Evercore Investment Banking Pitch Book

Financial Analysis

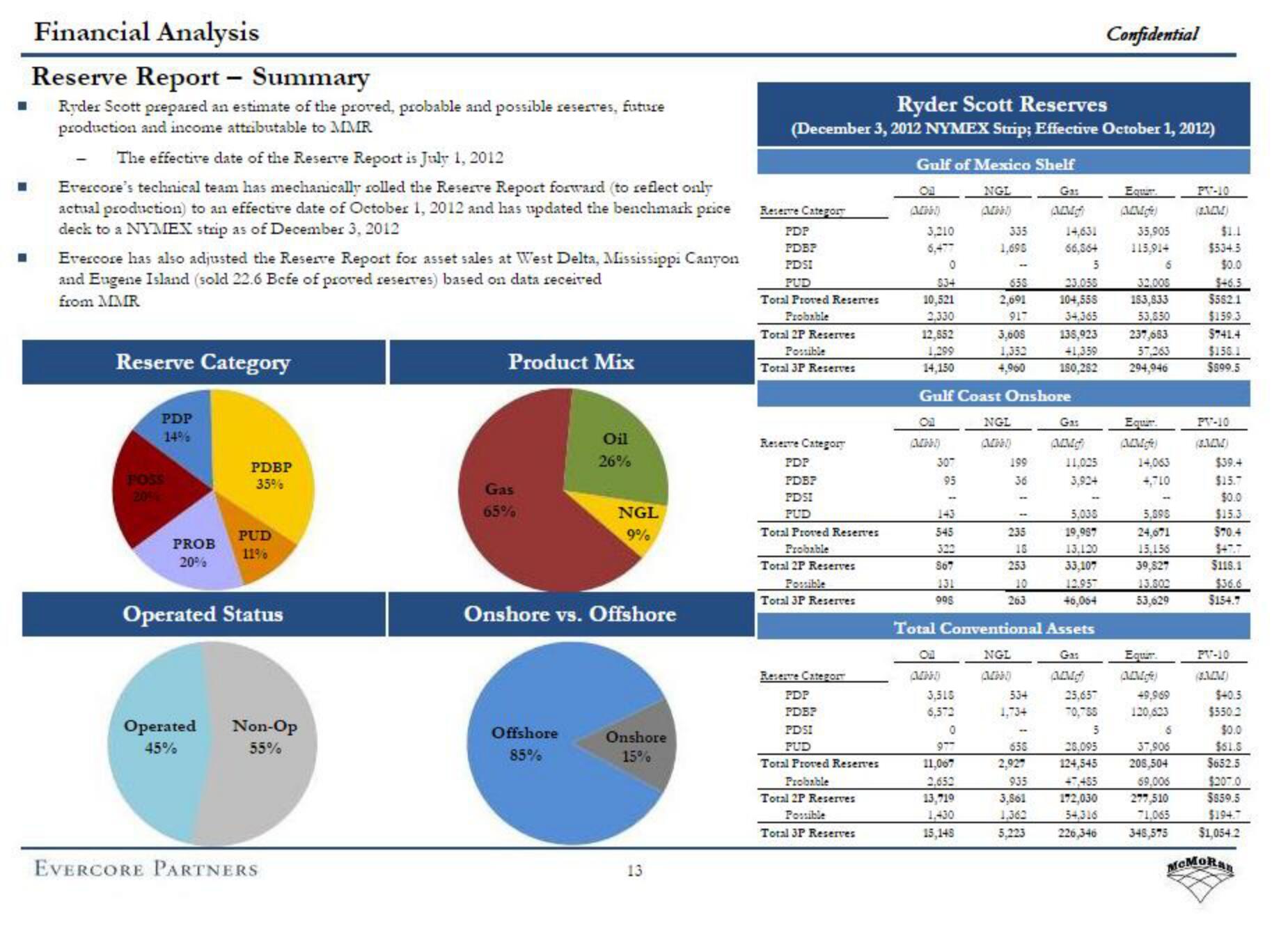

Reserve Report - Summary

Ryder Scott prepared an estimate of the proved, probable and possible reserves, future

production and income attributable to MMR

The effective date of the Reserve Report is July 1, 2012

Evercore's technical team has mechanically rolled the Reserve Report forward (to reflect only

actual production) to an effective date of October 1, 2012 and has updated the benchmark price

deck to a NYMEX strip as of December 3, 2012

Evercore has also adjusted the Reserve Report for asset sales at West Delta, Mississippi Canyon

and Eugene Island (sold 22.6 Befe of proved reserves) based on data received

from MMR

Reserve Category

PDP

14%

POSS

PDBP

35%

PROB

20%

PUD

11%

Operated Status

Operated Non-Op

45%

55%

EVERCORE PARTNERS

Product Mix

Gas

65%

Oil

26%

Offshore

85%

NGL

9%

Onshore vs. Offshore

Onshore

15%

13

Ryder Scott Reserves

(December 3, 2012 NYMEX Strip; Effective October 1, 2012)

Reserve Category

PDP

PDBP

PDSI

PUD

Total Proved Reserves

Probable

Total 2P Reserves

Possible

Total 3P Reserves

Reserve Category

PDP

PDBP

PDSI

PUD

Total Proved Reserves

Probable

Total 2P Reserves

Possible

Total 3P Reserves

Reserre CategoIT

PDP

PDEP

PDSI

PUD

Total Proved Reserves

Probable

Total 2P Reserves

Possible

Total 3P Reserves

Gulf of Mexico Shelf

NGL

(045)

A

3,210

6,477

0

307

95

334

10,521

2,330

12,852

1,299

14,150

Gulf Coast Onshore

143

545

322

867

131

998

On

000

335

1,695

3,518

6,572

658

2,691

917

3.600

1,352

4,960

0

977

11,067

2,652

13,719

1,430

15,148

NGL

199

36

5,038

19,967

13.120

33,107

12.95

46,064

Total Conventional Assets

Gas

ADM

235

18

253

10

263

NGL

(460)

534

1,734

Gas

656

2,927

935

3,861

1,362

5,223

14,631

35,905

66,56+ 115,914

5

6

23.055

32,005

104,558 183,833

34.365

53,850

135,923 237,683

+1,359

180,282

57,263

294,946

Gas

(AMg")

Confidential

11,025

3,924

Equi

Equir

14,063

4,740

5,898

24,671

15,156

39,827

13.802

53,629

Equi

25,657

70,765

5

6

28,095 37,906

124,545 208,504

47,455

172,030

69,006

277,510

71,065

54,316

226,346

348,575

49,969

120,623

PV-10

(MM)

$1.1

$534.5

$0.0

$46.5

$582.1

$159.3

$741.4

$156.1

$899.5

PV-10

(SMM)

$39.4

$15.7

$0.0

$15.3

$70.4

$118.1

$36.6

$154.7

PV-10

$40.5

$550.2

$0.0

$61.5

$652.5

$207.0

$859.5

$194.7

$1,054.2

MCMORanView entire presentation