Origin SPAC Presentation Deck

Detailed transaction overview

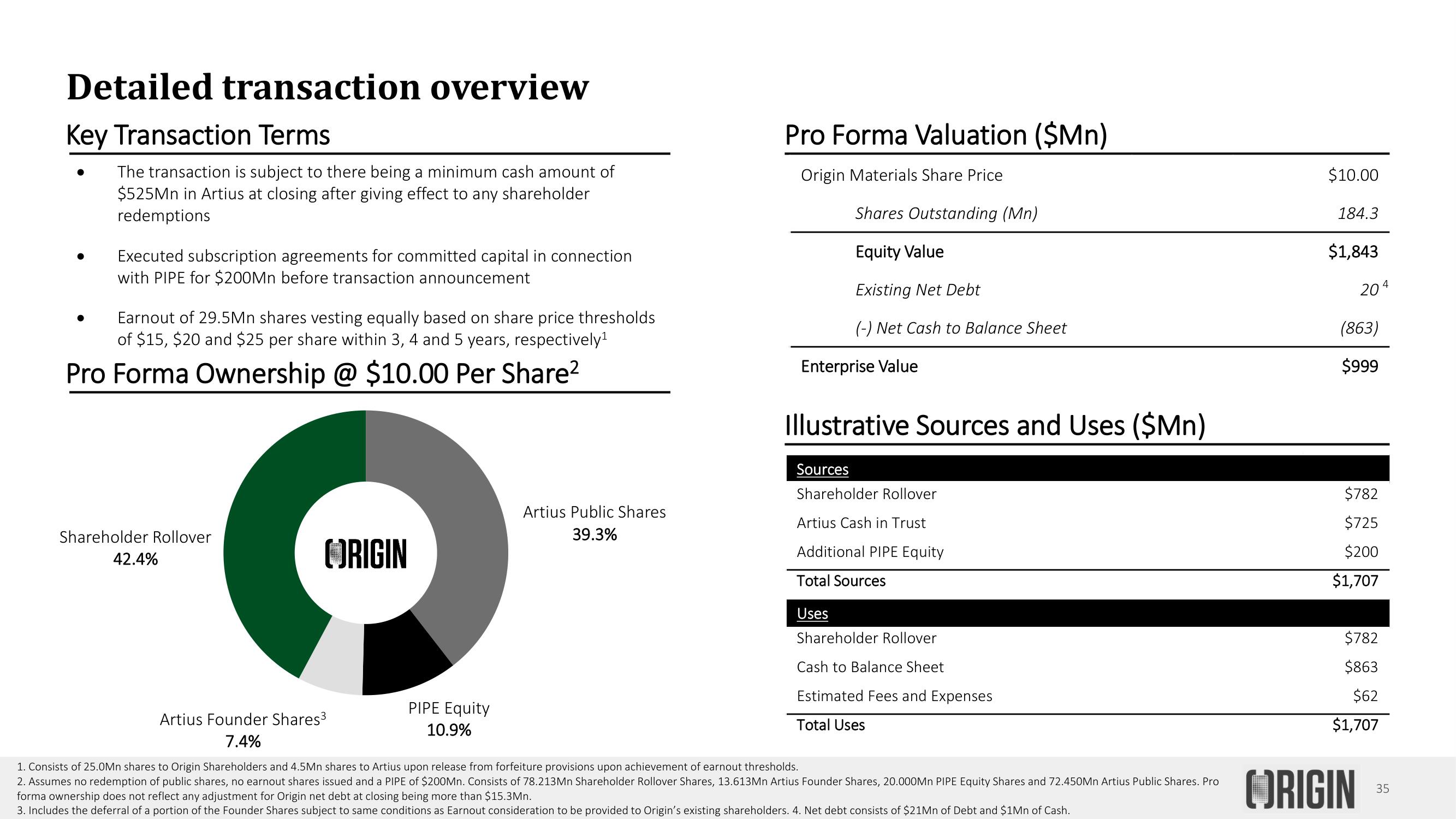

Key Transaction Terms

The transaction is subject to there being a minimum cash amount of

$525Mn in Artius at closing after giving effect to any shareholder

redemptions

Executed subscription agreements for committed capital in connection

with PIPE for $200Mn before transaction announcement

Earnout of 29.5Mn shares vesting equally based on share price thresholds

of $15, $20 and $25 per share within 3, 4 and 5 years, respectively¹

Pro Forma Ownership @ $10.00 Per Share²

Shareholder Rollover

42.4%

ORIGIN

Artius Founder Shares³

7.4%

PIPE Equity

10.9%

Artius Public Shares

39.3%

Pro Forma Valuation ($Mn)

Origin Materials Share Price

Shares Outstanding (Mn)

Equity Value

Existing Net Debt

(-) Net Cash to Balance Sheet

Enterprise Value

Illustrative Sources and Uses ($Mn)

Sources

Shareholder Rollover

Artius Cash in Trust

Additional PIPE Equity

Total Sources

Uses

Shareholder Rollover

Cash to Balance Sheet

Estimated Fees and Expenses

Total Uses

1. Consists of 25.0Mn shares to Origin Shareholders and 4.5Mn shares to Artius upon release from forfeiture provisions upon achievement of earnout thresholds.

2. Assumes no redemption of public shares, no earnout shares issued and a PIPE of $200Mn. Consists of 78.213Mn Shareholder Rollover Shares, 13.613Mn Artius Founder Shares, 20.000Mn PIPE Equity Shares and 72.450Mn Artius Public Shares. Pro

forma ownership does not reflect any adjustment for Origin net debt at closing being more than $15.3Mn.

3. Includes the deferral of a portion of the Founder Shares subject to same conditions as Earnout consideration to be provided to Origin's existing shareholders. 4. Net debt consists of $21Mn of Debt and $1Mn of Cash.

$10.00

184.3

$1,843

204

(863)

$999

$782

$725

$200

$1,707

$782

$863

$62

$1,707

ORIGIN

35View entire presentation