Paysafe Results Presentation Deck

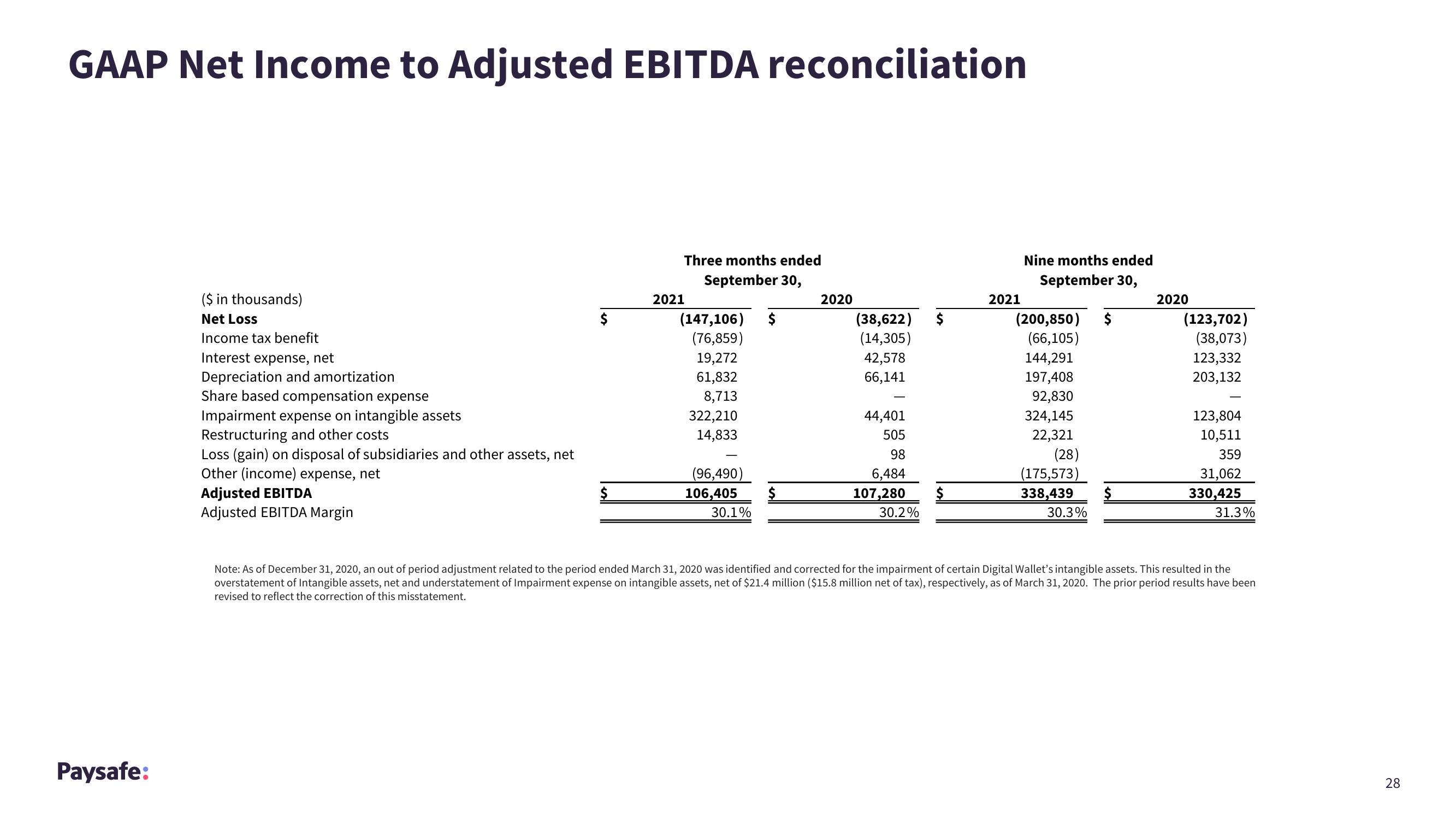

GAAP Net Income to Adjusted EBITDA reconciliation

Paysafe:

($ in thousands)

Net Loss

Income tax benefit

Interest expense, net

Depreciation and amortization

Share based compensation expense

Impairment expense on intangible assets

Restructuring and other costs

Loss (gain) on disposal of subsidiaries and other assets, net

Other (income) expense, net

Adjusted EBITDA

Adjusted EBITDA Margin

$

Three months ended

September 30,

2021

(147,106)

(76,859)

19,272

61,832

8,713

322,210

14,833

(96,490)

106,405

30.1%

$

$

2020

(38,622)

(14,305)

42,578

66,141

44,401

505

98

6,484

107,280

30.2%

2021

Nine months ended

September 30,

(200,850)

(66,105)

144,291

197,408

92,830

324,145

22,321

(28)

(175,573)

338,439

30.3%

$

$

2020

(123,702)

(38,073)

123,332

203,132

123,804

10,511

359

31,062

330,425

31.3%

Note: As of December 31, 2020, an out of period adjustment related to the period ended March 31, 2020 was identified and corrected for the impairment of certain Digital Wallet's intangible assets. This resulted in the

overstatement of Intangible assets, net and understatement of Impairment expense on intangible assets, net of $21.4 million ($15.8 million net of tax), respectively, as of March 31, 2020. The prior period results have been

revised to reflect the correction of this misstatement.

28View entire presentation