PJT Partners Investment Banking Pitch Book

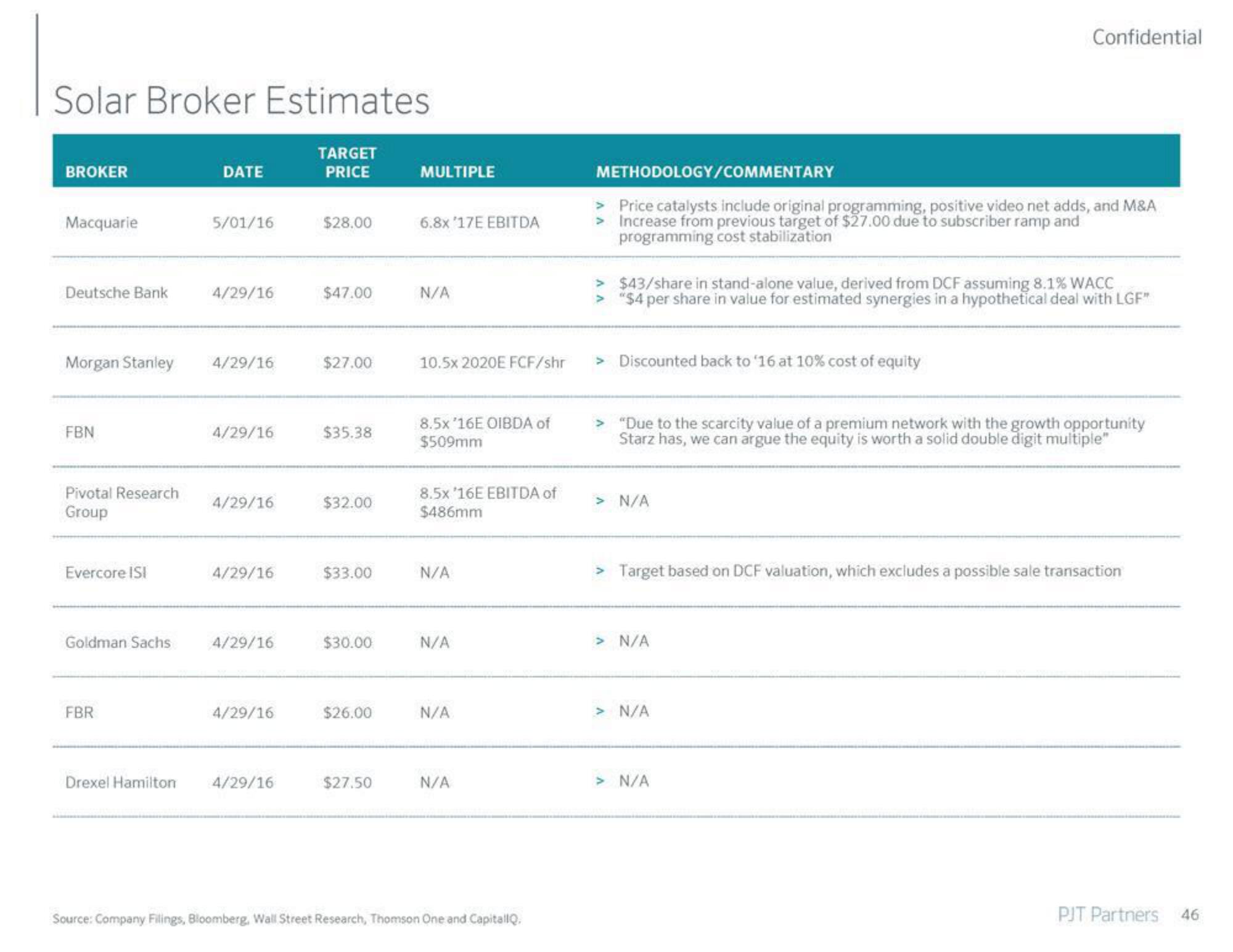

Solar Broker Estimates

TARGET

PRICE

BROKER

Macquarie

Deutsche Bank

Morgan Stanley

FBN

Pivotal Research

Group

Evercore ISI

Goldman Sachs

FBR

Drexel Hamilton

DATE

5/01/16

4/29/16

4/29/16

4/29/16

4/29/16

4/29/16

4/29/16

4/29/16

4/29/16

$28.00

$47.00

$27.00

$35.38

$32.00

$33.00

$30.00

$26.00

$27.50

MULTIPLE

6.8x '17E EBITDA

N/A

10.5x 2020E FCF/shr

8.5x '16E OIBDA of

$509mm

8.5x '16E EBITDA of

$486mm

N/A

N/A

N/A

N/A

Source: Company Filings, Bloomberg, Wall Street Research, Thomson One and CapitallQ.

METHODOLOGY/COMMENTARY

> Price catalysts include original programming, positive video net adds, and M&A

> Increase from previous target of $27.00 due to subscriber ramp and

programming cost stabilization

> $43/share in stand-alone value, derived from DCF assuming 8.1% WACC

"$4 per share in value for estimated synergies in a hypothetical deal with LGF"

> Discounted back to '16 at 10% cost of equity

> "Due to the scarcity value of a premium network with the growth opportunity

Starz has, we can argue the equity is worth a solid double digit multiple"

> N/A

Confidential

> Target based on DCF valuation, which excludes a possible sale transaction

> N/A

> N/A

> N/A

PJT Partners

46View entire presentation