Ready Capital Investor Presentation Deck

Fourth Quarter 2021 Results (continued)

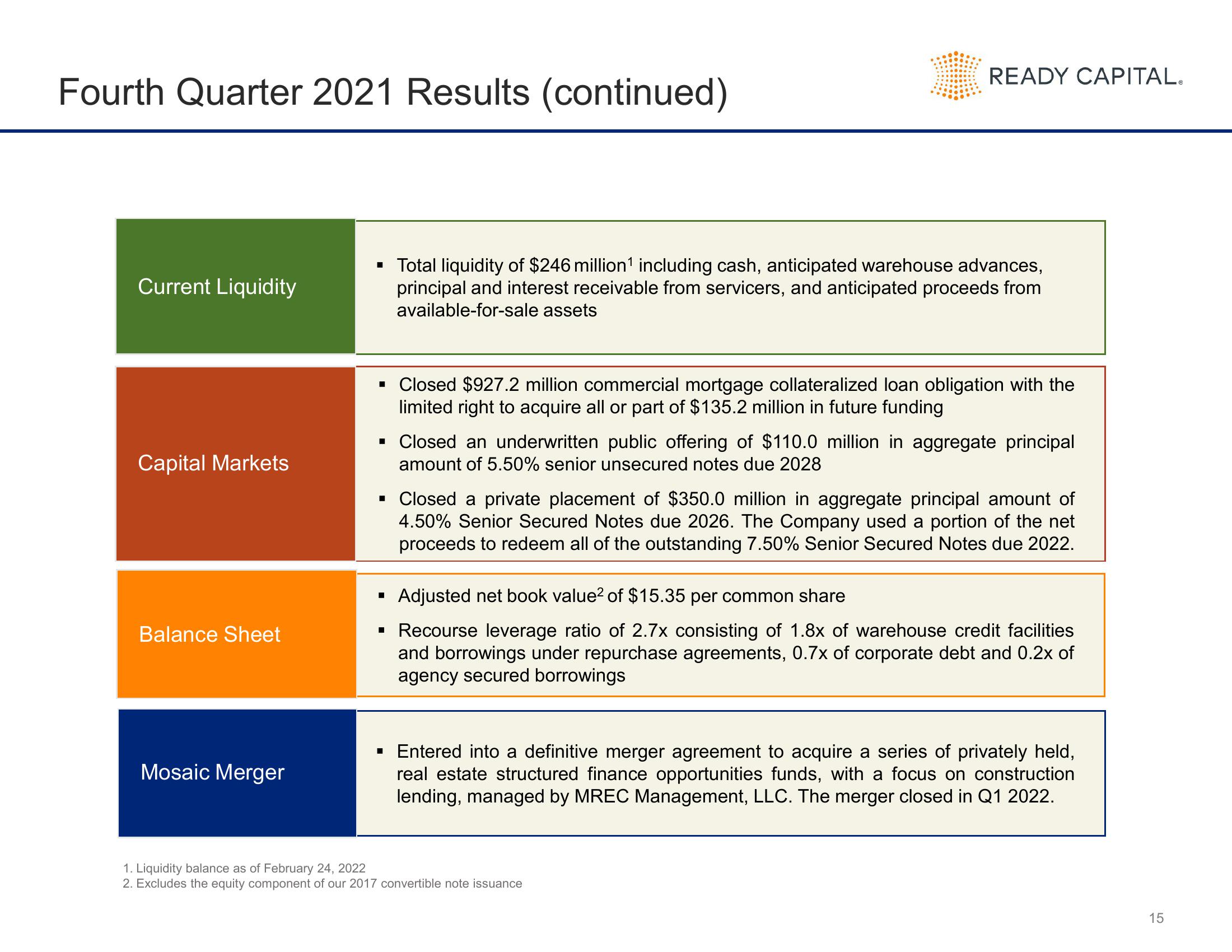

Current Liquidity

Capital Markets

Balance Sheet

Mosaic Merger

▪ Total liquidity of $246 million¹ including cash, anticipated warehouse advances,

principal and interest receivable from servicers, and anticipated proceeds from

available-for-sale assets

READY CAPITAL.

▪ Closed $927.2 million commercial mortgage collateralized loan obligation with the

limited right to acquire all or part of $135.2 million in future funding

▪ Closed an underwritten public offering of $110.0 million in aggregate principal

amount of 5.50% senior unsecured notes due 2028

▪ Closed a private placement of $350.0 million in aggregate principal amount of

4.50% Senior Secured Notes due 2026. The Company used a portion of the net

proceeds to redeem all of the outstanding 7.50% Senior Secured Notes due 2022.

■

Adjusted net book value2 of $15.35 per common share

▪ Recourse leverage ratio of 2.7x consisting of 1.8x of warehouse credit facilities

and borrowings under repurchase agreements, 0.7x of corporate debt and 0.2x of

agency secured borrowings

Entered into a definitive merger agreement to acquire a series of privately held,

real estate structured finance opportunities funds, with a focus on construction

lending, managed by MREC Management, LLC. The merger closed in Q1 2022.

1. Liquidity balance as of February 24, 2022

2. Excludes the equity component of our 2017 convertible note issuance

15View entire presentation