Bed Bath & Beyond Results Presentation Deck

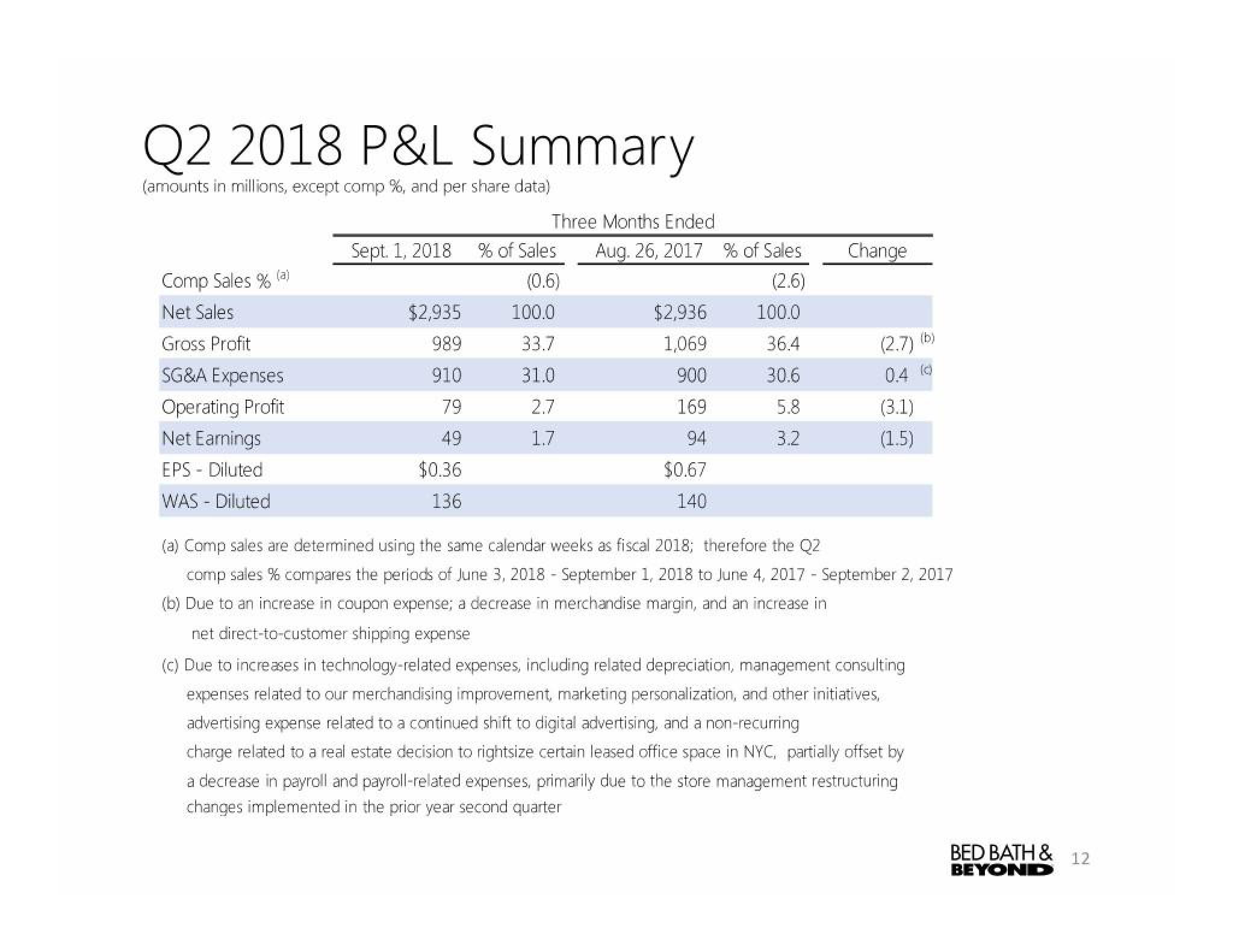

Q2 2018 P&L Summary

(amounts in millions, except comp%, and per share data)

Comp Sales % (a)

Net Sales

Gross Profit

SG&A Expenses

Operating Profit

Net Earnings

EPS - Diluted

WAS - Diluted

Sept. 1, 2018

$2,935

989

910

79

49

$0.36

136

Three Months Ended

% of Sales

(0.6)

100.0

33.7

31.0

2.7

1.7

Aug. 26, 2017 % of Sales

(2.6)

$2,936

1,069

900

169

94

$0.67

140

100.0

36.4

30.6

5.8

3.2

Change

(2.7)

0.4

(3.1)

(1.5)

(b)

(c) Due to increases in technology-related expenses, including related depreciation, management consulting

expenses related to our merchandising improvement, marketing personalization, and other initiatives,

advertising expense related to a continued shift to digital advertising, and a non-recurring

charge related to a real estate decision to rightsize certain leased office space in NYC, partially offset by

a decrease in payroll and payroll-related expenses, primarily due to the store management restructuring

changes implemented in the prior year second quarter

(0)

(a) Comp sales are determined using the same calendar weeks as fiscal 2018; therefore the Q2

comp sales % compares the periods of June 3, 2018 September 1, 2018 to June 4, 2017 - September 2, 2017

(b) Due to an increase in coupon expense; a decrease in merchandise margin, and an increase in

net direct-to-customer shipping expense

BED BATH & 12

BEYONDView entire presentation