Affirm Results Presentation Deck

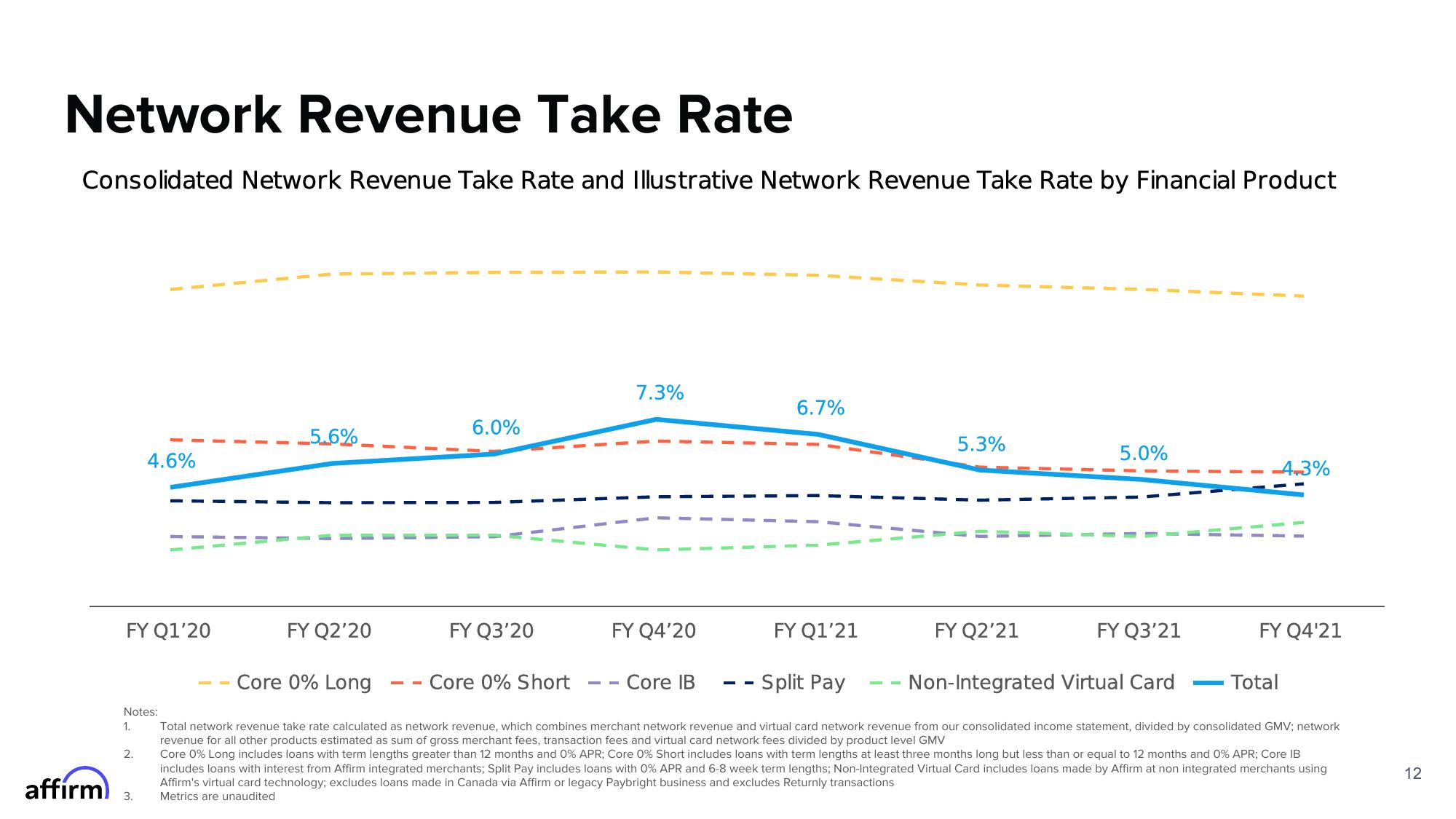

Network Revenue Take Rate

Consolidated Network Revenue Take Rate and Illustrative Network Revenue Take Rate by Financial Product

affirm)

FY Q1'20

4.6%

Notes:

1.

2.

3.

_5.6%

FY Q2'20

6.0%

FY Q3'20

7.3%

Core 0% Short

FY Q4'20

6.7%

Core IB

FY Q1'21

5.3%

FY Q2'21

5.0%

FY Q3'21

-4,3%

Core 0% Long

- - Split Pay

Non-Integrated Virtual Card

Total network revenue take rate calculated as network revenue, which combines merchant network revenue and virtual card network revenue from our consolidated income statement, divided by consolidated GMV; network

revenue for all other products estimated as sum of gross merchant fees, transaction fees and virtual card network fees divided by product level GMV

Core 0% Long includes loans with term lengths greater than 12 months and 0% APR; Core 0% Short includes loans with term lengths at least three months long but less than or equal to 12 months and 0% APR; Core IB

includes loans with interest from Affirm integrated merchants; Split Pay includes loans with 0% APR and 6-8 week term lengths; Non-Integrated Virtual Card includes loans made by Affirm at non integrated merchants using

Affirm's virtual card technology; excludes loans made in Canada via Affirm or legacy Paybright business and excludes Returnly transactions

Metrics are unaudited

FY Q4'21

Total

12View entire presentation