AeroFarms SPAC Presentation Deck

Transaction Overview

AEROFARMS®

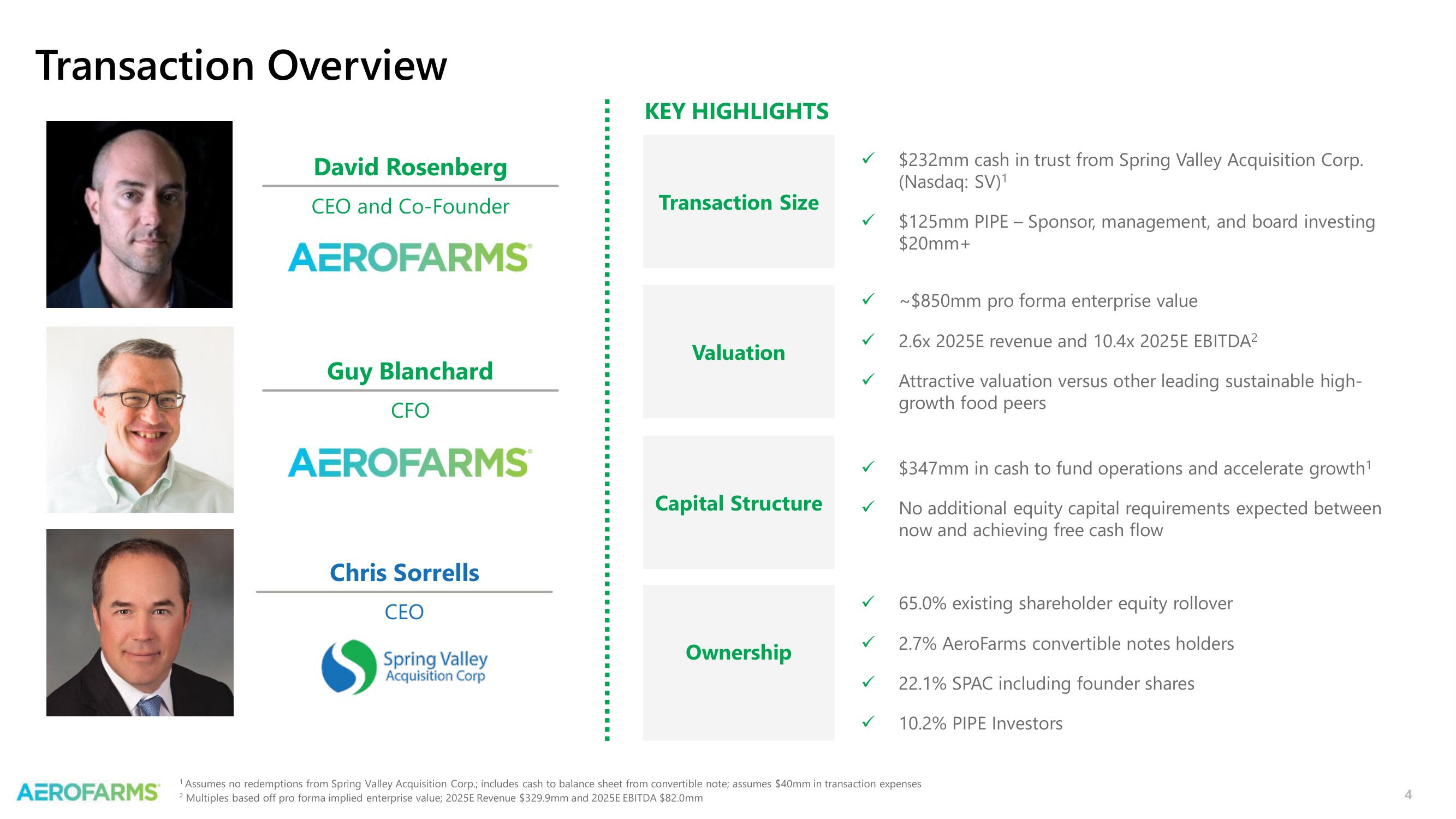

David Rosenberg

CEO and Co-Founder

AEROFARMS®

Guy Blanchard

CFO

AEROFARMS®

Chris Sorrells

S

CEO

Spring Valley

Acquisition Corp

KEY HIGHLIGHTS

Transaction Size

Valuation

Capital Structure

Ownership

✓

✓

$232mm cash in trust from Spring Valley Acquisition Corp.

(Nasdaq: SV)¹

$125mm PIPE - Sponsor, management, and board investing

$20mm+

~$850mm pro forma enterprise value

2.6x 2025E revenue and 10.4x 2025E EBITDA²

Attractive valuation versus other leading sustainable high-

growth food peers

$347mm in cash to fund operations and accelerate growth¹

No additional equity capital requirements expected between

now and achieving free cash flow

65.0% existing shareholder equity rollover

2.7% AeroFarms convertible notes holders

22.1% SPAC including founder shares

10.2% PIPE Investors

¹ Assumes no redemptions from Spring Valley Acquisition Corp.; includes cash to balance sheet from convertible note; assumes $40mm in transaction expenses

2 Multiples based off pro forma implied enterprise value; 2025E Revenue $329.9mm and 2025E EBITDA $82.0mm

4View entire presentation