Greystar Equity Partners XI (May-23)

PORTFOLIO CONSTRUCTION

MARKET SELECTION

Top-down macro views from our Investment Strategy &

Research team

Scale: economy, population, demographics, capital

liquidity

Growth: economic, employment, income, demographic,

population

Risk: regulatory environment, home price volatility,

recession resilience

Bottom-up, real-time local inputs from Regional

Investment teams

Market pricing/spot cap rates

Micro-location insights on growth and risk

*For illustrative purposes only. There can be no assurance that the Fund will achieve the same or comparable results.

PREPARED FOR EMPLOYEES' RETIREMENT SYSTEM OF RHODE

ISLAND ONLY. THIS IS NOT A PUBLIC OFFER OF DISTRIBUTION.

●

ASSET SELECTION

Seek to build a diversified portfolio of assets, identifying

the best relative value opportunities within the rental

residential sector

Leverage relationships with brokers and local market

participants to source potential investment opportunities

Underwrite between 1,000 and 1,500 opportunities per

year on behalf of the GEP Fund Series*

Complete comprehensive due diligence and approval

process prior to acquisition

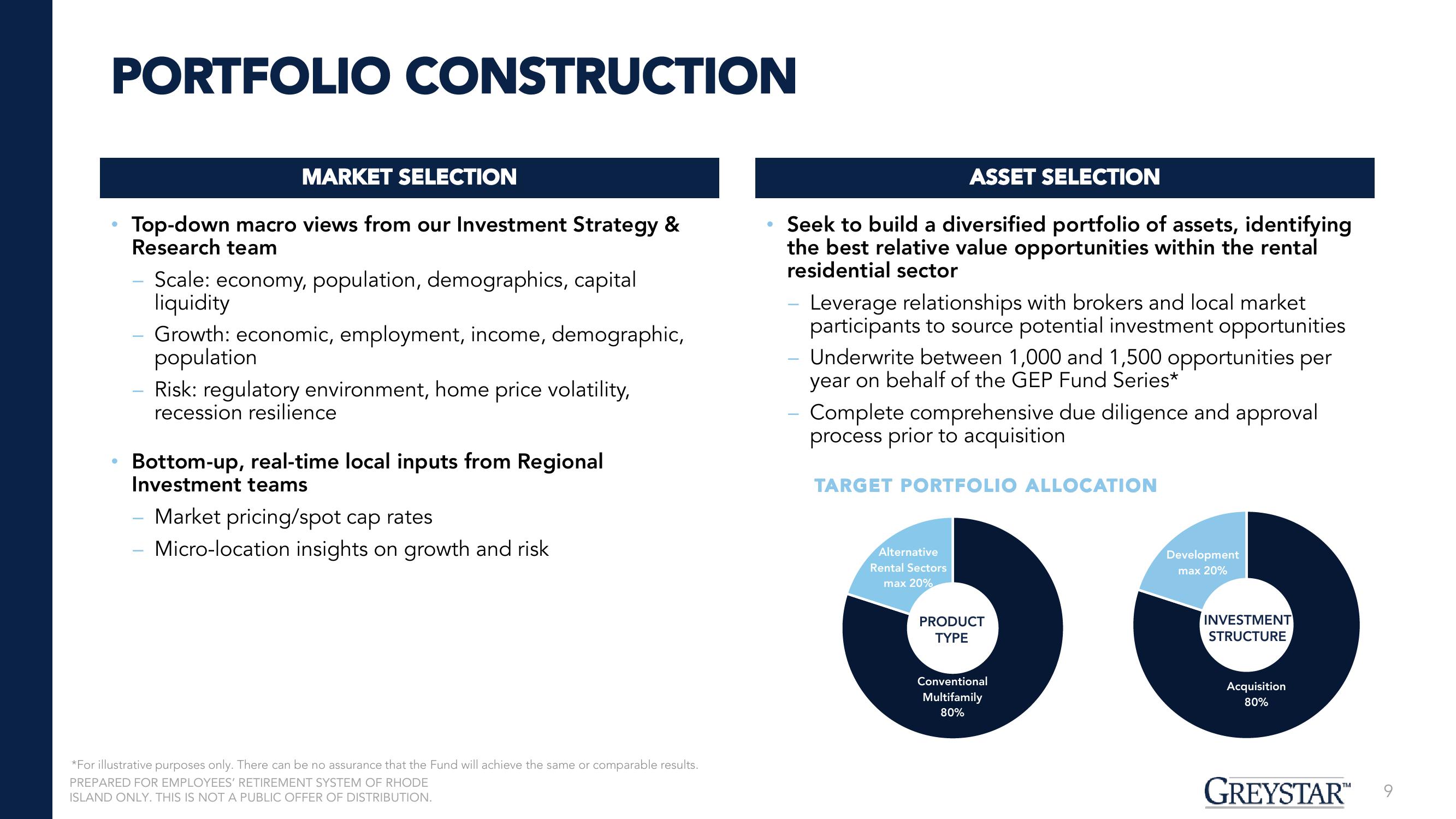

TARGET PORTFOLIO ALLOCATION

Alternative

Rental Sectors

max 20%

PRODUCT

TYPE

Conventional

Multifamily

80%

Development

max 20%

INVESTMENT

STRUCTURE

Acquisition

80%

GREYSTAR™

9View entire presentation