J.P.Morgan Investment Banking

APPENDIX

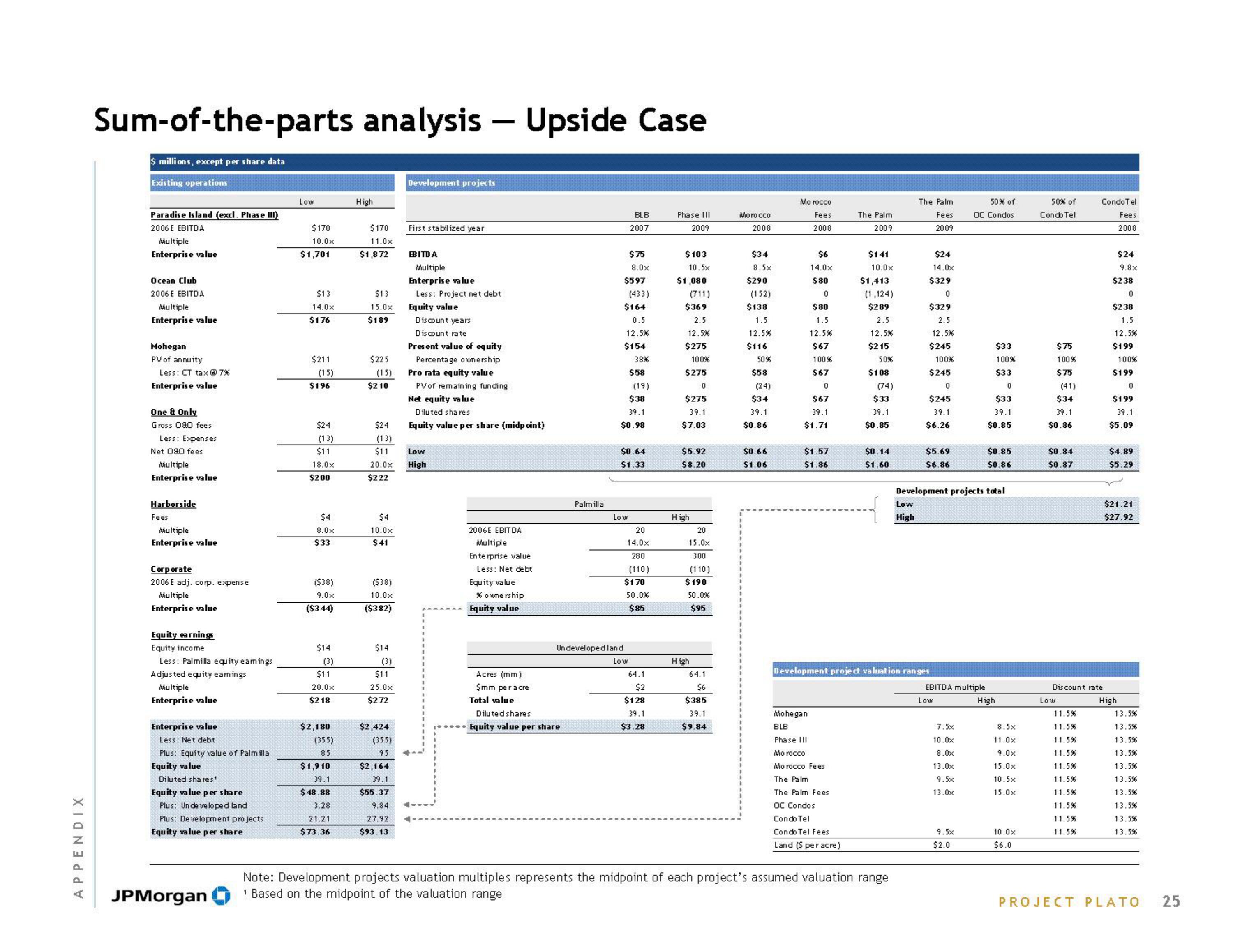

Sum-of-the-parts analysis - Upside Case

$ millions, except per share data

Existing operations

Paradise Island (excl. Phase III)

