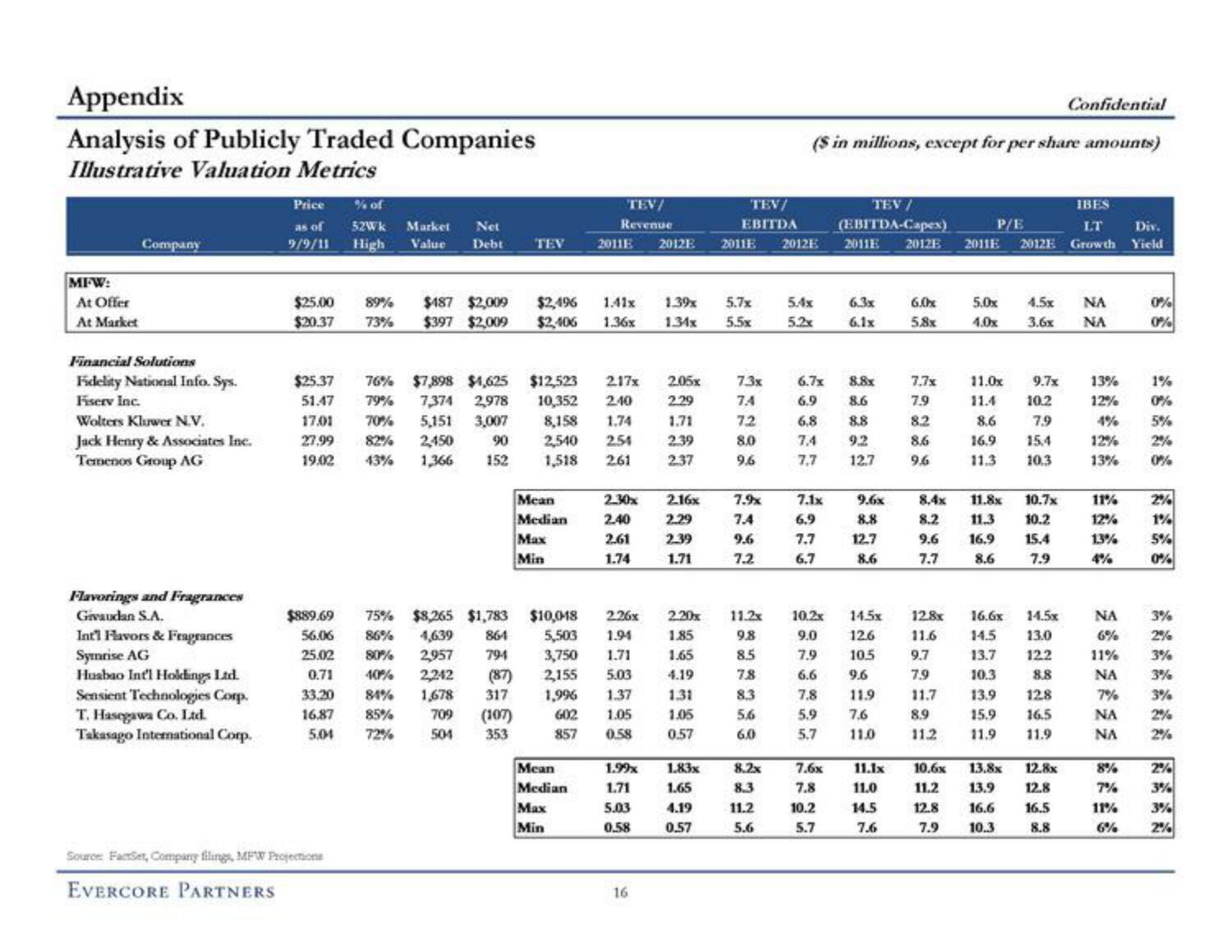

Analysis of Publicly Traded Companies

Illustrative Valuation Metrics

MFW:

At Offer

At Market

Company

Financial Solutions

Fidelity National Info. Sys.

Fiserv Inc.

Wolters Kluwer N.V.

Jack Henry & Associates Inc.

Temenos Group AG

Flavorings and Fragrances

Givaudan S.A.

Int'l Flavors & Fragrances

Symrise AG

Husbao Int'l Holdings Ltd.

Sensient Technologies Corp.

T. Hasegawa Co. Ltd.

Takasago International Corp.

Price

as of

9/9/11

$25.00

$20.37

% of

52Wk Market Net

High

Source FactSet, Company filings, MFW Projections

EVERCORE PARTNERS

Value Debt TEV

89% $187 $2,009 $2,496

$397 $2,009 $2,406

73%

$25.37 76% $7,898 $4,625

51.47 79% 7,374 2,978

17.01 70% 5,151 3,007

27.99 82% 2,450 90

19.02 43% 1,366 152

$889.69

56.06

25.02

0.71

33.20

84%

16.87 85%

5.04 72%

75% $8,265 $1,783

86% 4,639

864

80% 2,957 794

40%

2,242

1,678

709

504

(87)

317

(107)

353

Mean

Median

Max

Min

$10,048

5,503

3,750

2,155

1,996

$12,523 217x

10,352 2.40

8,158 1.74

2,540 2.54

1,518 261

TEV/

Revenue

Mean

Median

Max

Min

2011E 2012E 2011E 2012E

1.41x 1.39x 5.7x

1.36x 1.34x

5.5x

2.26x

1.94

1.71

5.03

1.37

602 1.05

857 0.58

2.30x 2.16x

2.40

2.29

2.61

2.39

1.74

1.71

1.99x

1.71

5.03

0.58

2.05x

2.29

1.71

2.39

2.37

16

TEV/

EBITDA

2.20x

1.85

1.65

4.19

1.31

1.05

0.57

1.83x

1.65

4.19

0.57

7.3x

7.4

7.2

8.0

9.6

7.9x

7.4

9.6

7.2

11.2x

9.8

8.5

7.8

8.3

5,6

6.0

8.2x

8.3

11.2

5.6

($ in millions, except for per share amounts)

5.4x

5.2x

6.7x

6.9

6.8

7,4

7,7

7.1x

6.9

7.7

6.7

10.2x

9.0

7.9

6.6

7.8

5.9

5.7

7.6x

7.8

10.2

5.7

TEV /

(EBITDA-Capex)

IBES

LT

Div.

2011E 2012B 2011E 2012E Growth Yield

6.3x

6.1x

8.8x

8.6

8.8

9.2

12.7

9.6x

8.8

12.7

8.6

115,

12.6

10.5

9.6

11.9

7.6

11.0

11.1x

11.0

14.5

7.6

6.0x

5.8x

7.7x

7.9

8.2

8.6

9.6

8.4x

8.2

9.6

7.7

P/E

5.0x

4.0x

11.0x 9.7x

11.4 10.2

8.6

16.9

7.9

15,4

11.3 10.3

4.5x NA

3.6x NA

11.8x 10.7x

11.3 10.2

16.9 15.4

8.6

7.9

12.8x 16.6x

1.5

11.6

14.5

13.0

9.7

13.7

122

7.9

10.3

8.8

11.7

13.9

128

8.9

15.9

16.5

11.2

11.9 11.9

10.6x 13.8x

11.2 13.9

12.8

7.9

Confidential

12.8x

12.8

16.6 16.5

8.8

10.3

13%

12%

4%

12%

13%

11%

12%

1.3%

4%

ΝΑ

6%

11%

ΝΑ

7%

NA

ΝΑ

8%

7%

11%

6%

0%

0%

1%

0%

5%

0%

2%

1%

5%

0%

3%

3%

3%

3%

2%

2%

2%

3%

3%

2%View entire presentation