Paysafe Results Presentation Deck

Leverage summary

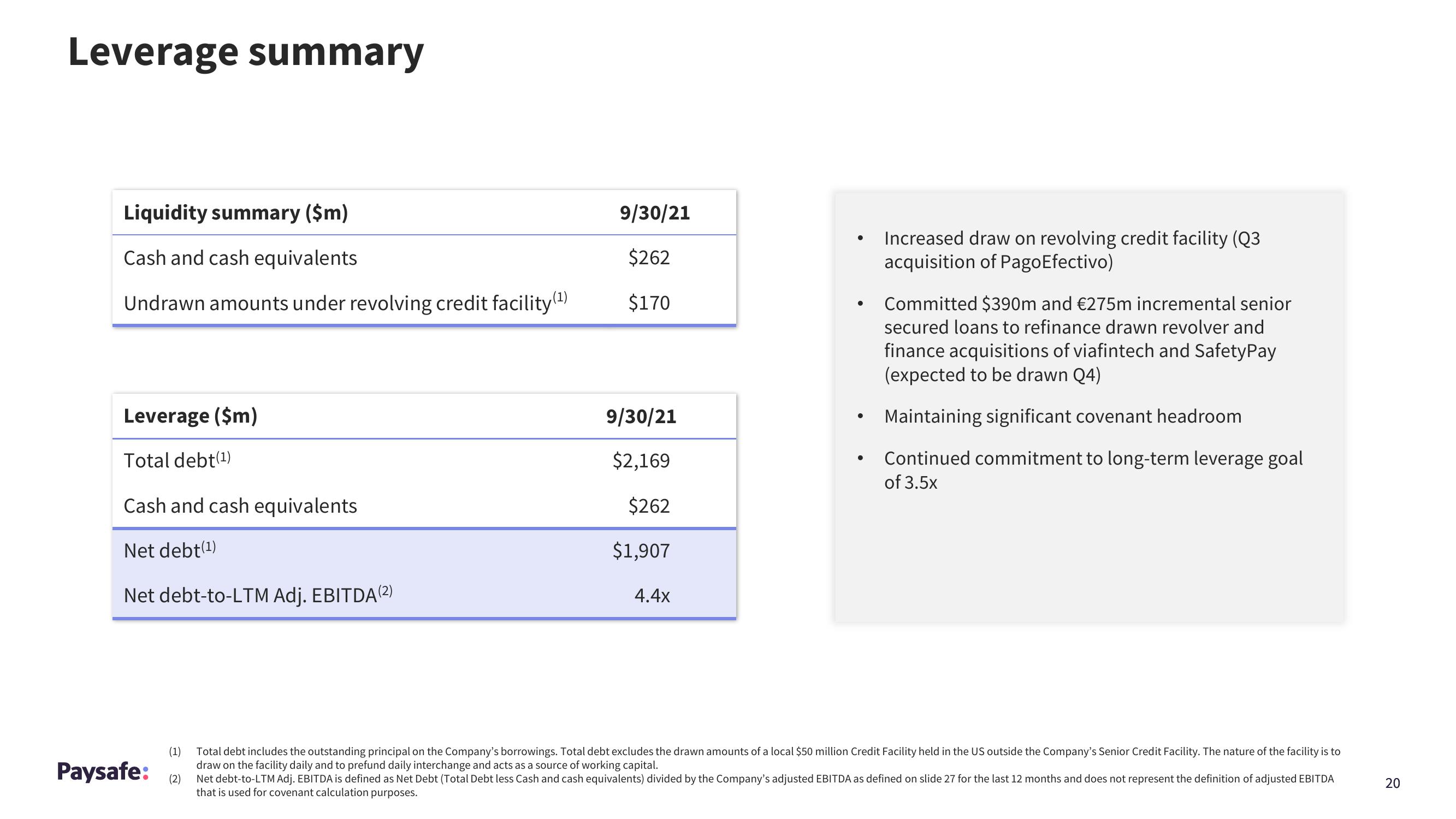

Liquidity summary ($m)

Cash and cash equivalents

Undrawn amounts under revolving credit facility (¹)

Leverage ($m)

Total debt(¹)

Cash and cash equivalents

Net debt(¹)

Net debt-to-LTM Adj. EBITDA(2)

Paysafe:

(1)

(2)

9/30/21

$262

$170

9/30/21

$2,169

$262

$1,907

4.4x

●

●

Increased draw on revolving credit facility (Q3

acquisition of PagoEfectivo)

Committed $390m and €275m incremental senior

secured loans to refinance drawn revolver and

finance acquisitions of viafintech and SafetyPay

(expected to be drawn Q4)

Maintaining significant covenant headroom

Continued commitment to long-term leverage goal

of 3.5x

Total debt includes the outstanding principal on the Company's borrowings. Total debt excludes the drawn amounts of a local $50 million Credit Facility held in the US outside the Company's Senior Credit Facility. The nature of the facility is to

draw on the facility daily and to prefund daily interchange and acts as a source of working capital.

Net debt-to-LTM Adj. EBITDA is defined as Net Debt (Total Debt less Cash and cash equivalents) divided by the Company's adjusted EBITDA as defined on slide 27 for the last 12 months and does not represent the definition of adjusted EBITDA

that is used for covenant calculation purposes.

20View entire presentation