Goldman Sachs Results Presentation Deck

Expenses

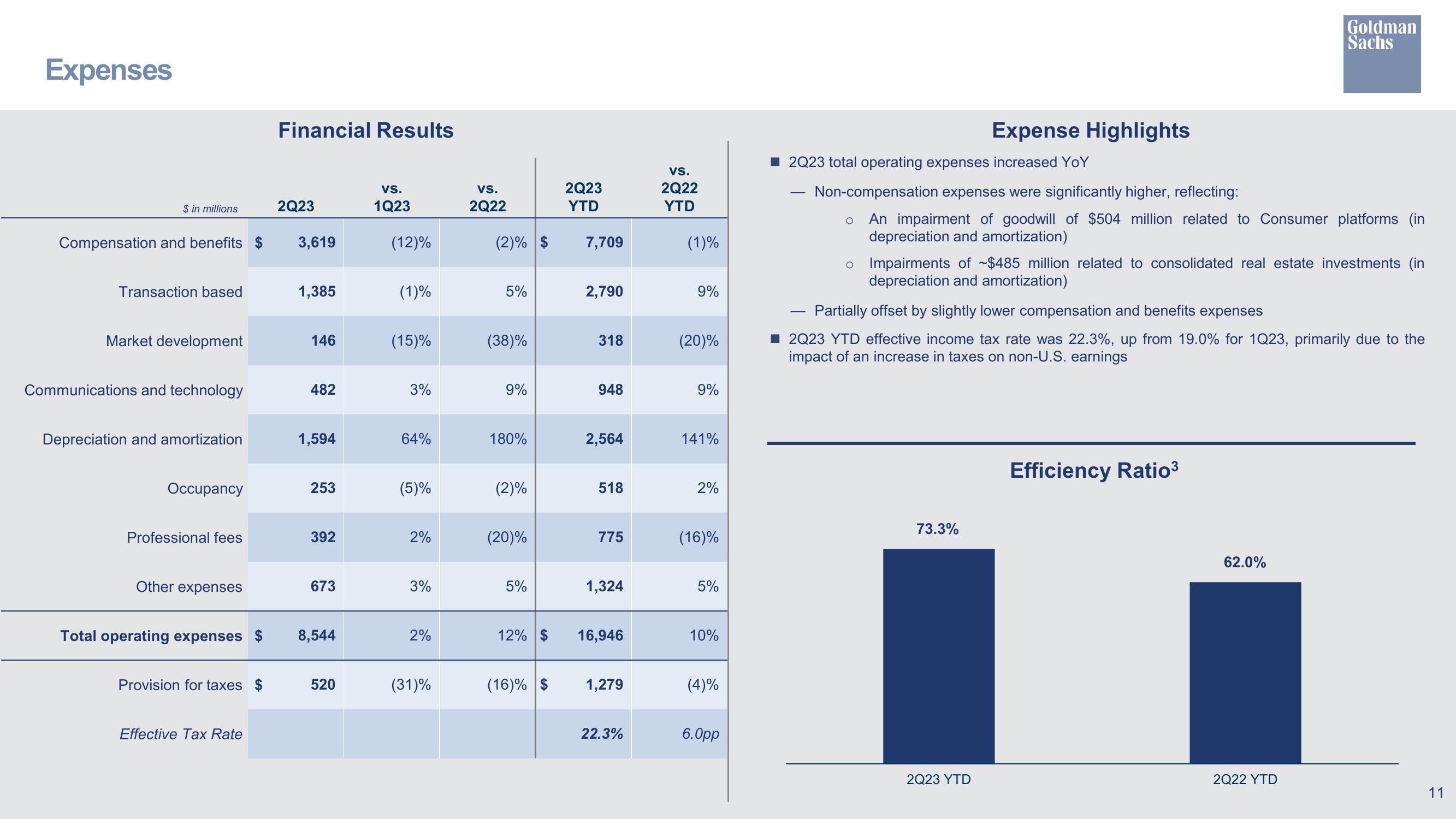

$ in millions

Compensation and benefits $

Transaction based

Market development

Communications and technology

Depreciation and amortization

Occupancy

Professional fees

Other expenses

Total operating expenses $

Provision for taxes $

Effective Tax Rate

Financial Results

2Q23

3,619

1,385

146

482

1,594

253

392

673

8,544

520

VS.

1Q23

(12)%

(1)%

(15)%

3%

64%

(5)%

2%

3%

2%

(31)%

VS.

2Q22

(2)%$

5%

(38)%

9%

180%

(2)%

(20)%

5%

12% $

(16)% $

2Q23

YTD

7,709

2,790

318

948

2,564

518

775

1,324

16,946

1,279

22.3%

VS.

2Q22

YTD

(1)%

9%

(20)%

9%

141%

2%

(16)%

5%

10%

(4)%

6.Opp

■2Q23 total operating expenses increased YoY

Expense Highlights

Non-compensation expenses were significantly higher, reflecting:

O An impairment of goodwill of $504 million related to Consumer platforms (in

depreciation and amortization)

O Impairments of ~$485 million related to consolidated real estate investments (in

depreciation and amortization)

73.3%

Partially offset by slightly lower compensation and benefits expenses

2Q23 YTD effective income tax rate was 22.3%, up from 19.0% for 1Q23, primarily due to the

impact of an increase in taxes on non-U.S. earnings

2Q23 YTD

Goldman

Sachs

Efficiency Ratio³

62.0%

2Q22 YTD

11View entire presentation