AngloAmerican Results Presentation Deck

Footnotes

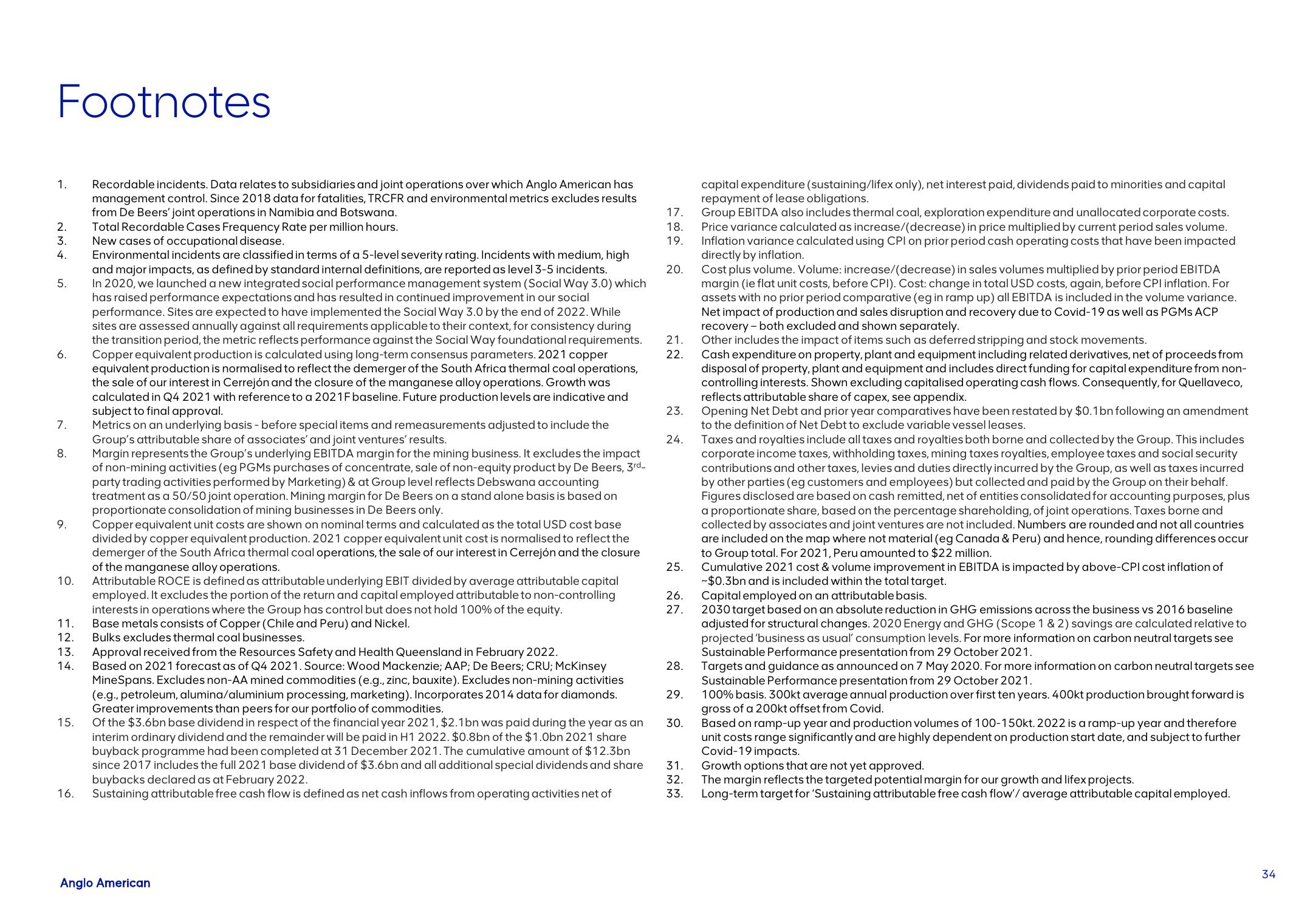

1. Recordable incidents. Data relates to subsidiaries and joint operations over which Anglo American has

management control. Since 2018 data for fatalities, TRCFR and environmental metrics excludes results

from De Beers' joint operations in Namibia and Botswana.

Total Recordable Cases Frequency Rate per million hours.

New cases of occupational disease.

Environmental incidents are classified in terms of a 5-level severity rating. Incidents with medium, high

and major impacts, as defined by standard internal definitions, are reported as level 3-5 incidents.

In 2020, we launched a new integrated social performance management system (Social Way 3.0) which

has raised performance expectations and has resulted in continued improvement i our social

performance. Sites are expected to have implemented the Social Way 3.0 by the end of 2022. While

sites are assessed annually against all requirements applicable to their context, for consistency during

the transition period, the metric reflects performance against the Social Way foundational requirements.

Copper equivalent production is calculated using long-term consensus parameters. 2021 copper

equivalent production is normalised to reflect the demerger of the South Africa thermal coal operations,

the sale of our interest in Cerrejón and the closure of the manganese alloy operations. Growth was

calculated in Q4 2021 with reference to a 2021F baseline. Future production levels are indicative and

subject to final approval.

