Bank of America Results Presentation Deck

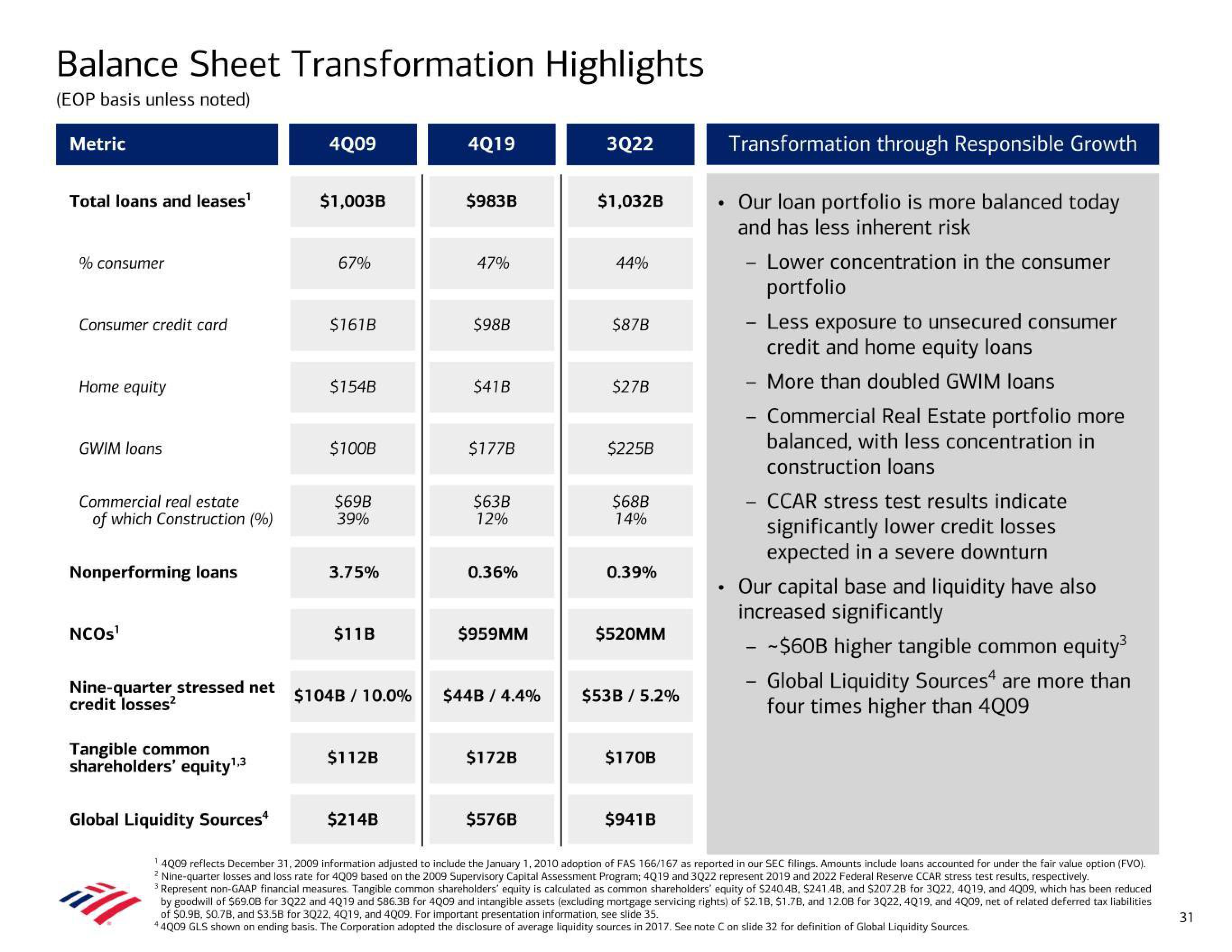

Balance Sheet Transformation Highlights

(EOP basis unless noted)

Metric

Total loans and leases¹

% consumer

Consumer credit card

Home equity

GWIM loans

Commercial real estate

of which Construction (%)

Nonperforming loans

NCOS¹

Nine-quarter stressed net

credit losses²

Tangible common

shareholders' equity¹,³

4Q09

$1,003B

67%

$161B

$154B

$100B

$69B

39%

3.75%

$11B

$104B / 10.0%

$112B

4Q19

$214B

$983B

47%

$98B

$41B

$177B

$63B

12%

0.36%

$959MM

$44B / 4.4%

$172B

3Q22

$576B

$1,032B

44%

$87B

$27B

$225B

$68B

14%

0.39%

$520MM

$53B / 5.2%

$170B

$941B

Transformation through Responsible Growth

• Our loan portfolio is more balanced today

and has less inherent risk

-

Lower concentration in the consumer

portfolio

- Less exposure to unsecured consumer

credit and home equity loans

- More than doubled GWIM loans

Commercial Real Estate portfolio more

balanced, with less concentration in

construction loans

- CCAR stress test results indicate

significantly lower credit losses

expected in a severe downturn

Our capital base and liquidity have also

increased significantly

-

Global Liquidity Sources*

¹4009 reflects December 31, 2009 information adjusted to include the January 1, 2010 adoption of FAS 166/167 as reported in our SEC filings. Amounts include loans accounted for under the fair value option (FVO).

2 Nine-quarter losses and loss rate for 4009 based on the 2009 Supervisory Capital Assessment Program; 4Q19 and 3Q22 represent 2019 and 2022 Federal Reserve CCAR stress test results, respectively.

3 Represent non-GAAP financial measures. Tangible common shareholders' equity is calculated as common shareholders' equity of $240.4B, $241.4B, and $207.2B for 3Q22, 4019, and 4Q09, which has been reduced

by goodwill of $69.0B for 3Q22 and 4Q19 and $86.3B for 4009 and intangible assets (excluding mortgage servicing rights) of $2.1B, $1.7B, and 12.0B for 3Q22, 4Q19, and 4009, net of related deferred tax liabilities

of $0.9B, $0.7B, and $3.5B for 3Q22, 4019, and 4Q09. For important presentation information, see slide 35.

44Q09 GLS shown on ending basis. The Corporation adopted the disclosure of average liquidity sources in 2017. See note C on slide 32 for definition of Global Liquidity Sources.

- ~$60B higher tangible common equity³

Global Liquidity Sources are more than

four times higher than 4Q09

31View entire presentation