EVBox SPAC Presentation Deck

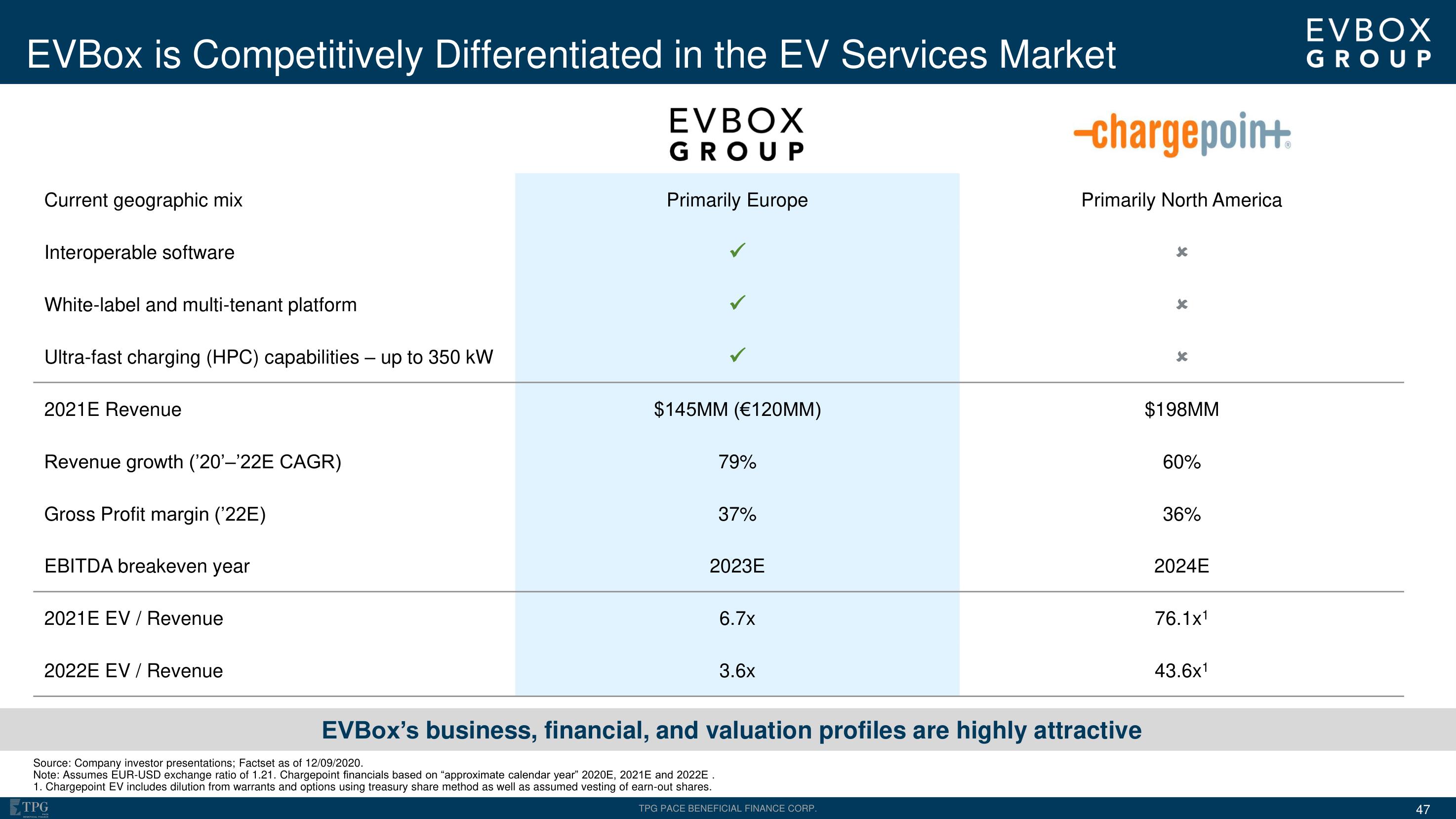

EVBox is Competitively Differentiated in the EV Services Market

EVBOX

GROUP

Current geographic mix

Interoperable software

White-label and multi-tenant platform

Ultra-fast charging (HPC) capabilities - up to 350 kW

2021E Revenue

Revenue growth ('20'-'22E CAGR)

Gross Profit margin ('22E)

EBITDA breakeven year

2021E EV / Revenue

2022E EV / Revenue

Primarily Europe

TPG

BENEFICIAL

$145MM (€120MM)

79%

Source: Company investor presentations; Factset as of 12/09/2020.

Note: Assumes EUR-USD exchange ratio of 1.21. Chargepoint financials based on "approximate calendar year" 2020E, 2021E and 2022E.

1. Chargepoint EV includes dilution from warrants and options using treasury share method as well as assumed vesting of earn-out shares.

37%

2023E

6.7x

3.6x

EVBox's business, financial, and valuation profiles are highly attractive

-chargepoin+

Primarily North America

TPG PACE BENEFICIAL FINANCE CORP.

X

X

X

$198MM

60%

36%

2024E

76.1x¹

43.6x¹

EVBOX

GROUP

47View entire presentation