Metrics on an underlying basis - before special items and remeasurements adjusted to include the

Group's attributable share of associates' and joint ventures' results.

Margin represents the Group's underlying EBITDA margin for the mining business. It excludes the impact

of non-mining activities (eg PGMs purchases of concentrate, sale of non-equity product by De Beers, 3rd_

party trading activities performed by Marketing) & at Group level reflects Debswana accounting

treatment as a 50/50 joint operation. Mining margin for De Beers on a stand alone basis is based on

proportionate consolidation of mining businesses in De Beers only.

Copper equivalent unit costs are shown on nominal terms and calculated as the total USD cost base

divided by copper equivalent production. 2021 copper equivalent unit cost is normalised to reflect the

demerger of the South Africa thermal coal operations, the sale of our interest in Cerrejón and the closure

of the manganese alloy operations.

Attributable ROCE is defined as attributable underlying EBIT divided by average attributable capital

employed. It excludes the portion of the return and capital employed attributable to non-controlling

interests in operations where the Group has control but does not hold 100% of the equity.

Base metals consists of Copper (Chile and Peru) and Nickel.

Bulks excludes thermal coal businesses.

234

3.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

Approval received from the Resources Safety and Health Queensland in February 2022.

Based on 2021 forecast as of Q4 2021. Source: Wood Mackenzie; AAP; De Beers; CRU; McKinsey

MineSpans. Excludes non-AA mined commodities (e.g., zinc, bauxite). Excludes non-mining activities

(e.g., petroleum, alumina/aluminium processing, marketing). Incorporates 2014 data for diamonds.

Greater improvements than peers for our portfolio of commodities.

Of the $3.6bn base dividend in respect of the financial year 2021, $2.1bn was paid during the year as an

interim ordinary dividend and the remainder will be paid in H1 2022. $0.8bn of the $1.0bn 2021 share

buyback programme had been completed at 31 December 2021. The cumulative amount of $12.3bn

since 2017 includes the full 2021 base dividend of $3.6bn and all additional special dividends and share

buybacks declared as at February 2022.

16. Sustaining attributable free cash flow is defined as net cash inflows from operating activities net of

15.

Anglo American

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

32.

33.

capital expenditure (sustaining/lifex only), net interest paid, dividends paid to minorities and capital

repayment of lease obligations.

Group EBITDA also includes thermal coal, exploration expenditure and unallocated corporate costs.

Price variance calculated as increase/(decrease) in price multiplied by current period sales volume.

Inflation variance calculated using CPI on prior period cash operating costs that have been impacted

directly by inflation.

Cost plus volume. Volume: increase/(decrease) in sales volumes multiplied by prior period EBITDA

margin (ie flat unit costs, before CPI). Cost: change in total USD costs, again, before CPI inflation. For

assets with no prior period comparative (eg in ramp up) all EBITDA is included in the volume variance.

Net impact of production and sales disruption and recovery due to Covid-19 as well as PGMs ACP

recovery - both excluded and shown separately.

Other includes the impact of items such as deferred stripping and stock movements.

Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from

disposal of property, plant and equipment and includes direct funding for capital expenditure from non-

controlling interests. Shown excluding capitalised operating cash flows. Consequently, for Quellaveco,

reflects attributable share of capex, see appendix.

Opening Net Debt and prior year comparatives have been restated by $0.1bn following an amendment

to the definition of Net Debt to exclude variable vessel leases.

Taxes and royalties include all taxes and royalties both borne and collected by the Group. This includes

corporate income taxes, withholding taxes, mining taxes royalties, employee taxes and social security

contributions and other taxes, levies and duties directly incurred by the Group, as well as taxes incurred

by other parties (eg customers and employees) but collected and paid by the Group on their behalf.

Figures disclosed are based on cash remitted, net of entities consolidated for accounting purposes, plus

a proportionate share, based on the percentage shareholding, of joint operations. Taxes borne and

collected by associates and joint ventures are not included. Numbers are rounded and not all countries

are included on the map where not material (eg Canada & Peru) and hence, rounding differences occur

to Group total. For 2021, Peru amounted to $22 million.

Cumulative 2021 cost & volume improvement in EBITDA is impacted by above-CPI cost inflation of

~$0.3bn and is included within the total target.

Capital employed on an attributable basis.

2030 target based on an absolute reduction in GHG emissions across the business vs 2016 baseline

adjusted for structural changes. 2020 Energy and GHG (Scope 1 & 2) savings are calculated relative to

projected 'business as usual' consumption levels. For more information on carbon neutral targets see

Sustainable Performance presentation from 29 October 2021.

Targets and guidance as announced on 7 May 2020. For more information on carbon neutral targets see

Sustainable Performance presentation from 29 October 2021.

100% basis. 300kt average annual production over first ten years. 400kt production brought forward is

gross of a 200kt offset from Covid.

Based on ramp-up year and production volumes of 100-150kt. 2022 is a ramp-up year and therefore

unit costs range significantly and are highly dependent on production start date, and subject to further

Covid-19 impacts.

Growth options that are not yet approved.

The margin reflects the targeted potential margin for our growth and lifex projects.

Long-term target for 'Sustaining attributable free cash flow'/ average attributable capital employed.

34View entire presentation