Mondi Mergers and Acquisitions Presentation Deck

MONDI GROUP KEY FINANCIALS

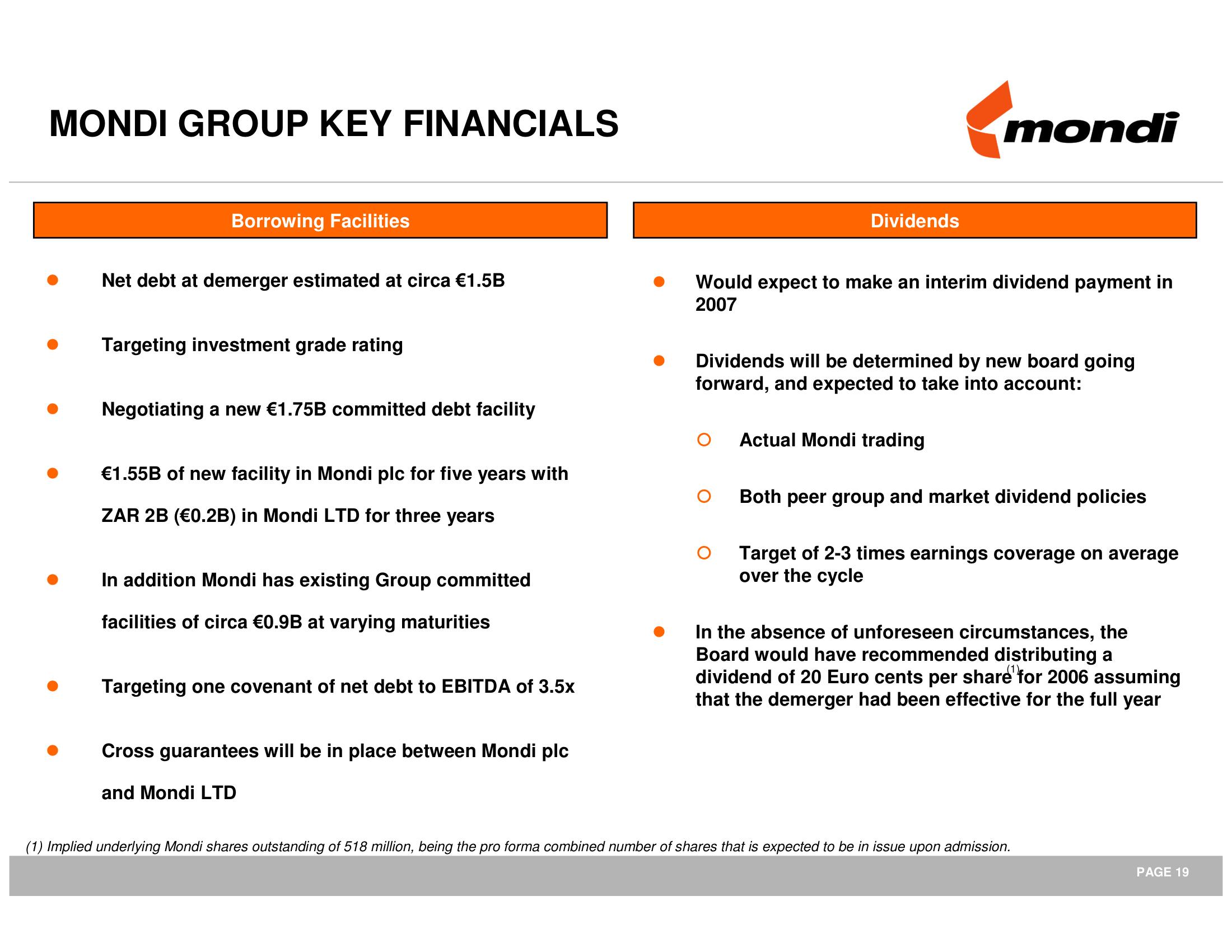

Borrowing Facilities

Net debt at demerger estimated at circa €1.5B

Targeting investment grade rating

Negotiating a new €1.75B committed debt facility

€1.55B of new facility in Mondi plc for five years with

ZAR 2B (€0.2B) in Mondi LTD for three years

In addition Mondi has existing Group committed

facilities of circa €0.9B at varying maturities

Targeting one covenant of net debt to EBITDA of 3.5x

Cross guarantees will be in place between Mondi plc

and Mondi LTD

Dividends

Would expect to make an interim dividend payment in

2007

O

mondi

Dividends will be determined by new board going

forward, and expected to take into account:

Actual Mondi trading

Both peer group and market dividend policies

Target of 2-3 times earnings coverage on average

over the cycle

In the absence of unforeseen circumstances, the

Board would have recommended distributing a

dividend of 20 Euro cents per share for 2006 assuming

that the demerger had been effective for the full year

(1) Implied underlying Mondi shares outstanding of 518 million, being the pro forma combined number of shares that is expected to be in issue upon admission.

PAGE 19View entire presentation