Affirm Results Presentation Deck

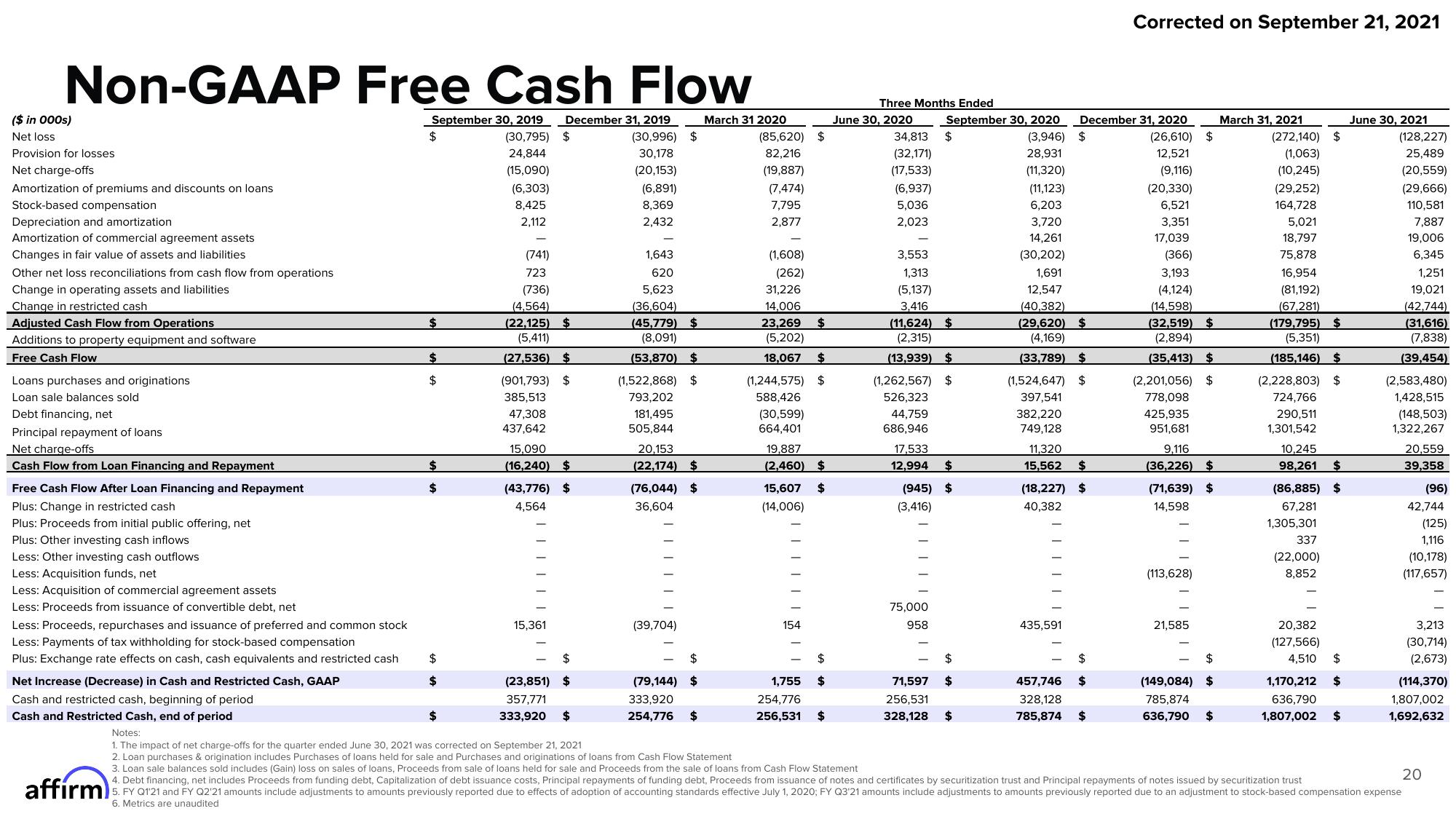

Non-GAAP Free Cash Flow

September 30, 2019 December 31, 2019

(30,795) $

(30,996)

24,844

30,178

(15,090)

(20,153)

(6,303)

(6,891)

8,425

8,369

2,112

2,432

($ in 000s)

