IGI SPAC Presentation Deck

6 Conservative Balance Sheet and Capital Management

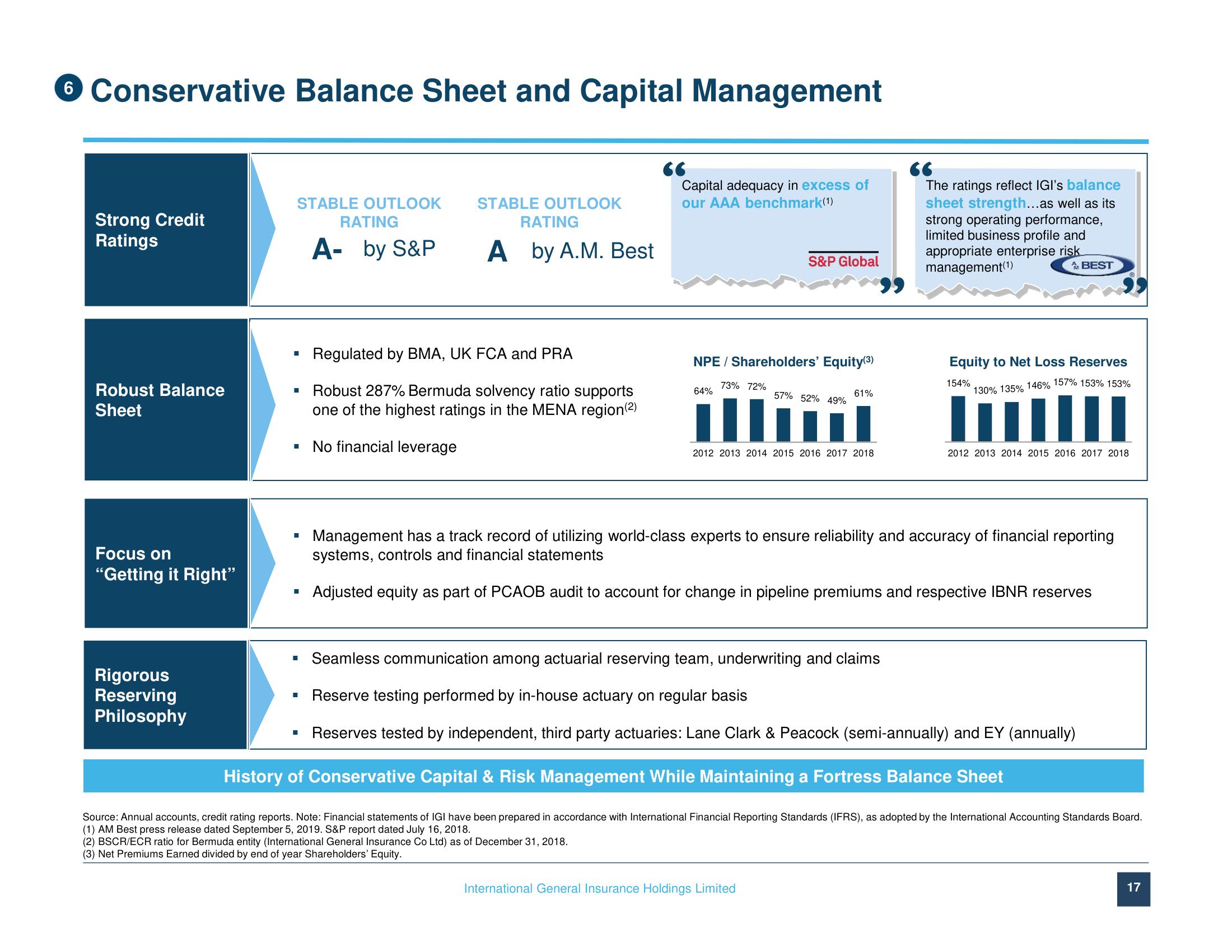

Strong Credit

Ratings

Robust Balance

Sheet

Focus on

"Getting it Right"

STABLE OUTLOOK

Rigorous

Reserving

Philosophy

■

■

I

■

■

RATING

A- by S&P

I

STABLE OUTLOOK

No financial leverage

RATING

A by A.M. Best

Regulated by BMA, UK FCA and PRA

Robust 287% Bermuda solvency ratio supports

one of the highest ratings in the MENA region(²)

Capital adequacy in excess of

our AAA benchmark(1)

NPE /Shareholders' Equity(3)

73% 72%

S&P Global

64%

11

2012 2013 2014 2015 2016 2017 2018

57% 52% 49%

International General Insurance Holdings Limited

61%

Seamless communication among actuarial reserving team, underwriting and claims

Reserve testing performed by in-house actuary on regular basis

Reserves tested by independent, third party actuaries: Lane Clark & Peacock (semi-annually) and EY (annually)

History of Conservative Capital & Risk Management While Maintaining a Fortress Balance Sheet

Source: Annual accounts, credit rating reports. Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board.

(1) AM Best press release dated September 5, 2019. S&P report dated July 16, 2018.

(2) BSCR/ECR ratio for Bermuda entity (International General Insurance Co Ltd) as of December 31, 2018.

(3) Net Premiums Earned divided by end of year Shareholders' Equity.

The ratings reflect IGI's balance

sheet strength...as well as its

strong operating performance,

limited business profile and

appropriate enterprise risk

management (¹)

ABEST

Equity to Net Loss Reserves

154%

130% 135% 146 % 157% 153% 153%

m

2012 2013 2014 2015 2016 2017 2018

Management has a track record of utilizing world-class experts to ensure reliability and accuracy of financial reporting

systems, controls and financial statements

Adjusted equity as part of PCAOB audit to account for change in pipeline premiums and respective IBNR reserves

17View entire presentation