NuStar Energy Investor Conference Presentation Deck

NuStar

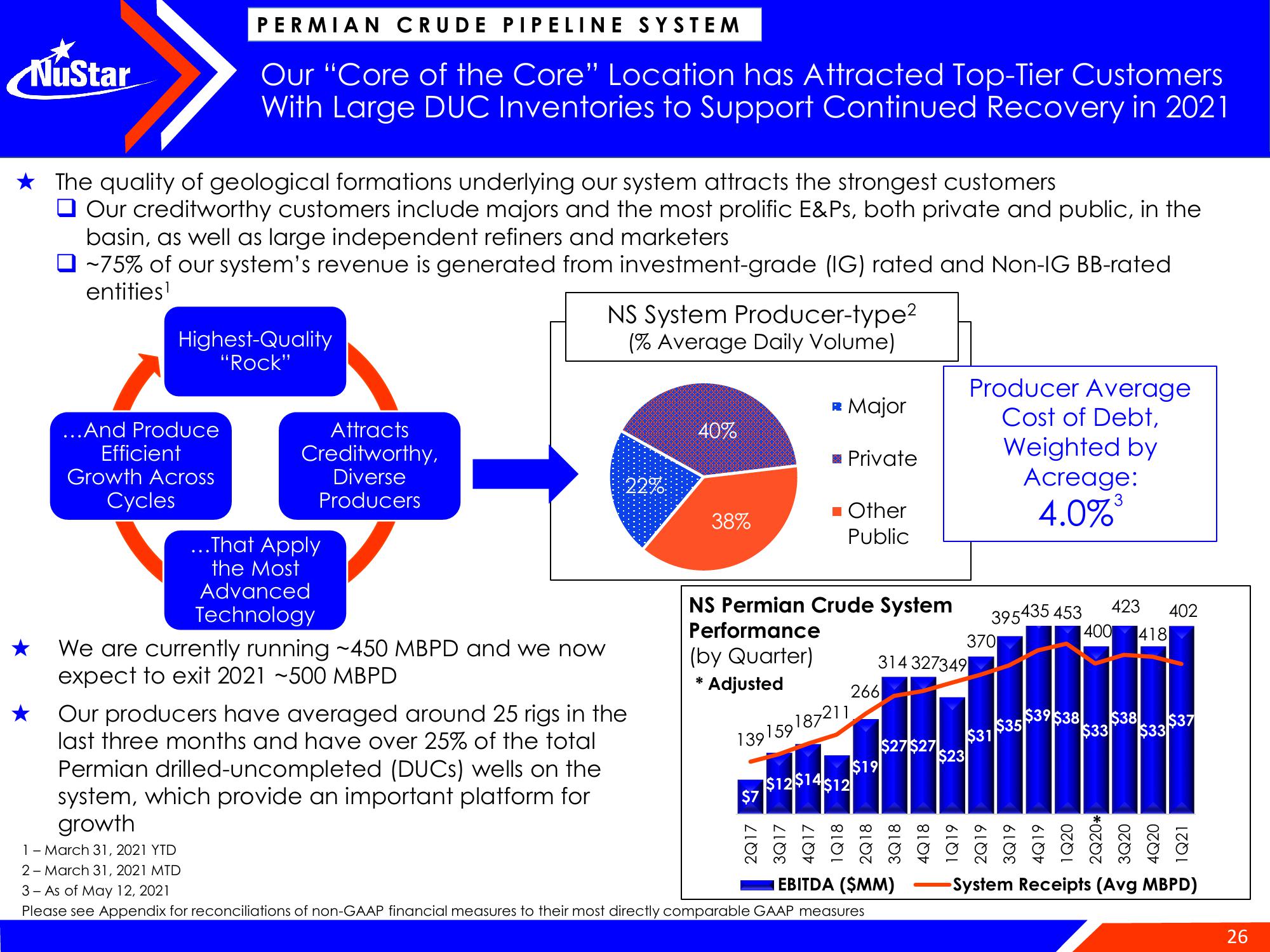

PERMIAN CRUDE PIPELINE SYSTEM

Our "Core of the Core" Location has Attracted Top-Tier Customers

With Large DUC Inventories to Support Continued Recovery in 2021

★ The quality of geological formations underlying our system attracts the strongest customers

Our creditworthy customers include majors and the most prolific E&Ps, both private and public, in the

basin, as well as large independent refiners and marketers

☐ ~75% of our system's revenue is generated from investment-grade (IG) rated and Non-IG BB-rated

entities¹

Highest-Quality

"Rock"

...And Produce

Efficient

Growth Across

Cycles

Attracts

Creditworthy,

Diverse

Producers

...That Apply

the Most

Advanced

Technology

We are currently running ~450 MBPD and we now

expect to exit 2021 ~500 MBPD

NS System Producer-type²

(% Average Daily Volume)

22%

40%

38%

(by Quarter)

Adjusted

*

NS Permian Crude System

Performance

Major

Private

■ Other

Public

1391591

Our producers have averaged around 25 rigs in the

last three months and have over 25% of the total

Permian drilled-uncompleted (DUCs) wells on the

system, which provide an important platform for

growth

1 - March 31, 2021 YTD

2 March 31, 2021 MTD

3- As of May 12, 2021

Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

›187211.

2Q17

3Q17

4Q17

1Q18

266

$12$14$12

$19

8107

314 327349

$27 $27

$23

EBITDA ($MM)

Producer Average

Cost of Debt,

370

395435 453

Weighted by

Acreage:

3

4.0%³

$31

$35 $39 $38

423

400 418

$33

402

$38 $37

$33

3Q18

4Q18

1Q19

2Q19

3Q19

4Q19

1Q20

2Q20*

3Q20

4Q20

1Q21

-System Receipts (Avg MBPD)

26View entire presentation