Net loss

Provision for losses

Net charge-offs

Amortization of premiums and discounts on loans

Stock-based compensation

Depreciation and amortization

Amortization of commercial agreement assets

Changes in fair value of assets and liabilities

Other net loss reconciliations from cash flow from operations

Change in operating assets and liabilities

Change in restricted cash

Adjusted Cash Flow from Operations

Additions to property equipment and software

Free Cash Flow

Loans purchases and originations

Loan sale balances sold

Debt financing, net

Principal repayment of loans

Net charge-offs

Cash Flow from Loan Financing and Repayment

Free Cash Flow After Loan Financing and Repayment

Plus: Change in restricted cash

Plus: Proceeds from initial public offering, net

Plus: Other investing cash inflows

Less: Other investing cash outflows

Less: Acquisition funds, net

Less: Acquisition of commercial agreement assets

Less: Proceeds from issuance of convertible debt, net

Less: Proceeds, repurchases and issuance of preferred and common stock

Less: Payments of tax withholding for stock-based compensation

Plus: Exchange rate effects on cash, cash equivalents and restricted cash

Net Increase (Decrease) in Cash and Restricted Cash, GAAP

Cash and restricted cash, beginning of period

Cash and Restricted Cash, end of period

$

$

$

$

$

$

$

$

$

(741)

723

(736)

(4,564)

(22,125)

(5,411)

(27,536) $

(901,793) $

385,513

47,308

437,642

$

15,090

(16,240) $

(43,776) $

4,564

15,361

$

(23,851) $

357,771

333,920 $

$

1,643

620

5,623

(36,604)

(45,779) $

(8,091)

(53,870) $

(1,522,868) $

793,202

181,495

505,844

20,153

(22,174)

$

(76,044) $

36,604

(39,704)

(79,144) $

333,920

254,776

$

March 31 2020

(85,620)

82,216

(19,887)

(7,474)

7,795

2,877

(1,608)

(262)

$

31,226

14,006

23,269

(5,202)

18,067 $

(1,244,575) $

588,426

(30,599)

664,401

154

$

19,887

(2,460) $

15,607 $

(14,006)

1,755

254,776

256,531 $

$

Three Months Ended

June 30, 2020

34,813

(32,171)

(17,533)

(6,937)

5,036

2,023

September 30, 2020

(3,946)

28,931

(11,320)

$

3,553

1,313

(5,137)

3,416

(11,624) $

(2,315)

(13,939) $

(1,262,567) $

526,323

44,759

686,946

75,000

958

17,533

12,994 $

(945) $

(3,416)

$

$

71,597

256,531

328,128 $

(11,123)

6,203

3,720

14,261

(30,202)

1,691

12,547

(40,382)

(29,620) $

(4,169)

(33,789) $

(1,524,647) $

397,541

382,220

749,128

IIII

December 31, 2020

$

11,320

15,562 $

(18,227) $

40,382

435,591

Corrected on September 21, 2021

457,746 $

328,128

785,874 $

(26,610) $

12,521

(9,116)

(20,330)

6,521

3,351

17,039

(366)

3,193

(4,124)

(14,598)

(32,519) $

(2,894)

(35,413) $

(2,201,056) $

778,098

425,935

951,681

9,116

(36,226) $

(71,639) $

14,598

(113,628)

21,585

$

(149,084) $

785,874

636,790 $

March 31, 2021

(272,140) $

(1,063)

(10,245)

(29,252)

164,728

5,021

18,797

75,878

16,954

(81,192)

(67,281)

(179,795)

(5,351)

(185,146) $

(2,228,803) $

724,766

290,511

1,301,542

10,245

98,261 $

(86,885) $

67,281

1,305,301

337

(22,000)

8,852

$

20,382

(127,566)

4,510 $

1,170,212 $

636,790

1,807,002

$

June 30, 2021

(128,227)

25,489

(20,559)

(29,666)

110,581

7,887

19,006

6,345

1,251

19,021

(42,744)

(31,616)

(7,838)

(39,454)

(2,583,480)

1,428,515

(148,503)

1,322,267

20,559

39,358

Notes:

1. The impact of net charge-offs for the quarter ended June 30, 2021 was corrected on September 21, 2021

2. Loan purchases & origination includes Purchases of loans held for sale and Purchases and originations of loans from Cash Flow Statement

3. Loan sale balances sold includes (Gain) loss on sales of loans, Proceeds from sale of loans held for sale and Proceeds from the sale of loans from Cash Flow Statement

4. Debt financing, net includes Proceeds from funding debt, Capitalization of debt issuance costs, Principal repayments of funding debt, Proceeds from issuance of notes and certificates by securitization trust and Principal repayments of notes issued by securitization trust

5. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020; FY Q3'21 amounts include adjustments to amounts previously reported due to an adjustment to stock-based compensation expense

6. Metrics are unaudited

affirm

(96)

42,744

(125)

1,116

(10,178)

(117,657)

3,213

(30,714)

(2,673)

(114,370)

1,807,002

1,692,632

20View entire presentation