Trian Partners Activist Presentation Deck

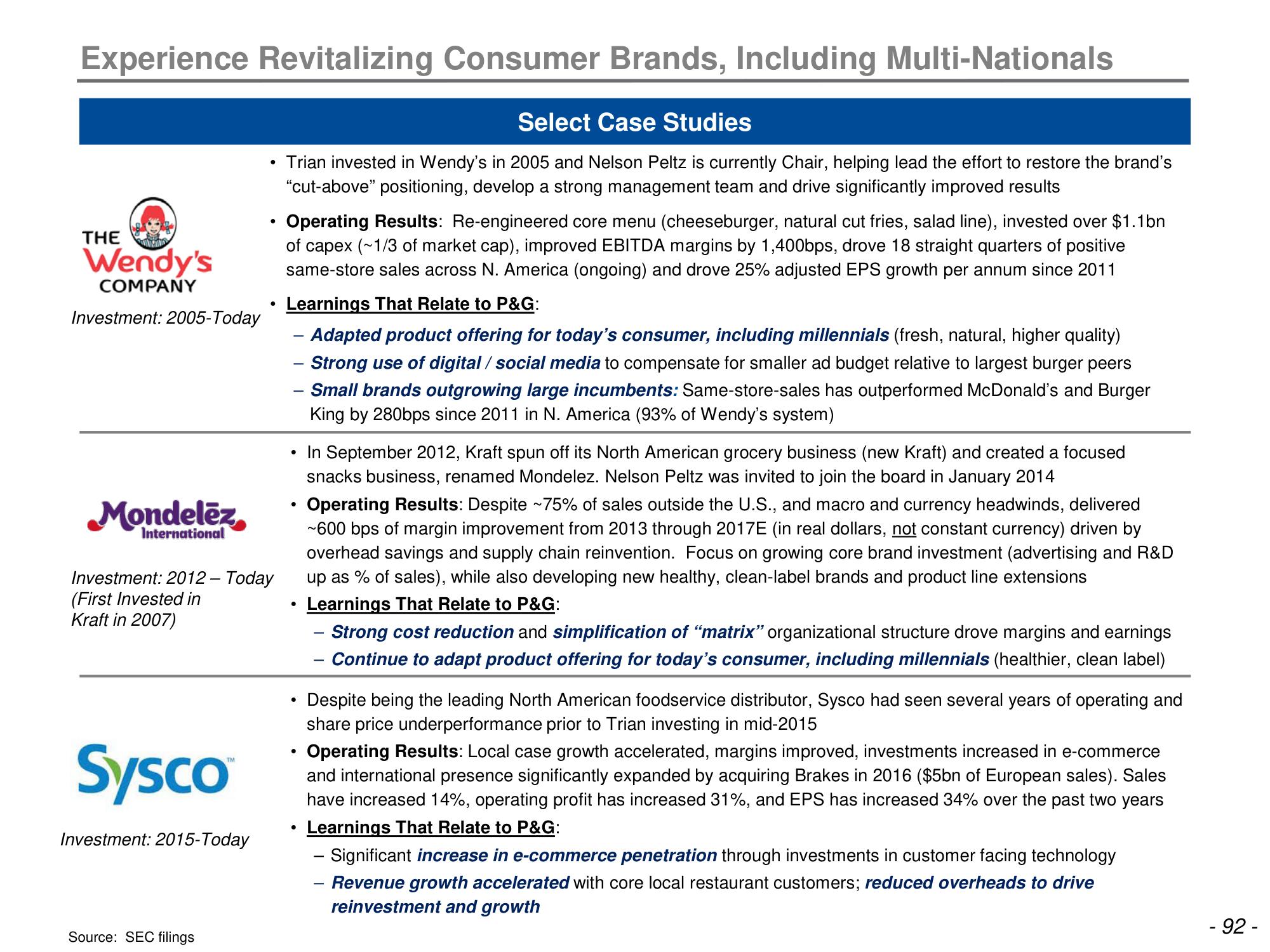

Experience Revitalizing Consumer Brands, Including Multi-Nationals

THE

Wendy's

COMPANY

Investment: 2005-Today

Mondelez

International

Sysco

Investment: 2012 - Today

(First Invested in

Kraft in 2007)

Investment: 2015-Today

●

Source: SEC filings

●

Select Case Studies

Trian invested in Wendy's in 2005 and Nelson Peltz is currently Chair, helping lead the effort to restore the brand's

"cut-above" positioning, develop a strong management team and drive significantly improved results

Operating Results: Re-engineered core menu (cheeseburger, natural cut fries, salad line), invested over $1.1bn

capex (~1/3 of market cap), improved EBITDA margins by 1,400bps, drove 18 straight quarters of positive

same-store sales across N. America (ongoing) and drove 25% adjusted EPS growth per annum since 2011

Learnings That Relate to P&G:

- Adapted product offering for today's consumer, including millennials (fresh, natural, higher quality)

-Strong use of digital/social media to compensate for smaller ad budget relative to largest burger peers

Small brands outgrowing large incumbents: Same-store-sales has outperformed McDonald's and Burger

King by 280bps since 2011 in N. America (93% of Wendy's system)

●

●

●

In September 2012, Kraft spun off its North American grocery business (new Kraft) and created a focused

snacks business, renamed Mondelez. Nelson Peltz was invited to join the board in January 2014

Operating Results: Despite ~75% of sales outside the U.S., and macro and currency headwinds, delivered

~600 bps of margin improvement from 2013 through 2017E (in real dollars, not constant currency) driven by

overhead savings and supply chain reinvention. Focus on growing core brand investment (advertising and R&D

up as % of sales), while also developing new healthy, clean-label brands and product line extensions

Learnings That Relate to P&G:

- Strong cost reduction and simplification of "matrix" organizational structure drove margins and earnings

Continue to adapt product offering for today's consumer, including millennials (healthier, clean label)

Despite being the leading North American foodservice distributor, Sysco had seen several years of operating and

share price underperformance prior to Trian investing in mid-2015

Operating Results: Local case growth accelerated, margins improved, investments increased in e-commerce

and international presence significantly expanded by acquiring Brakes in 2016 ($5bn of European sales). Sales

have increased 14%, operating profit has increased 31%, and EPS has increased 34% over the past two years

Learnings That Relate to P&G:

- Significant increase in e-commerce penetration through investments in customer facing technology

Revenue growth accelerated with core local restaurant customers; reduced overheads to drive

reinvestment and growth

- 92 -View entire presentation