Comcast Results Presentation Deck

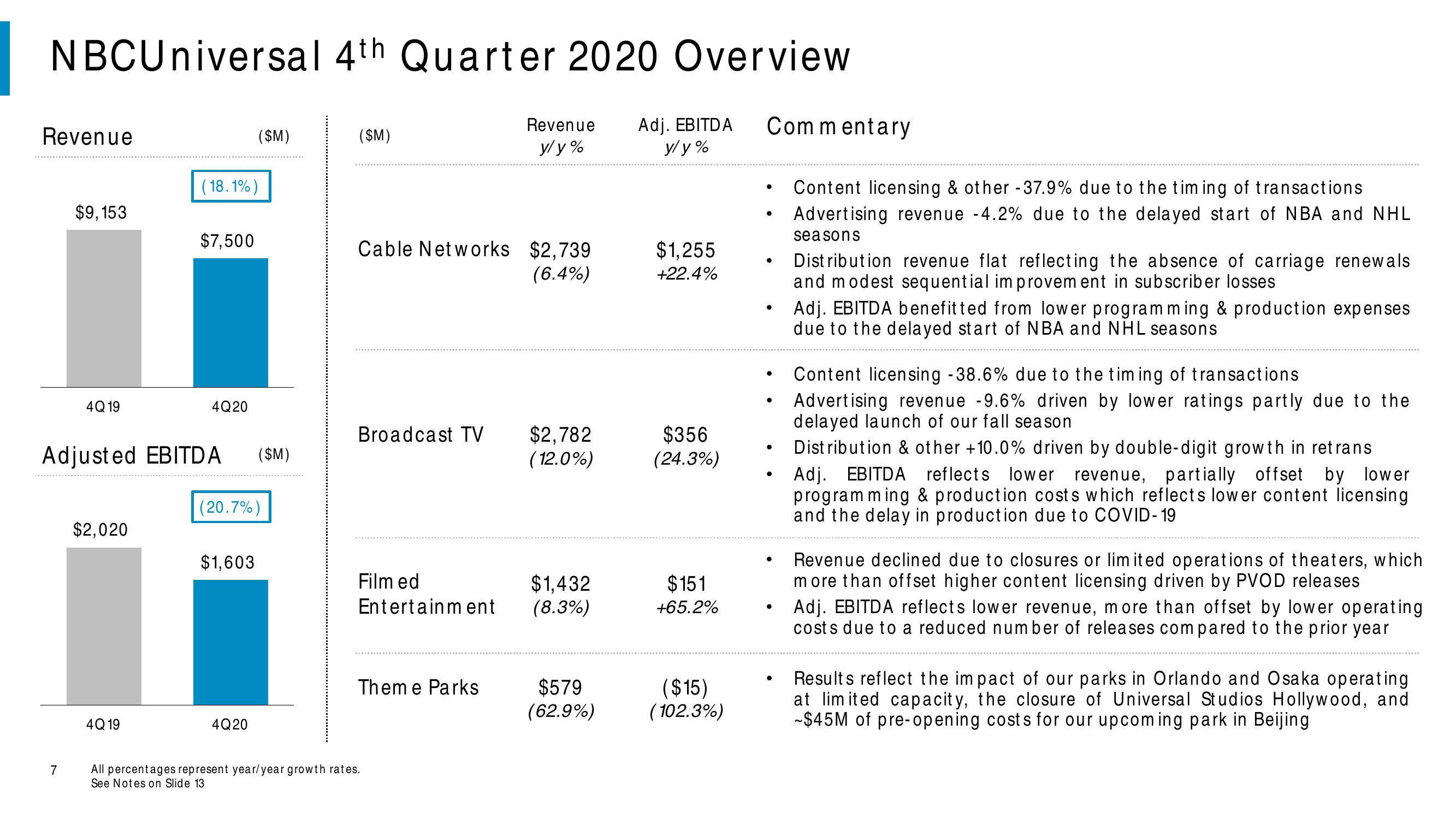

NBCUniversal 4th Quarter 2020 Overview

Revenue

y/y%

Adj. EBITDA

y/y%

Revenue

$9,153

7

4Q 19

$2,020

4Q 19

(18.1%)

$7,500

Adjusted EBITDA ($M)

4Q20

($M)

(20.7%)

$1,603

4Q20

($M)

Cable Networks $2,739

(6.4%)

Broadcast TV

Film ed

Entertainment

Theme Parks

All percentages represent year/year growth rates.

See Notes on Slide 13

$2,782

(12.0%)

$1,432

(8.3%)

$579

(62.9%)

$1,255

+22.4%

$356

(24.3%)

$151

+65.2%

($15)

(102.3%)

Commentary

●

●

●

●

●

●

●

●

●

●

Content licensing & other -37.9% due to the timing of transactions

Advertising revenue -4.2% due to the delayed start of NBA and NHL

seasons

Distribution revenue flat reflecting the absence of carriage renewals

and modest sequential improvement in subscriber losses

Adj. EBITDA benefitted from lower programming & production expenses

due to the delayed start of NBA and NHL seasons

Content licensing -38.6% due to the timing of transactions

Advertising revenue -9.6% driven by lower ratings partly due to the

delayed launch of our fall season

Distribution & other +10.0% driven by double-digit growth in retrans

Adj. EBITDA reflects lower revenue, partially offset by lower

programming & production costs which reflects lower content licensing

and the delay in production due to COVID-19

Revenue declined due to closures or limited operations of theaters, which

more than offset higher content licensing driven by PVOD releases

Adj. EBITDA reflects lower revenue, more than offset by lower operating

costs due to a reduced number of releases compared to the prior year

Results reflect the impact of our parks in Orlando and Osaka operating

at limited capacity, the closure of Universal Studios Hollywood, and

-$45M of pre-opening costs for our upcoming park in BeijingView entire presentation