Rocket Companies Investor Presentation Deck

Endnotes

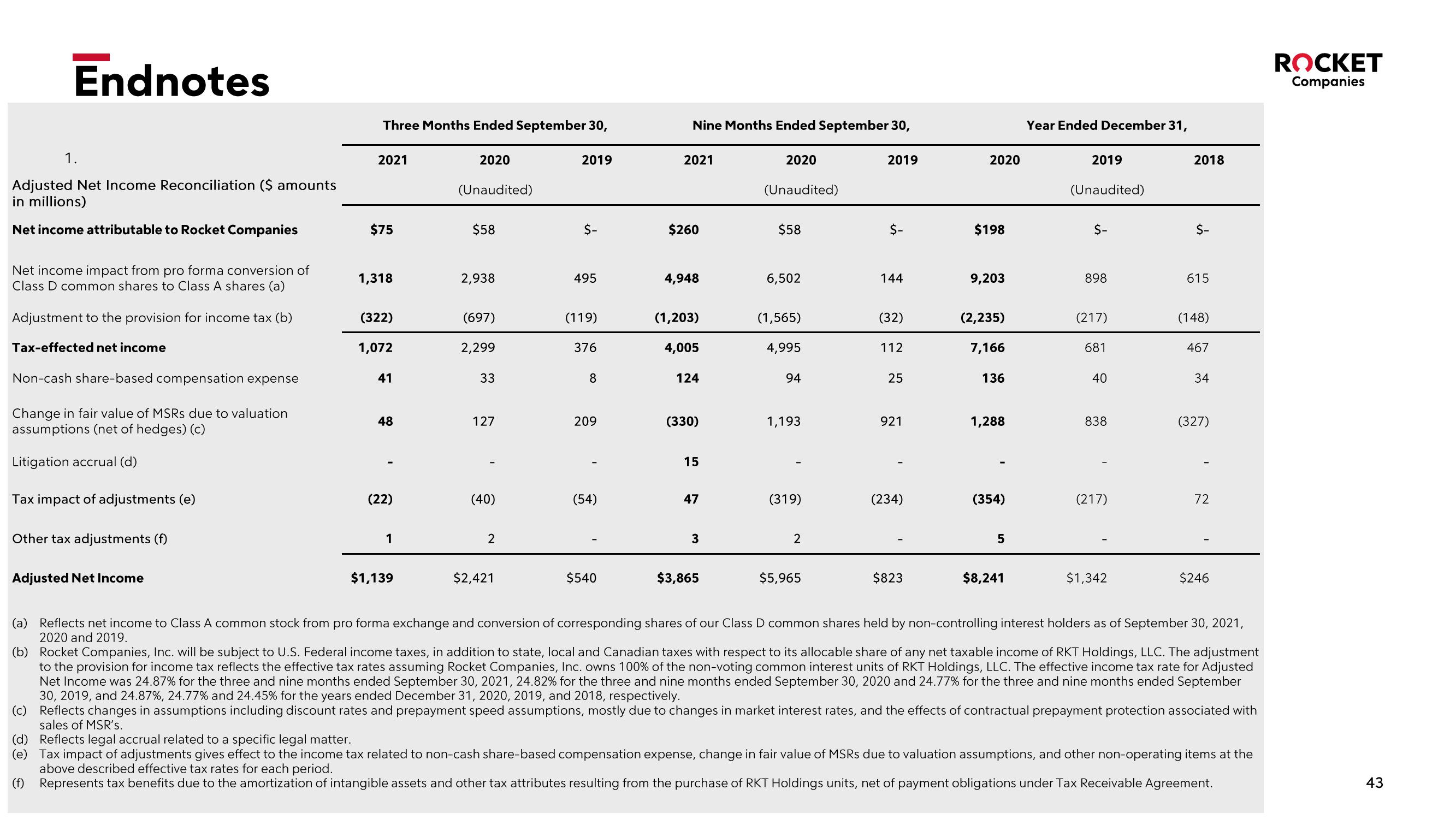

1.

Adjusted Net Income Reconciliation ($ amounts

in millions)

Net income attributable to Rocket Companies

Net income impact from pro forma conversion of

Class D common shares to Class A shares (a)

Adjustment to the provision for income tax (b)

Tax-effected net income

Non-cash share-based compensation expense

Change in fair value of MSRs due to valuation

assumptions (net of hedges) (c)

Litigation accrual (d)

Tax impact of adjustments (e)

Other tax adjustments (f)

Adjusted Net Income

Three Months Ended September 30,

2020

(Unaudited)

2021

$75

1,318

(322)

1,072

41

48

(22)

1

$1,139

$58

2,938

(697)

2,299

33

127

(40)

2

$2,421

2019

$-

495

(119)

376

8

209

(54)

$540

Nine Months Ended September 30,

2020

(Unaudited)

2021

$260

4,948

(1,203)

4,005

124

(330)

15

47

3

$3,865

$58

6,502

(1,565)

4,995

94

1,193

(319)

2

$5,965

2019

$-

144

(32)

112

25

921

(234)

$823

2020

$198

9,203

(2,235)

7,166

136

1,288

(354)

5

$8,241

Year Ended December 31,

2019

(Unaudited)

$-

898

(217)

681

40

838

(217)

$1,342

2018

$-

615

(148)

467

34

(327)

72

$246

(a) Reflects net income to Class A common stock from pro forma exchange and conversion of corresponding shares of our Class D common shares held by non-controlling interest holders as of September 30, 2021,

2020 and 2019.

(b) Rocket Companies, Inc. will be subject to U.S. Federal income taxes, in addition to state, local and Canadian taxes with respect to its allocable share of any net taxable income of RKT Holdings, LLC. The adjustment

to the provision for income tax reflects the effective tax rates assuming Rocket Companies, Inc. owns 100% of the non-voting common interest units of RKT Holdings, LLC. The effective income tax rate for Adjusted

Net Income was 24.87% for the three and nine months ended September 30, 2021, 24.82% for the three and nine months ended September 30, 2020 and 24.77% for the three and nine months ended September

30, 2019, and 24.87%, 24.77% and 24.45% for the years ended December 31, 2020, 2019, and 2018, respectively.

(c) Reflects changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in market interest rates, and the effects of contractual prepayment protection associated with

sales of MSR's.

(d) Reflects legal accrual related to a specific legal matter.

(e) Tax impact of adjustments gives effect to the income tax related to non-cash share-based compensation expense, change in fair value of MSRS due to valuation assumptions, and other non-operating items at the

above described effective tax rates for each period.

(f) Represents tax benefits due to the amortization of intangible assets and other tax attributes resulting from the purchase of RKT Holdings units, net of payment obligations under Tax Receivable Agreement.

ROCKET

Companies

43View entire presentation