Deutsche Bank Fixed Income Presentation Deck

Sustainability

Q1 2023 highlights

Recent achievements

Sustainable

Finance

513

Policies &

Commitments

-

People &

Own

Operations

Thought

Leadership &

Stakeholder

Engagement

> Increased Sustainable Finance volumes by € 22bn QoQ to € 238bn¹ (cumulative since 2020)

> Signed agreement between DB Private Bank and WWF Germany for advisory service to advance sustainable

finance offering

> Invested into Berlin start-up Plan A which offers carbon measurement solutions/services

> Acted as Sole Mandated Lead Arranger and Sustainability Coordinator in a 5-year, € 120m Senior Secured

Sustainability-Linked Term Loan to Beontag Ltd. (Investment Bank FIC)

Deutsche Bank

Investor Relations

> Tightened thermal policy effective May 2023

> New ambition that at least 90% of high emitting clients in most carbon intensive sectors that engage in new

lending transactions shall have a net zero commitment from 2026 onwards

> Published updated Human Rights Statement

> Offered comprehensive training for client facing staff²

> Initiated vendor engagement program to address scope 3 carbon emissions focusing on Purchased Goods and

Services (Scope 3 category 1)

> Implemented digital delivery program for financial magazines resulting in ~3m sheets of paper saved

> Completed relocation project in Tokyo, re-using 90% of furniture

> Signed green contract for electricity consumption in Australia

> Hosted 2nd Sustainability Deep Dive in Mar 2023

> Hosted Deutsche Bank's 3rd dbAccess Global ESG Conference in Mar 2023, facilitating interviews and panel

discussions as part of a dedicated Climate and Security Day

› Donated ~€ 500k for earthquake victims in Turkey and Syria in Q1; and so far employees donated

~€ 280k across regions to support the work of Red Cross organisations

Note: For footnotes refer to slides 35 and 36

Q1 2023 Fixed Income Investor Call

April 28, 2023

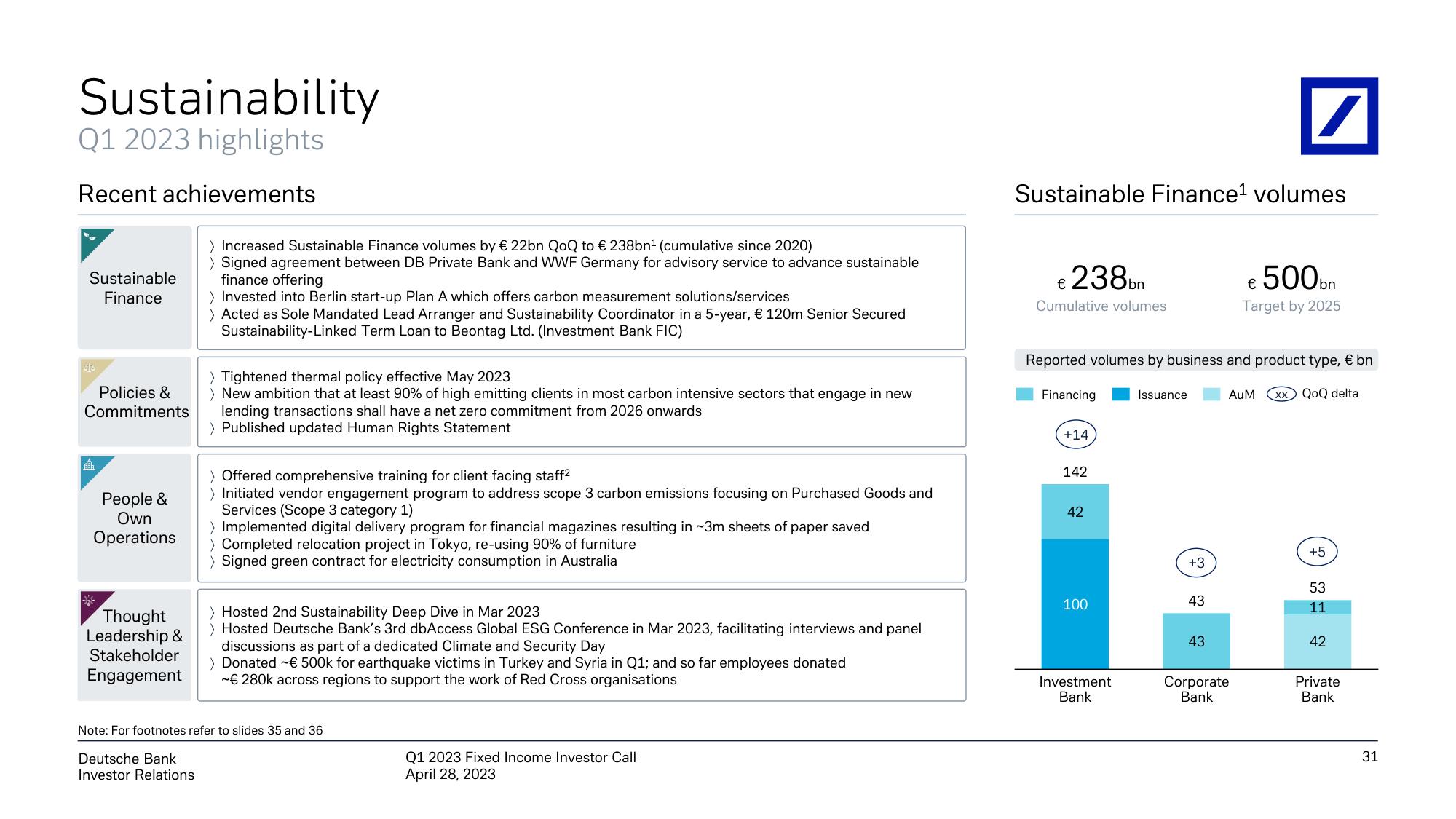

Sustainable Finance¹ volumes

€ 238bn

Cumulative volumes

Reported volumes by business and product type, € bn

AuM xx QoQ delta

Financing

+14

142

42

100

Investment

Bank

Issuance

+3

43

43

€ 500bn

Target by 2025

Corporate

Bank

+5

53

11

42

Private

Bank

31View entire presentation