2006 E EBITDA

Multiple

Enterprise value

Ocean Club

2006 E EBITDA

Multiple

Enterprise value

Mohegan

PV of annuity

Less: CT tax @ 7%

Enterprise value

One & Only

Gross 080 fees

Less: Expenses

Net 080 fees

Multiple

Enterprise value

Harborside

Fees

Multiple

Enterprise value

Corporate

2006 E adj. corp. expense

Multiple

Enterprise value

Equity earnings

Equity income

Less: Palmilla equity earnings

Adjusted equity eamings

Multiple

Enterprise value

Enterprise value

Less: Net debt

Plus: Equity value of Palmilla

Equity value

Diluted shares¹

Equity value per share

Plus: Un developed land

Plus: Development projects

Equity value per share

JPMorgan

Low

$170

10.0x

$1,701

$13

14.0x

$176

$211

(15)

$196

$24

(13)

$11

18.0x

$200

$4

8.0x

$33

($38)

9.0x

($344)

$14

(3)

$11

20.0x

$218

$2,180

(355)

85

$1,910

39.1

$48.88

3.28

21.21

$73.36

High

$170

11.0x

$1,872

$13

15.0x

$189

$225

(15)

$210

20.0x

$222

$4

10.0x

$41

($38)

10.0x

($382)

$24

(13)

$11 Low

High

$14

(3)

$11

25.0x

$272

$2,424

Development projects

(355)

95

$2,164

39.1

$55.37

9.84

27.92

$93.13

First stabilized year

EBITDA

Multiple

Enterprise value

Less: Project net debt

Equity value

Discount years

Discount rate

Present value of equity

Percentage ownership

Pro rata equity value

PV of remaining funding

Net equity value

Diluted shares

Equity value per share (midpoint)

2006E EBITDA

Multiple

Enterprise value

Less: Net debt

Equity value

% ownership

Equity value

Acres (mm)

$mm per acre

Total value

Palmilla

Diluted shares

Equity value per share

BLB

2007

$75

$597

8.0x

(433)

$164

0.5

12.5%

Low

$154

38%

$58

$38

39.1

$0.98

(19)

$0.64

$1.33

Undeveloped land

Low

20

14.0x

280

(110)

$170

50.0%

$85

64.1

$2

$128

39.1

$3.28

Phase III

2009

$103

10.5x

$1,080

(711)

$369

2.5

12.5%

$275

$275

0

$275

39.1

$7.03

High

100%

$5.92

$8.20

20

15.0x

300

(110)

$190

50.0%

$95

High

64.1

$6

$385

39.1

$9.84

Morocco

2008

$34

8.5x

$290

(152)

$138

1.5

12.5%

$116

50%

$58

(24)

$34

39.1

$0.86

$0.66

$1.06

Morocco

Fees

2008

$6

14.0x

$80

0

$80

1.5

12.5%

$67

100%

$67

0

$67

39.1

$1.71

$1.57

$1.86

Mohegan

BLB

Phase III

Morocco

Morocco Fees

The Palm

2009

The Palm

The Palm Fees

OC Condos

Condo Tel

Condo Tel Fees

Land ($ per acre)

$141

10.0x

$1,413

(1,124)

$289

2.5

12.5%

$215

50%

$108

(74)

$33

39.1

$0.85

$0.14

$1.60

Note: Development projects valuation multiples represents the midpoint of each project's assumed valuation range

1 Based on the midpoint of the valuation range

The Palm

Fees

2009

Low

High

$329

Development project valuation ranges

$24

14.0x

0

$329

2.5

12.5%

$245

100%

$245

0

$245

39.1

$6.26

$5.69

$6.86

Development projects total

Low

EBITDA multiple

7.5x

10.0x

8.0x

13.0x

9.5x

13.0x

50% of

OC Condos

9.5x

$2.0

$33

100%

$33

0

$33

39.1

$0.85

$0.85

$0.86

High

8.5x

11.0x

9.0x

15.0x

10.5x

15.0x

10.0x

$6.0

50% of

Condo Tel

$75

100%

$75

(41)

$34

39.1

$0.86

$0.84

$0.87

Low

Discount rate

Condotel

Fees

2008

11.5%

11.5%

11.5%

11.5%

11.5%

11.5%

11.5%

11.5%

11.5%

11.5%

$24

9.8x

$238

0

$238

1.5

12.5%

$199

100%

$199

0

$199

39.1

$5.09

$4.89

$5.29

$21.21

$27.92

High

13.5%

13.5%

13.5%

13.5%

13.5%

13.5%

13.5%

13.5%

13.5%

13.5%

PROJECT PLATO

25View entire presentation