W3BCLOUD SPAC

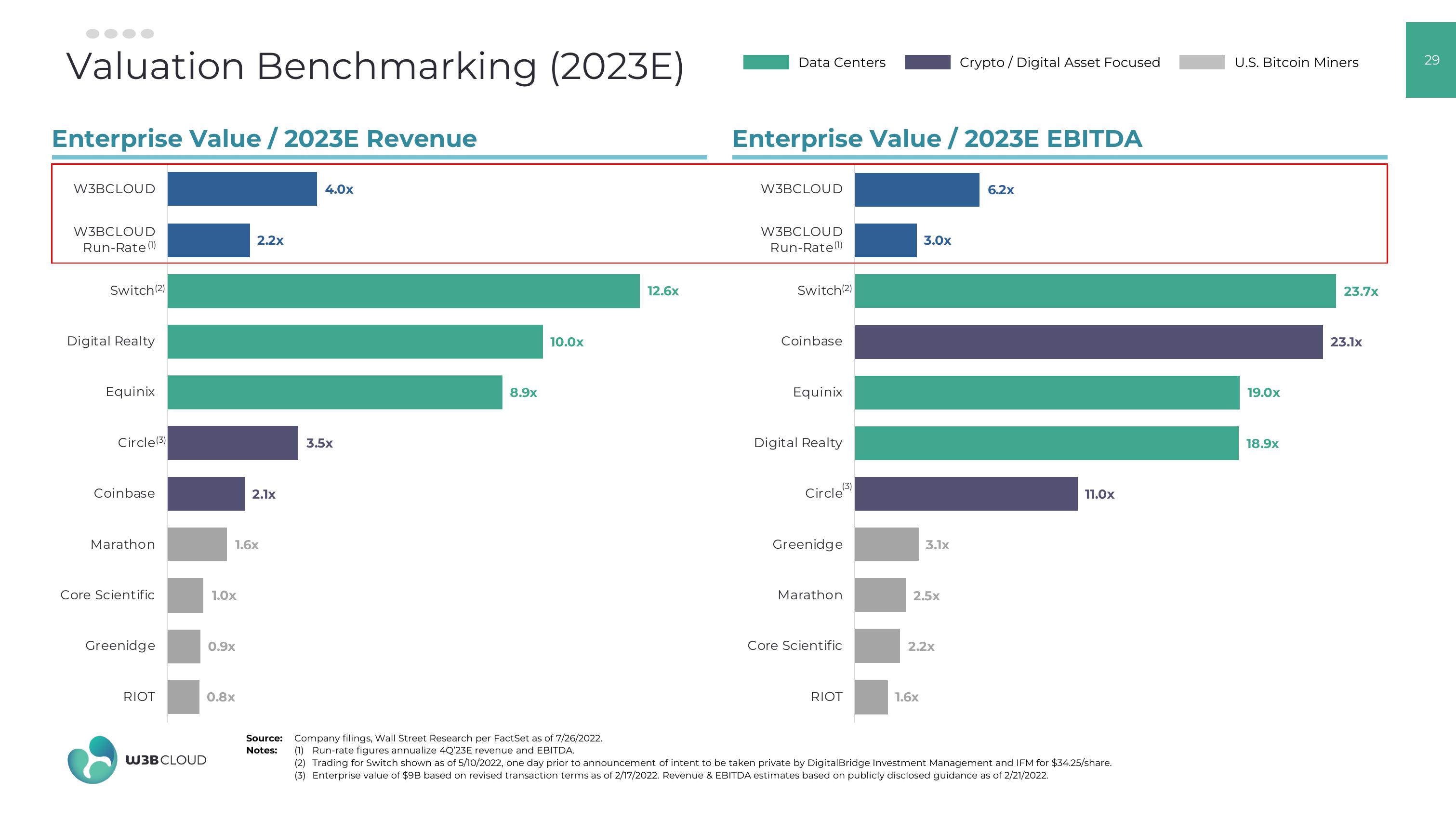

Valuation Benchmarking (2023E)

Enterprise Value / 2023E Revenue

W3BCLOUD

W3BCLOUD

Run-Rate (¹)

Switch (2)

Digital Realty

Equinix

Circle (3)

Coinbase

Marathon

Core Scientific

Greenidge

RIOT

W3B CLOUD

1.0x

1.6x

0.9x

2.2x

0.8x

2.1x

4.0x

3.5x

8.9x

10.0x

12.6x

Data Centers

Enterprise Value / 2023E EBITDA

W3BCLOUD

W3BCLOUD

Run-Rate(¹)

Switch(2)

Coinbase

Equinix

Digital Realty

(3)

Circle

Greenidge

Marathon

Core Scientific

RIOT

3.0x

3.1x

2.5x

1.6x

2.2x

Crypto/ Digital Asset Focused

6.2x

11.0x

Source: Company filings, Wall Street Research per FactSet as of 7/26/2022.

Notes:

(1) Run-rate figures annualize 4Q'23E revenue and EBITDA.

(2) Trading for Switch shown as of 5/10/2022, one day prior to announcement of intent to be taken private by Digital Bridge Investment Management and IFM for $34.25/share.

(3) Enterprise value of $9B based on revised transaction terms as of 2/17/2022. Revenue & EBITDA estimates based on publicly disclosed guidance as of 2/21/2022.

U.S. Bitcoin Miners

19.0x

18.9x

23.7x

23.1x

29View entire presentation