Nikola SPAC Presentation Deck

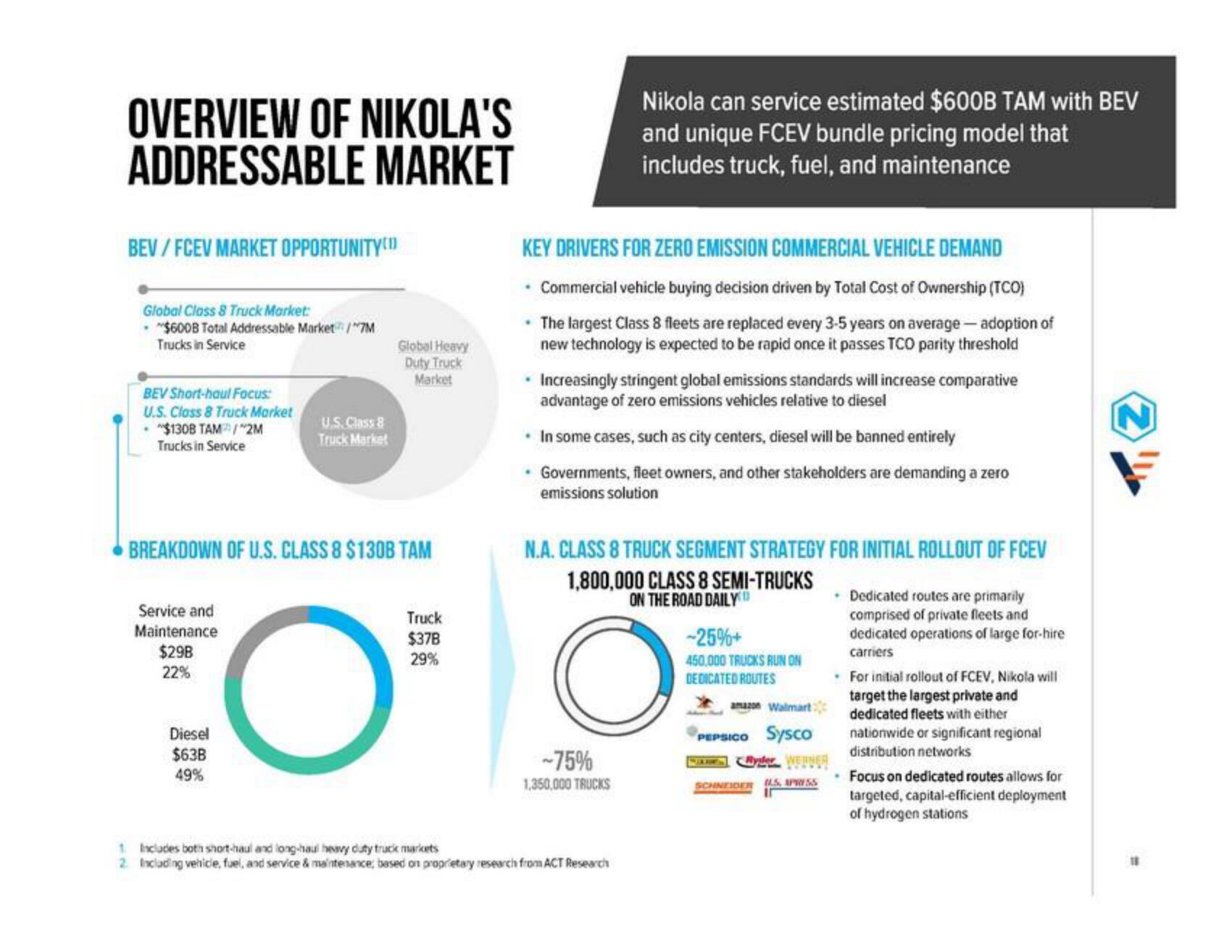

OVERVIEW OF NIKOLA'S

ADDRESSABLE MARKET

BEV/FCEV MARKET OPPORTUNITY

Global Class 8 Truck Market:

- "$600B Total Addressable Market/"7M

Trucks in Service

BEV Short-haul Focus:

U.S. Class 8 Truck Market

• "$130B TAM/"2M

Trucks in Service

Service and

Maintenance

$29B

22%

U.S. Class 8

Truck Market

BREAKDOWN OF U.S. CLASS 8 $130B TAM

Diesel

$63B

49%

Global Heavy

Duty Truck

Market

O

Truck

$378

29%

KEY DRIVERS FOR ZERO EMISSION COMMERCIAL VEHICLE DEMAND

• Commercial vehicle buying decision driven by Total Cost of Ownership (TCO)

• The largest Class 8 fleets are replaced every 3-5 years on average - adoption of

new technology is expected to be rapid once it passes TCO parity threshold

Nikola can service estimated $600B TAM with BEV

and unique FCEV bundle pricing model that

includes truck, fuel, and maintenance

• Increasingly stringent global emissions standards will increase comparative

advantage of zero emissions vehicles relative to diesel

• In some cases, such as city centers, diesel will be banned entirely

Governments, fleet owners, and other stakeholders are demanding a zero

emissions solution

N.A. CLASS 8 TRUCK SEGMENT STRATEGY FOR INITIAL ROLLOUT OF FCEV

1,800,000 CLASS 8 SEMI-TRUCKS

ON THE ROAD DAILY

O

-75%

1,350,000 TRUCKS

1 Includes both short-haul and long-haul heavy duty truck markets

2 Including vehicle, fuel, and service & maintenance, based on proprietary research from ACT Research

-25%+

450.000 TRUCKS RUN ON

DEDICATED ROUTES

amazon Walmart:

PEPSICO SYSCO

S Byder WERNER

SCHNEIDER S, APRESS

I

• Dedicated routes are primarily

comprised of private fleets and

dedicated operations of large for-hire

carriers

• For initial rollout of FCEV, Nikola will

target the largest private and

dedicated fleets with either

nationwide or significant regional

distribution networks

. Focus on dedicated routes allows for

targeted, capital-efficient deployment

of hydrogen stationsView entire presentation