Kinnevik Results Presentation Deck

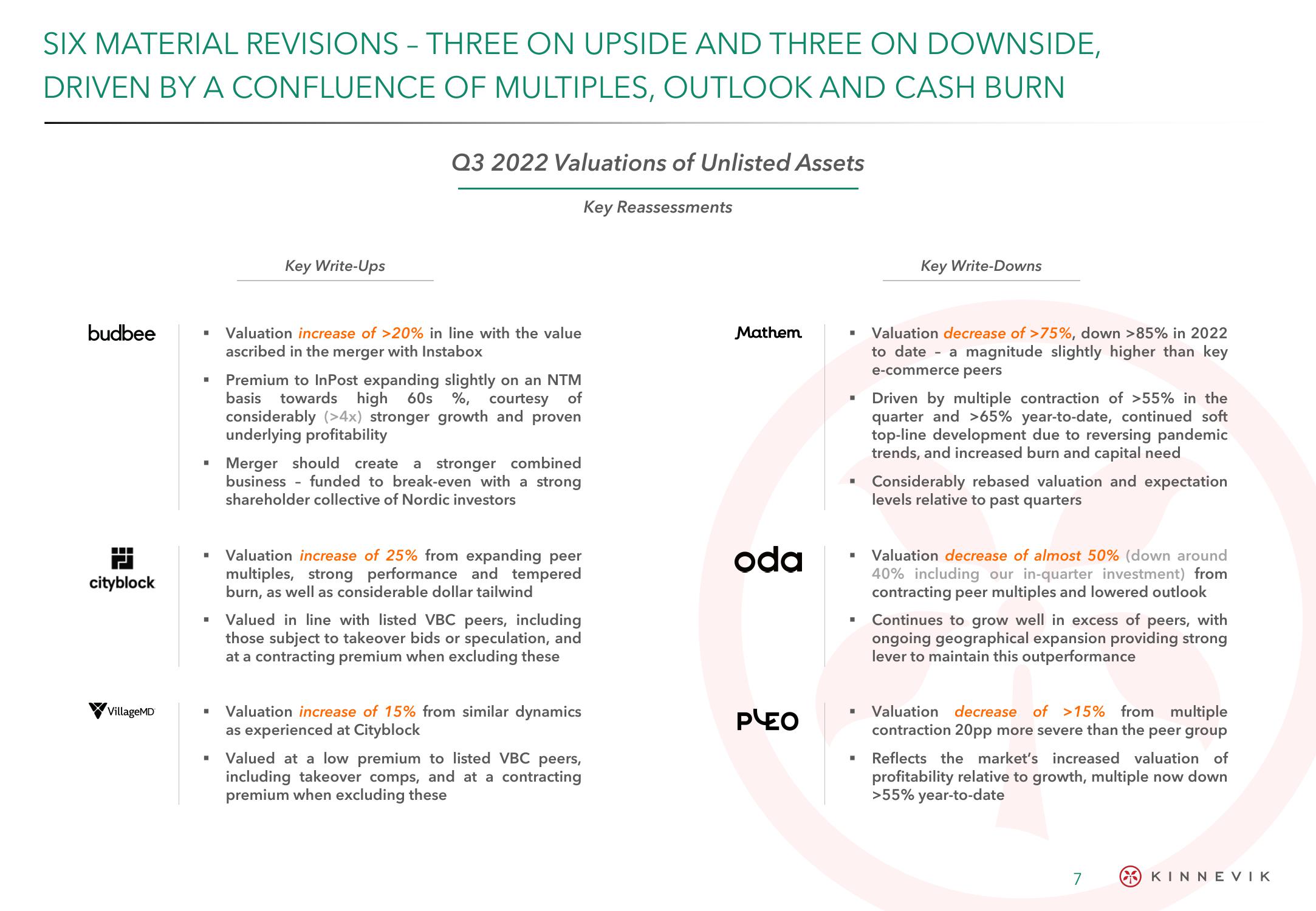

SIX MATERIAL REVISIONS - THREE ON UPSIDE AND THREE ON DOWNSIDE,

DRIVEN BY A CONFLUENCE OF MULTIPLES, OUTLOOK AND CASH BURN

budbee

i

cityblock

VillageMD

■

Key Write-Ups

■

Q3 2022 Valuations of Unlisted Assets

Valuation increase of >20% in line with the value

ascribed in the merger with Instabox

Premium to InPost expanding slightly on an NTM

basis towards high 60s %, courtesy of

considerably (>4x) stronger growth and proven

underlying profitability

▪ Merger should create a stronger combined

business funded to break-even with a strong

shareholder collective of Nordic investors

Valuation increase of 25% from expanding peer

multiples, strong performance and tempered

burn, as well as considerable dollar tailwind

Valued in line with listed VBC peers, including

those subject to takeover bids or speculation, and

at a contracting premium when excluding these

Valuation increase of 15% from similar dynamics

as experienced at Cityblock

Key Reassessments

Valued at a low premium to listed VBC peers,

including takeover comps, and at a contracting

premium when excluding these

Mathem

oda

PLEO

I

■

■

■

Key Write-Downs

Valuation decrease of >75%, down >85% in 2022

to date - a magnitude slightly higher than key

e-commerce peers

Driven by multiple contraction of >55% in the

quarter and >65% year-to-date, continued soft

top-line development due to reversing pandemic

trends, and increased burn and capital need

Considerably rebased valuation and expectation

levels relative to past quarters

Valuation decrease of almost 50% (down around

40% including our in-quarter investment) from

contracting peer multiples and lowered outlook

Continues to grow well in excess of peers, with

ongoing geographical expansion providing strong

lever to maintain this outperformance

Valuation decrease of >15% from multiple

contraction 20pp more severe than the peer group

I Reflects the market's increased valuation of

profitability relative to growth, multiple now down

>55% year-to-date

7

KINNEVIKView entire presentation