AgroFresh SPAC Presentation Deck

Valuation Benchmarking

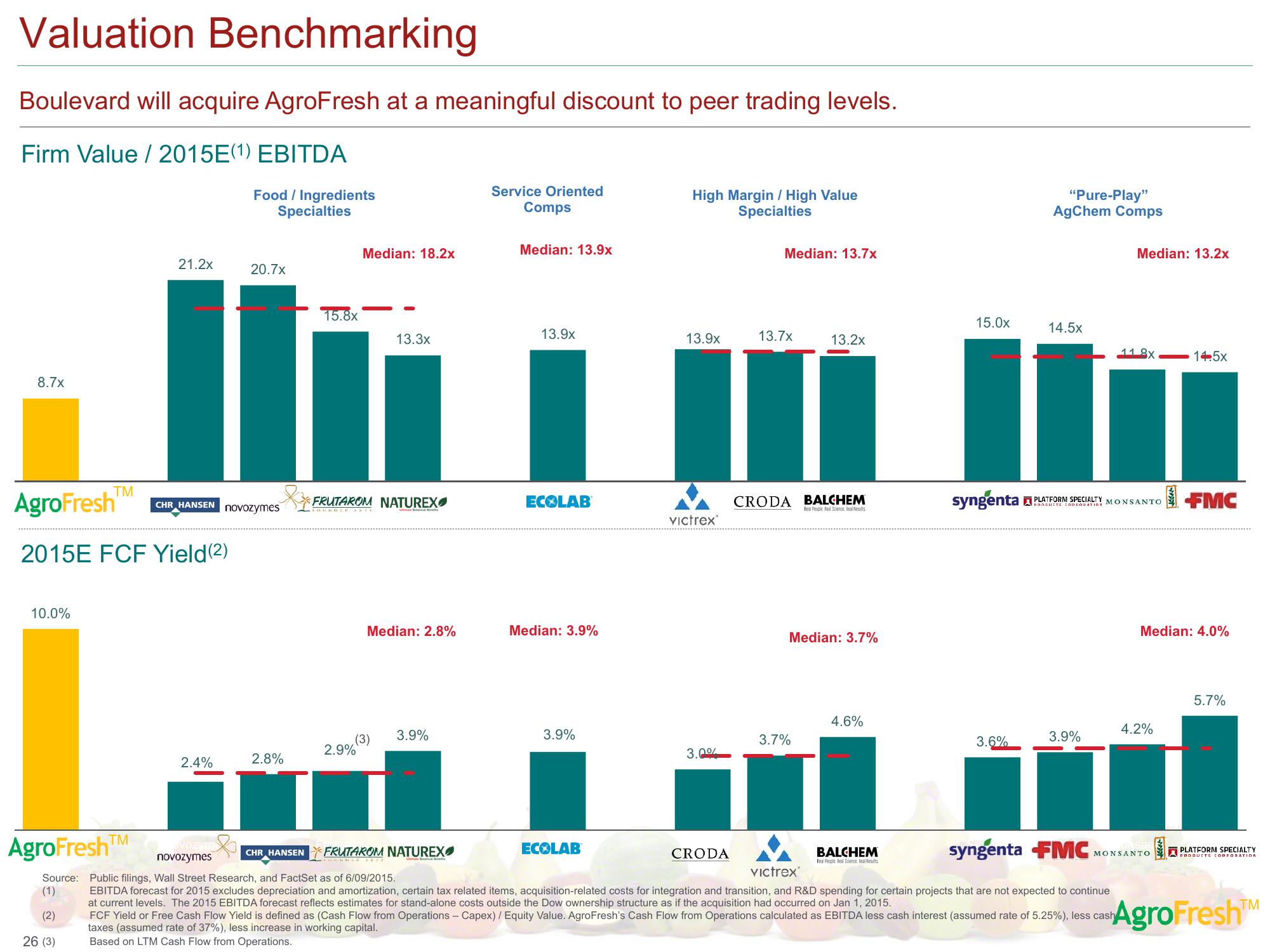

Boulevard will acquire AgroFresh at a meaningful discount to peer trading levels.

Firm Value / 2015E(1) EBITDA

Food / Ingredients

Specialties

8.7x

TM

10.0%

AgroFresh

2015E FCF Yield(2)

21.2x

TM

20.7x

CHR HANSEN novozymes

2.4%

2.8%

15.8x

CHR HANSEN

Median: 18.2x

13.3x

FRUTAROM NATUREX

Botanical netts

Median: 2.8%

(3) 3.9%

2.9%

Service Oriented

Comps

FRUTAROM NATUREX

FOUNDER TREN

matrical s

Median: 13.9x

13.9x

ECOLAB

Median: 3.9%

3.9%

High Margin / High Value

Specialties

ECOLAB

13.9x

Victrex®

3.0%

Median: 13.7x

CRODA

13.7x

13.2x

CRODA BALCHEM

Real People Real Stierce lealResults

Median: 3.7%

3.7%

4.6%

15.0x

BALCHEM

Real People Real Science Real Results

AgroFresh

syngenta FMC

Victrex®

novozymes

Source: Public filings, Wall Street Research, and FactSet as of 6/09/2015.

(1) EBITDA forecast for 2015 excludes depreciation and amortization, certain tax related items, acquisition-related costs for integration and transition, and R&D spending for certain projects that are not expected to continue

at current levels. The 2015 EBITDA forecast reflects estimates for stand-alone costs outside the Dow ownership structure as if the acquisition had occurred on Jan 1, 2015.

(2)

FCF Yield or Free Cash Flow Yield is defined as (Cash Flow from Operations - Capex) / Equity Value. AgroFresh's Cash Flow from Operations calculated as EBITDA less cash interest (assumed rate of 5.25%), less cash

taxes (assumed rate of 37%), less increase in working capital.

26 (3)

Based on LTM Cash Flow from Operations.

"Pure-Play"

AgChem Comps

3.6%

14.5×

syngenta PLATFORM SPECIALTY

3.9%

Median: 13.2x

PRODUCTE CODPORATION MONSANTO

11 8x

4.2%

14.5x

Median: 4.0%

MONSANTO

FMC

5.7%

PLATFORM SPECIALTY

PRODUCTE CORPORATIDA

CashAgroFresh™View entire presentation