SoftBank Results Presentation Deck

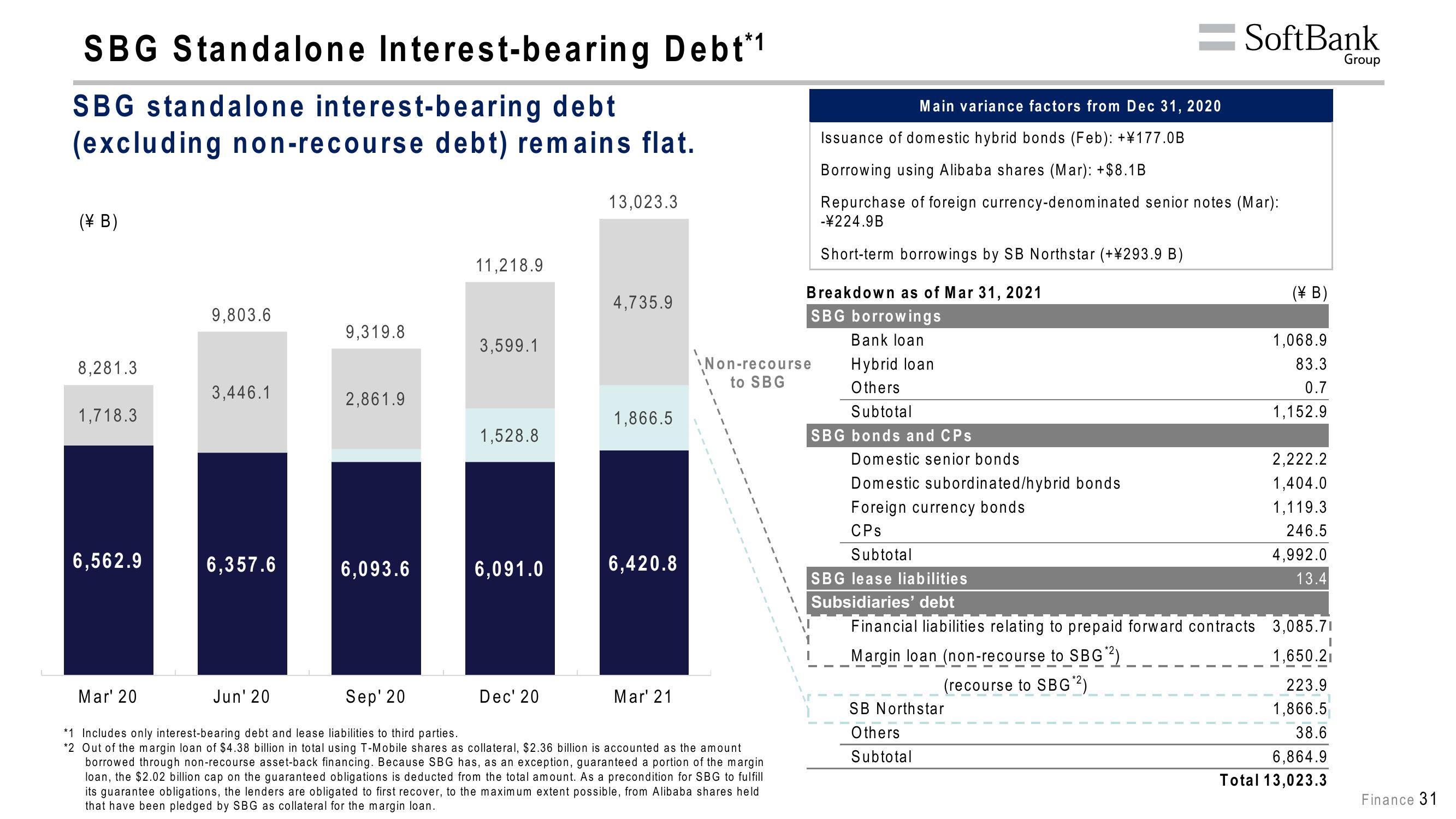

SBG Standalone Interest-bearing Debt*1

SBG standalone interest-bearing debt

(excluding non-recourse debt) remains flat.

(B)

8,281.3

1,718.3

6,562.9

Mar' 20

9,803.6

3,446.1

6,357.6

Jun' 20

9,319.8

2,861.9

6,093.6

Sep' 20

11,218.9

3,599.1

1,528.8

6,091.0

Dec' 20

13,023.3

4,735.9

1,866.5

6,420.8

Mar' 21

Non-recourse

to SBG

*1 Includes only interest-bearing debt and lease liabilities to third parties.

*2 Out of the margin loan of $4.38 billion in total using T-Mobile shares as collateral, $2.36 billion is accounted as the amount

borrowed through non-recourse asset-back financing. Because SBG has, as an exception, guaranteed a portion of the margin

loan, the $2.02 billion cap on the guaranteed obligations is deducted from the total amount. As a precondition for SBG to fulfill

its guarantee obligations, the lenders are obligated to first recover, to the maximum extent possible, from Alibaba shares held

that have been pledged by SBG as collateral for the margin loan.

Main variance factors from Dec 31, 2020

Breakdown as of Mar 31, 2021

SBG borrowings

Bank loan

Hybrid loan

Others

Subtotal

SBG bonds and CPs

Issuance of domestic hybrid bonds (Feb): +¥177.0B

Borrowing using Alibaba shares (Mar): +$8.1B

Repurchase of foreign currency-denominated senior notes (Mar):

-¥224.9B

Short-term borrowings by SB Northstar (+¥293.9 B)

Domestic senior bonds

Domestic subordinated/hybrid bonds

Foreign currency bonds

CPs

Subtotal

SBG lease liabilities

Subsidiaries' debt

SoftBank

SB Northstar

Others

Subtotal

(B)

1,068.9

83.3

0.7

1,152.9

2,222.2

1,404.0

1,119.3

246.5

4,992.0

13.4

Financial liabilities relating to prepaid forward contracts 3,085.71

Margin loan (non-recourse to SBG¹²)

1,650.21

(recourse to SBG *2)

223.9

1,866.5

38.6

6,864.9

Total 13,023.3

Group

Finance 31View entire presentation