Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

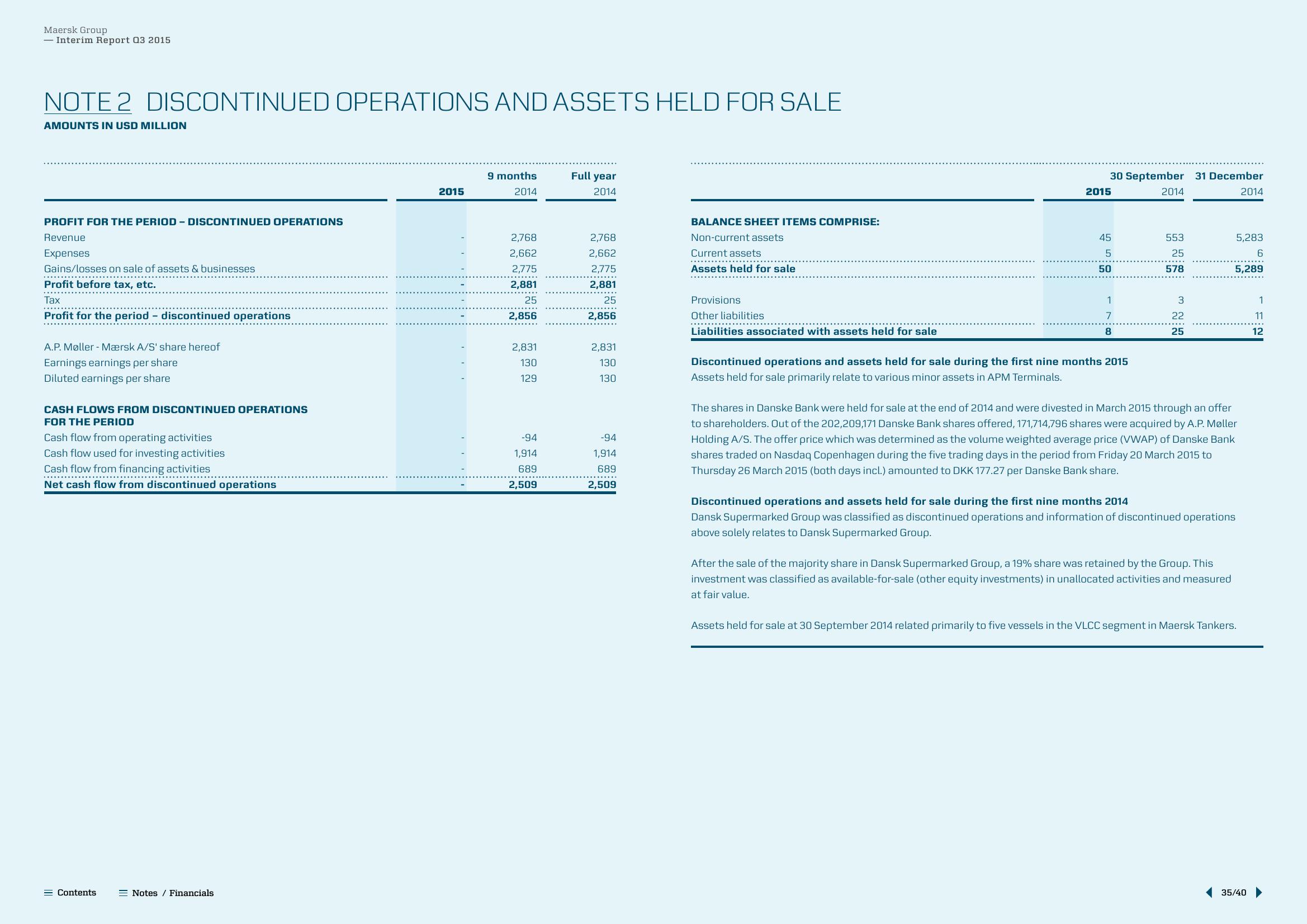

NOTE 2 DISCONTINUED OPERATIONS AND ASSETS HELD FOR SALE

AMOUNTS IN USD MILLION

PROFIT FOR THE PERIOD- DISCONTINUED OPERATIONS

Revenue

Expenses

Gains/losses on sale of assets & businesses

****************

Profit before tax, etc.

Tax

Profit for the period - discontinued operations

A.P. Møller-Mærsk A/S' share hereof

Earnings earnings per share

Diluted earnings per share

CASH FLOWS FROM DISCONTINUED OPERATIONS

FOR THE PERIOD

Cash flow from operating activities

Cash flow used for investing activities

Cash flow from financing activities

Net cash flow from discontinued operations

= Contents

Notes / Financials

2015

9 months

2014

2,768

2,662

2,775

2,881

25

2,856

2,831

130

129

-94

1,914

689

2,509

Full year

2014

2,768

2,662

2,775

2,881

25

2,856

2,831

130

130

-94

1,914

689

2,509

BALANCE SHEET ITEMS COMPRISE:

Non-current assets

Current assets

..….….......

Assets held for sale

Provisions

Other liabilities

Liabilities associated with assets held for sale

30 September 31 December

2014

2015

45

5

50

1

7

8

Discontinued operations and assets held for sale during the first nine months 2015

Assets held for sale primarily relate to various minor assets in APM Terminals.

2014

553

25

578

3

22

25

5,283

6

5,289

The shares in Danske Bank were held for sale at the end of 2014 and were divested in March 2015 through an offer

to shareholders. Out of the 202,209,171 Danske Bank shares offered, 171,714,796 shares were acquired by A.P. Møller

Holding A/S. The offer price which was determined as the volume weighted average price (VWAP) of Danske Bank

shares traded on Nasdaq Copenhagen during the five trading days in the period from Friday 20 March 2015 to

Thursday 26 March 2015 (both days incl.) amounted to DKK 177.27 per Danske Bank share.

Discontinued operations and assets held for sale during the first nine months 2014

Dansk Supermarked Group was classified as discontinued operations and information of discontinued operations

above solely relates to Dansk Supermarked Group.

After the sale of the majority share in Dansk Supermarked Group, a 19% share was retained by the Group. This

investment was classified as available-for-sale (other equity investments) in unallocated activities and measured

at fair value.

Assets held for sale at 30 September 2014 related primarily to five vessels in the VLCC segment in Maersk Tankers.

35/40

1

11

12View entire presentation