Taboola Investor Presentation Deck

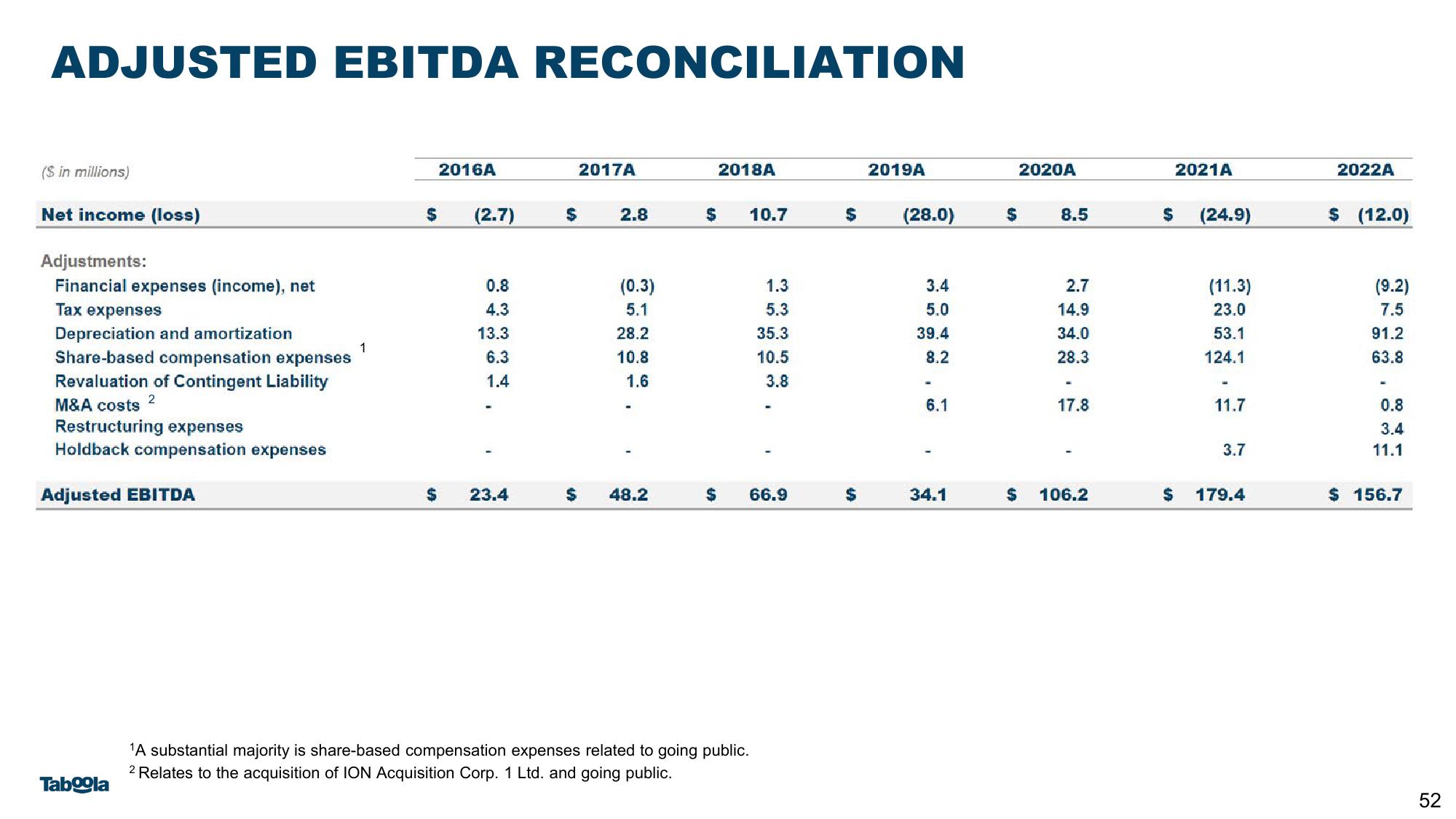

ADJUSTED EBITDA RECONCILIATION

($ in millions)

Net income (loss)

Adjustments:

Financial expenses (income), net

Tax expenses

Depreciation and amortization

Share-based compensation expenses

Revaluation of Contingent Liability

2

M&A costs

Restructuring expenses

Holdback compensation expenses

Adjusted EBITDA

Taboola

1

$

2016A

(2.7)

0.8

4.3

13.3

6.3

1.4

$ 23.4

$

2017A

2.8

(0.3)

5.1

28.2

10.8

1.6

48.2

2018A

$

S

10.7

1.3

5.3

35.3

10.5

3.8

66.9

¹A substantial majority is share-based compensation expenses related to going public.

2 Relates to the acquisition of ION Acquisition Corp. 1 Ltd. and going public.

2019A

$ (28.0)

$

3.4

5.0

39.4

8.2

6.1

34.1

$

$

2020A

8.5

2.7

14.9

34.0

28.3

17.8

106.2

$

2021A

(24.9)

(11.3)

23.0

53.1

124.1

-

11.7

3.7

$ 179.4

2022A

$ (12.0)

(9.2)

7.5

91.2

63.8

-

0.8

3.4

11.1

$ 156.7

52View entire presentation