First Merchants Investor Presentation Deck

Loan Portfolio

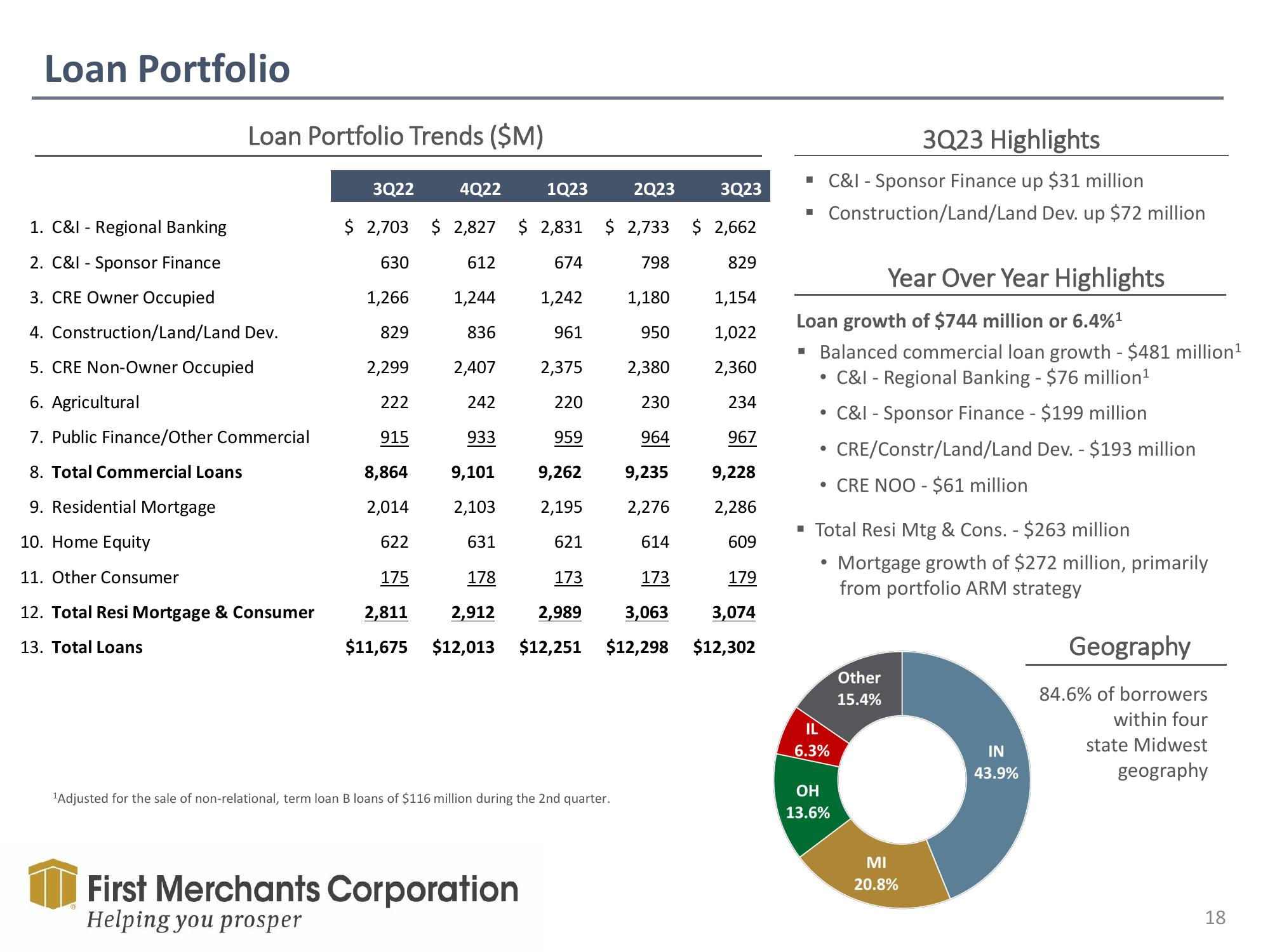

1. C&I - Regional Banking

2. C&I - Sponsor Finance

3. CRE Owner Occupied

Loan Portfolio Trends ($M)

4. Construction/Land/Land Dev.

5. CRE Non-Owner Occupied

6. Agricultural

7. Public Finance/Other Commercial

8. Total Commercial Loans

9. Residential Mortgage

10. Home Equity

11. Other Consumer

12. Total Resi Mortgage & Consumer

13. Total Loans

3Q22

1Q23

2Q23

3Q23

$ 2,703 $2,827 $ 2,831 $ 2,733 $ 2,662

630

674

798

829

1,266

1,244

1,242

1,180

1,154

829

836

961

950

1,022

2,299

2,407

2,375

2,380

2,360

222

242

220

230

234

915

933

959

964

967

8,864

9,101 9,262 9,235

9,228

2,014

2,103

2,195

2,276

2,286

622

631

621

614

609

175

178

173

173

179

2,811

2,912

2,989

3,063

3,074

$11,675 $12,013 $12,251 $12,298 $12,302

4Q22

612

¹Adjusted for the sale of non-relational, term loan B loans of $116 million during the 2nd quarter.

First Merchants Corporation

Helping you prosper

3Q23 Highlights

▪ C&I - Sponsor Finance up $31 million

Construction/Land/Land Dev. up $72 million

■

Loan growth of $744 million or 6.4%¹

▪ Balanced commercial loan growth - $481 million¹

C&I - Regional Banking - $76 million ¹

• C&I - Sponsor Finance - $199 million

CRE/Constr/Land/Land Dev. - $193 million

• CRE NOO - $61 million

●

●

▪ Total Resi Mtg & Cons. - $263 million

●

IL

6.3%

Year Over Year Highlights

OH

13.6%

Mortgage growth of $272 million, primarily

from portfolio ARM strategy

Other

15.4%

MI

20.8%

IN

43.9%

Geography

84.6% of borrowers

within four

state Midwest

geography

18View entire presentation