Sonos Results Presentation Deck

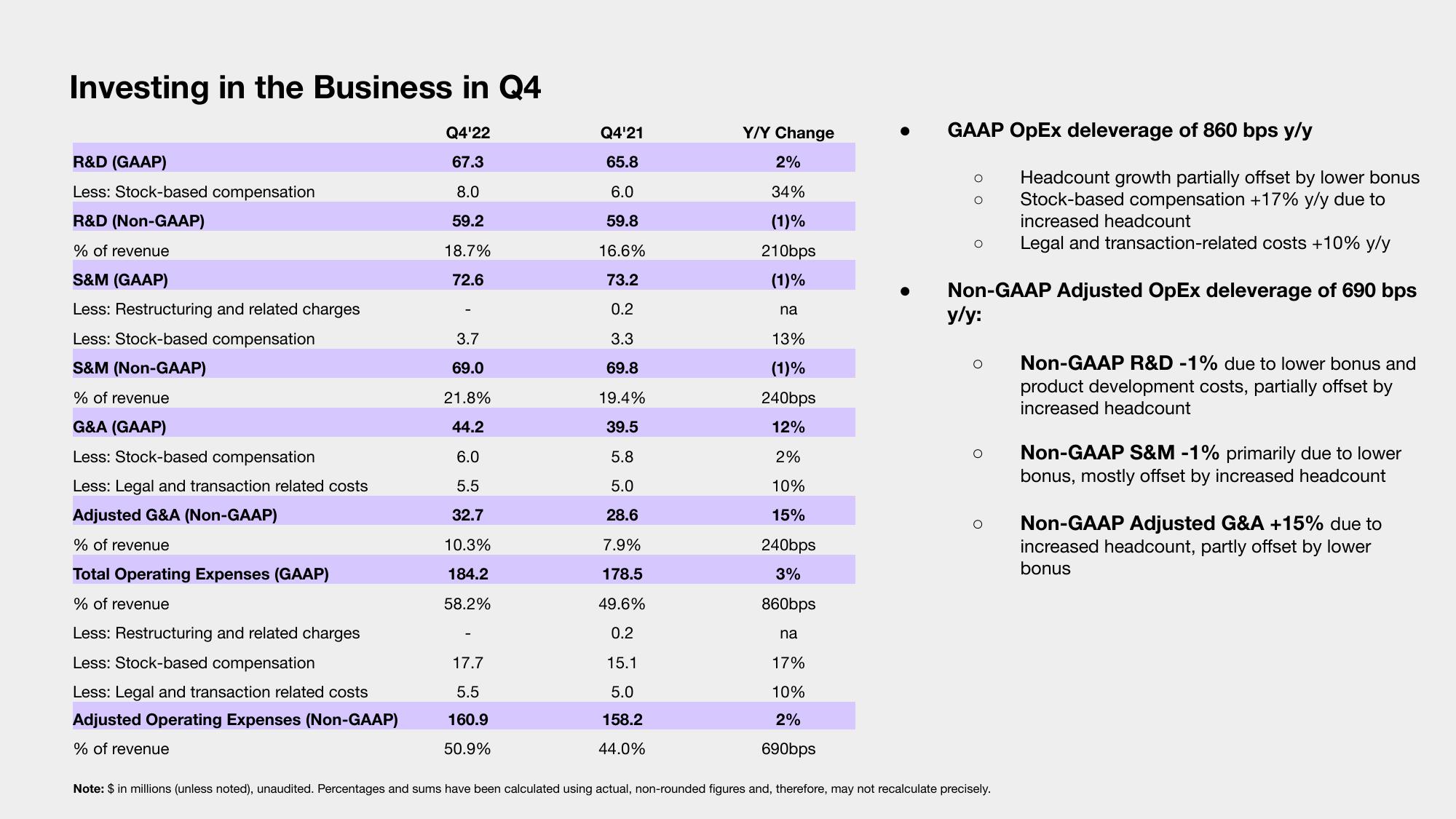

Investing in the Business in Q4

R&D (GAAP)

Less: Stock-based compensation

R&D (Non-GAAP)

% of revenue

S&M (GAAP)

Less: Restructuring and related charges

Less: Stock-based compensation

S&M (Non-GAAP)

% of revenue

G&A (GAAP)

Less: Stock-based compensation

Less: Legal and transaction related costs

Adjusted G&A (Non-GAAP)

% of revenue

Total Operating Expenses (GAAP)

% of revenue

Less: Restructuring and related charges

Less: Stock-based compensation

Less: Legal and transaction related costs

Adjusted Operating Expenses (Non-GAAP)

% of revenue

Q4'22

67.3

8.0

59.2

18.7%

72.6

3.7

69.0

21.8%

44.2

6.0

5.5

32.7

10.3%

184.2

58.2%

17.7

5.5

160.9

50.9%

Q4'21

65.8

6.0

59.8

16.6%

73.2

0.2

3.3

69.8

19.4%

39.5

5.8

5.0

28.6

7.9%

178.5

49.6%

0.2

15.1

5.0

158.2

44.0%

Y/Y Change

2%

34%

(1)%

210bps

(1)%

na

13%

(1)%

240bps

12%

2%

10%

15%

240bps

3%

860bps

na

17%

10%

2%

690bps

GAAP OpEx deleverage of 860 bps y/y

O

O

O

Non-GAAP Adjusted OpEx deleverage of 690 bps

y/y:

O

Headcount growth partially offset by lower bonus

Stock-based compensation +17% y/y due to

increased headcount

Legal and transaction-related costs +10% y/y

O

O Non-GAAP S&M -1% primarily due to lower

bonus, mostly offset by increased headcount

Note: $ in millions (unless noted), unaudited. Percentages and sums have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

Non-GAAP R&D -1% due to lower bonus and

product development costs, partially offset by

increased headcount

Non-GAAP Adjusted G&A +15% due to

increased headcount, partly offset by lower

bonusView entire presentation