Corecentric Investor Presentation Deck

Transaction summary

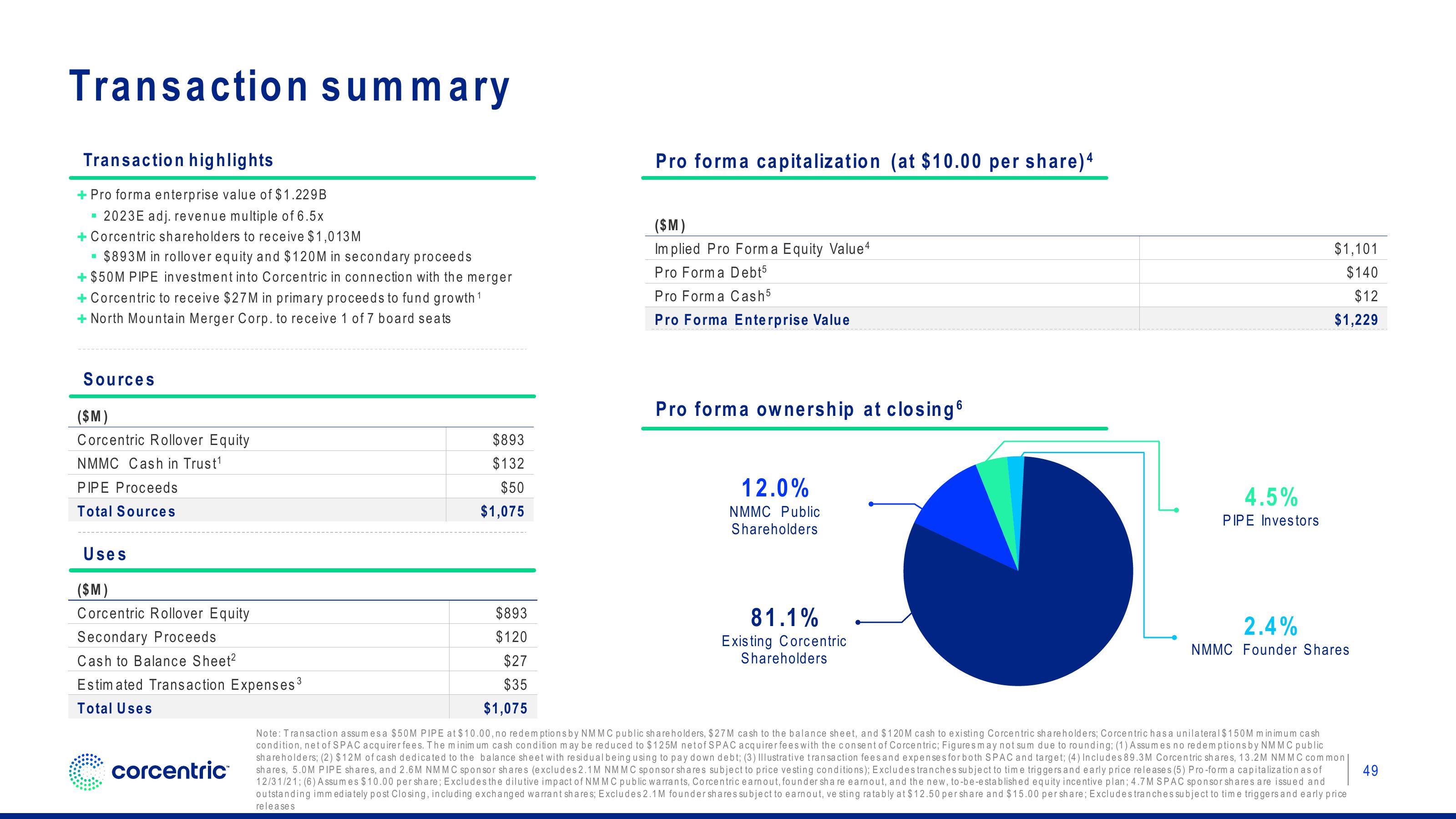

Transaction highlights

Pro forma enterprise value of $1.229B

2023E adj. revenue multiple of 6.5x

Corcentric shareholders to receive $1,013 M

$893M in rollover equity and $120M in secondary proceeds

$50M PIPE investment into Corcentric in connection with the merger

+ Corcentric to receive $27M in primary proceeds to fund growth ¹ 1

+ North Mountain Merger Corp. to receive 1 of 7 board seats

M

H

Sources

($M)

Corcentric Rollover Equity

NMMC Cash in Trust¹

PIPE Proceeds

Total Sources

Uses

($M)

Corcentric Rollover Equity

Secondary Proceeds

Cash to Balance Sheet²

Estimated Transaction Expenses ³ 3

Total Uses

corcentric

$893

$132

$50

$1,075

Pro forma capitalization (at $10.00 per share) 4

($M)

Implied Pro Forma Equity Value4

Pro Forma Debt5

Pro Forma Cash5

Pro Forma Enterprise Value

Pro forma ownership at closing

12.0%

NMMC Public

Shareholders

81.1%

Existing Corcentric

Shareholders

4.5%

PIPE Investors

$1,101

$140

$12

$1,229

$893

$120

$27

$35

$1,075

Note: Transaction assumes a $50M PIPE at $10.00, no redemptions by NMMC public shareholders, $27M cash to the balance sheet, and $120M cash to existing Corcentric shareholders; Corcentric has a unilateral $150M minimum cash

condition, net of SPAC acquirer fees. The minimum cash condition may be reduced to $125M netof SPAC acquirer fees with the consent of Corcentric; Figures may not sum due to rounding; (1) Assumes no redemptions by NM MC public

shareholders; (2) $12M of cash dedicated to the balance sheet with residual being using to pay down debt; (3) Illustrative transaction fees and expenses for both SPAC and target; (4) Includes 89.3M Corcentric shares, 13.2 M NM MC common

shares, 5.0M PIPE shares, and 2.6 M NM MC sponsor shares (excludes 2.1 M NM MC sponsor shares subject to price vesting conditions); Excludes tranches subject to time triggers and early price releases (5) Pro-form a capitalization as of

12/31/21; (6) Assumes $10.00 per share; Excludes the dilutive impact of NM MC public warrants, Corcentric earnout, founder share earnout, and the new, to-be-established equity incentive plan; 4.7 M SPAC sponsor shares are issued and

outstanding immediately post Closing, including exchanged warrant shares; Excludes 2.1 M foundershares subject to earnout, ve sting ratably at $12.50 per share and $15.00 per share; Excludes tranches subject to time triggers and early price

releases

2.4%

NMMC Founder Shares

49View entire presentation