Lyft Results Presentation Deck

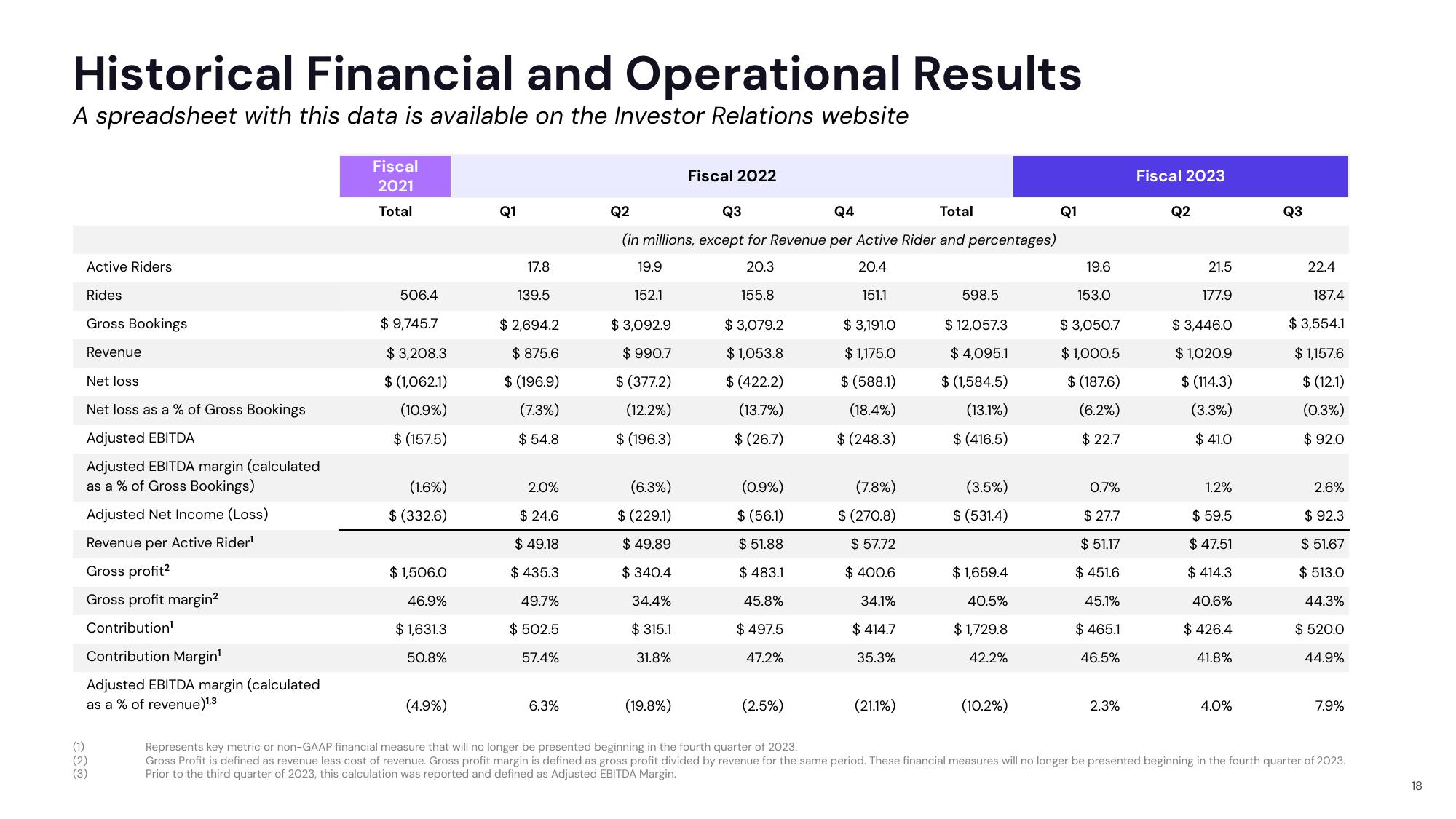

Historical Financial and Operational Results

A spreadsheet with this data is available on the Investor Relations website

Active Riders

Rides

Gross Bookings

Revenue

Net loss

Net loss as a % of Gross Bookings

Adjusted EBITDA

Adjusted EBITDA margin (calculated

as a % of Gross Bookings)

Adjusted Net Income (Loss)

Revenue per Active Rider¹

Gross profit²

Gross profit margin²

Contribution¹

Contribution Margin¹

Adjusted EBITDA margin (calculated

as a % of revenue)1,3

(1)

(2)

(3)

Fiscal

2021

Total

506.4

$9,745.7

$3,208.3

$ (1,062.1)

(10.9%)

$ (157.5)

(1.6%)

$ (332.6)

$1,506.0

46.9%

$1,631.3

50.8%

(4.9%)

Q1

17.8

139.5

$ 2,694.2

$ 875.6

$ (196.9)

(7.3%)

$54.8

2.0%

$24.6

$ 49.18

$435.3

49.7%

$ 502.5

57.4%

6.3%

Q2

Q3

Q4

Total

(in millions, except for Revenue per Active Rider and percentages)

20.4

151.1

20.3

155.8

$ 3,079.2

$1,053.8

$ (422.2)

(13.7%)

$ (26.7)

$ 3,191.0

$ 1,175.0

$ (588.1)

(18.4%)

$ (248.3)

19.9

152.1

$3,092.9

$990.7

$ (377.2)

(12.2%)

$ (196.3)

(6.3%)

$ (229.1)

$ 49.89

$340.4

34.4%

$ 315.1

31.8%

Fiscal 2022

(19.8%)

(0.9%)

$ (56.1)

$51.88

$ 483.1

45.8%

$497.5

47.2%

(2.5%)

(7.8%)

$ (270.8)

$57.72

$ 400.6

34.1%

$ 414.7

35.3%

(21.1%)

598.5

$ 12,057.3

$ 4,095.1

$ (1,584.5)

(13.1%)

$ (416.5)

(3.5%)

$ (531.4)

$1,659.4

40.5%

$1,729.8

42.2%

(10.2%)

Q1

19.6

153.0

$3,050.7

$1,000.5

$ (187.6)

(6.2%)

$22.7

0.7%

$27.7

$ 51.17

$ 451.6

45.1%

$ 465.1

46.5%

2.3%

Fiscal 2023

Q2

21.5

177.9

$ 3,446.0

$ 1,020.9

$ (114.3)

(3.3%)

$41.0

1.2%

$59.5

$ 47.51

$414.3

40.6%

$426.4

41.8%

4.0%

Q3

22.4

187.4

$ 3,554.1

$ 1,157.6

$ (12.1)

(0.3%)

$92.0

2.6%

$ 92.3

$51.67

$513.0

44.3%

$ 520.0

44.9%

7.9%

Represents key metric or non-GAAP financial measure that will no longer be presented beginning in the fourth quarter of 2023.

Gross Profit is defined as revenue less cost of revenue. Gross profit margin is defined as gross profit divided by revenue for the same period. These financial measures will no longer be presented beginning in the fourth quarter of 2023.

Prior to the third quarter of 2023, this calculation was reported and defined as Adjusted EBITDA Margin.

18View entire presentation