Credit Suisse Investment Banking Pitch Book

Illustrative building blocks of value

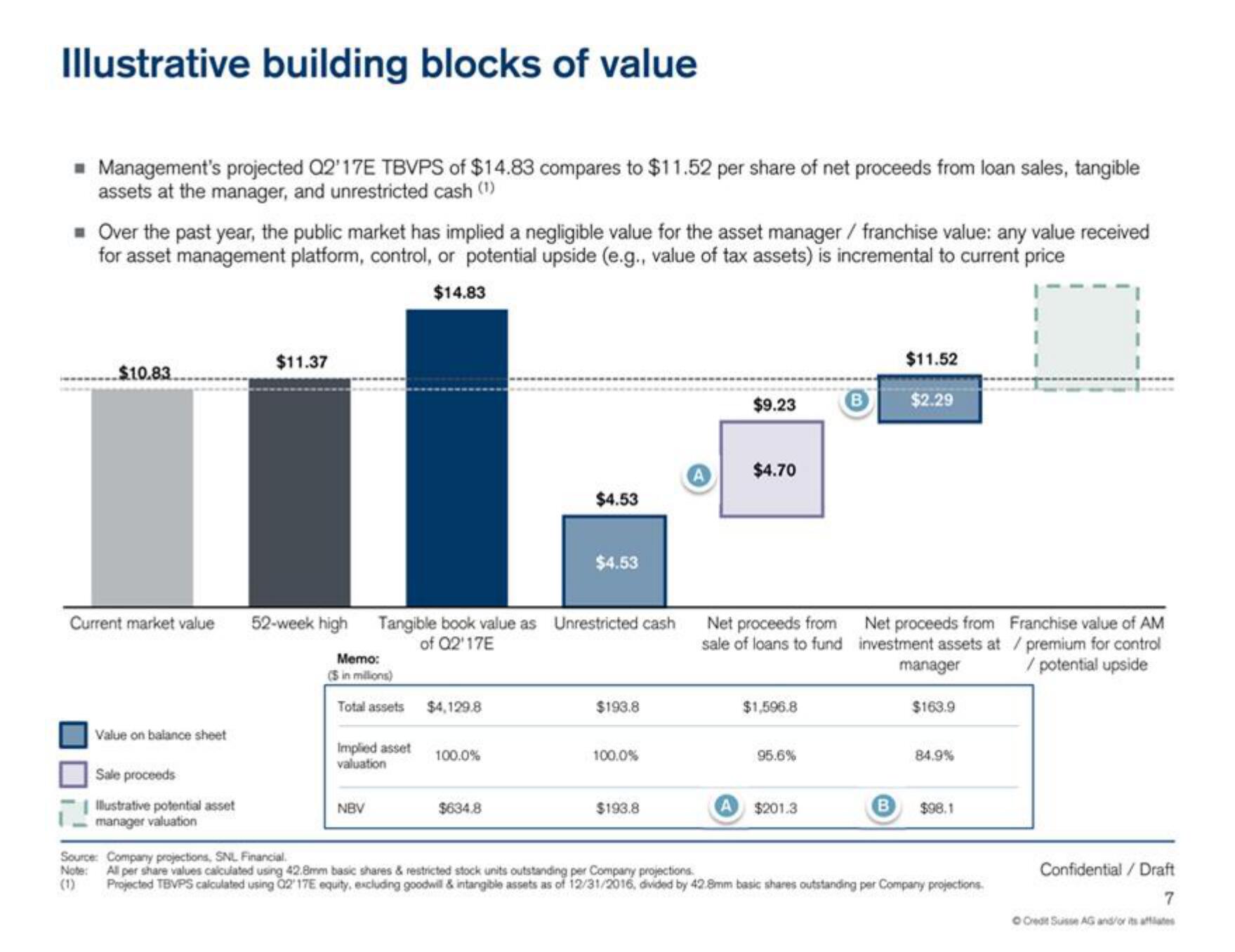

■ Management's projected 02'17E TBVPS of $14.83 compares to $11.52 per share of net proceeds from loan sales, tangible

assets at the manager, and unrestricted cash (¹)

■ Over the past year, the public market has implied a negligible value for the asset manager / franchise value: any value received

for asset management platform, control, or potential upside (e.g., value of tax assets) is incremental to current price

$14.83

$10.83.

Current market value

Value on balance sheet

Sale proceeds

Illustrative potential asset

manager valuation

$11.37

Memo:

($ in millions)

Total assets $4,129.8

52-week high Tangible book value as Unrestricted cash

of Q2'17E

Implied asset

valuation

NBV

100.0%

$4.53

$634.8

$4.53

$193.8

100.0%

$193.8

$9.23

$4.70

Net proceeds from

sale of loans to fund

$1,596.8

95.6%

$201.3

$11.52

$2.29

Net proceeds from

investment assets at

manager

$163.9

84.9%

$98.1

Source: Company projections, SNL Financial.

Note: All per share values calculated using 42.8mm basic shares & restricted stock units outstanding per Company projections.

(1) Projected TBVPS calculated using 02 17E equity, excluding goodwill & intangible assets as of 12/31/2016, divided by 42.8mm basic shares outstanding per Company projections.

Franchise value of AM

/ premium for control

/potential upside

Confidential / Draft

7

O Credit Suisse AG and/or its affiliatesView entire presentation