Goldman Sachs Results Presentation Deck

Global Banking & Markets

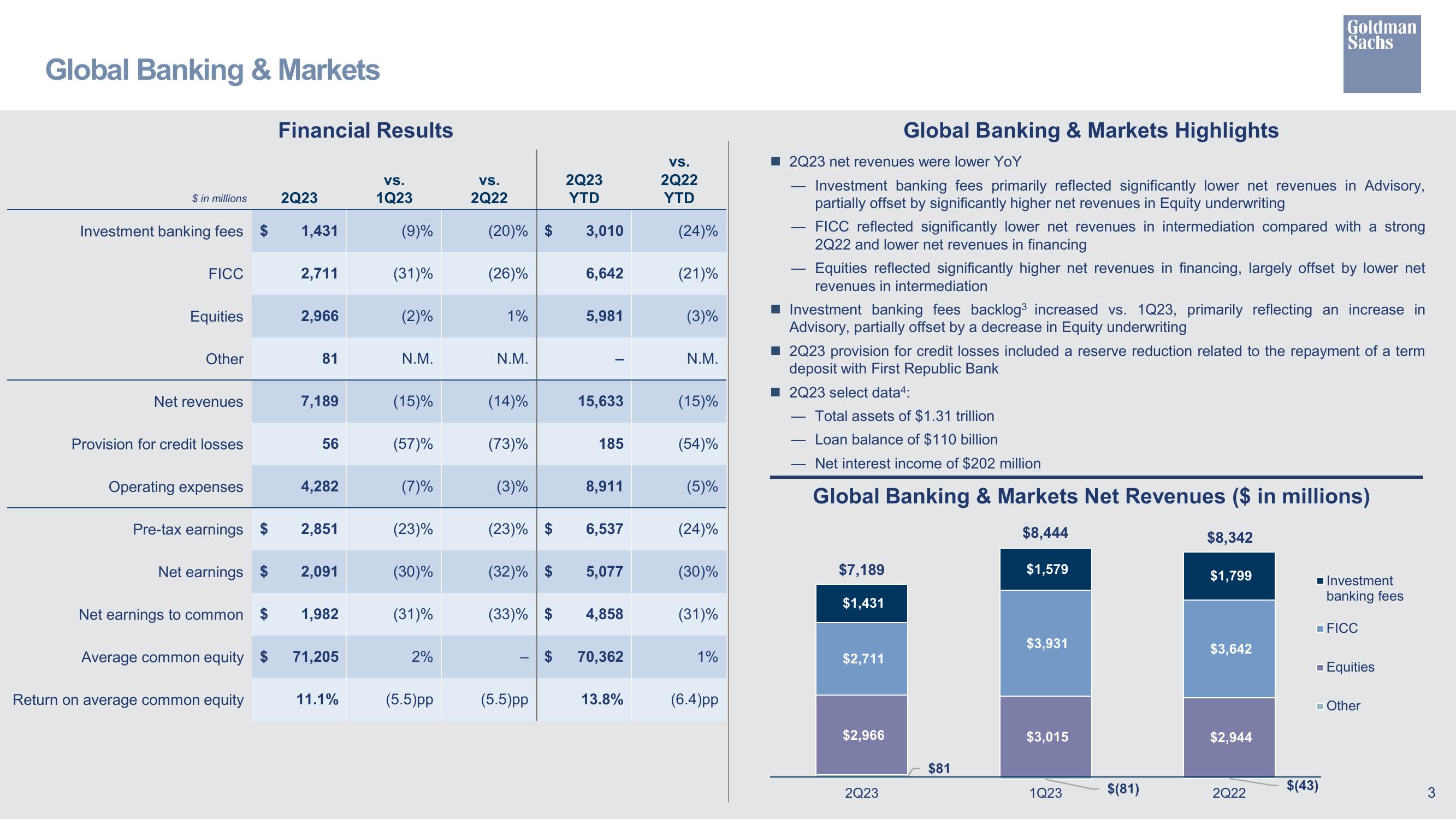

$ in millions

Investment banking fees $

FICC

Equities

Other

Net revenues

Provision for credit losses

Operating expenses

Pre-tax earnings $

Net earnings $

Net earnings to common

Financial Results

Return on average common equity

2Q23

1,431

2,711

2,966

81

7,189

56

4,282

2,851

2,091

1,982

Average common equity $ 71,205

11.1%

VS.

1Q23

(9)%

(31)%

(2)%

N.M.

(15)%

(57)%

(7)%

(23)%

(30)%

(31)%

2%

(5.5)pp

VS.

2Q22

(20)% $

(26)%

1%

N.M.

(14)%

(73)%

(3)%

(23)% $

(32)% $

(33)% $

T

(5.5)pp

LA

2Q23

YTD

3,010

6,642

5,981

15,633

185

8,911

6,537

5,077

4,858

70,362

13.8%

VS.

2Q22

YTD

(24)%

(21)%

(3)%

N.M.

(15)%

(54)%

(5)%

(24)%

(30)%

(31)%

1%

(6.4)pp

2Q23 net revenues were lower YoY

Investment banking fees primarily reflected significantly lower net revenues in Advisory,

partially offset by significantly higher net revenues in Equity underwriting

FICC reflected significantly lower net revenues in intermediation compared with a strong

2Q22 and lower net revenues in financing

Global Banking & Markets Highlights

Equities reflected significantly higher net revenues in financing, largely offset by lower net

revenues in intermediation

■ Investment banking fees backlog³ increased vs. 1Q23, primarily reflecting an increase in

Advisory, partially offset by a decrease in Equity underwriting

■ 2Q23 provision for credit losses included a reserve reduction related to the repayment of a term

deposit with First Republic Bank

■2Q23 select data4:

$7,189

$1,431

Total assets of $1.31 trillion

Loan balance of $110 billion

Net interest income of $202 million

Global Banking & Markets Net Revenues ($ in millions)

$8,444

$8,342

$1,799

$2,711

$2,966

2Q23

$81

$1,579

$3,931

$3,015

Goldman

Sachs

1Q23

$(81)

$3,642

$2,944

2Q22

■ Investment

$(43)

banking fees

FICC

■ Equities

Other

3View entire presentation